China factory output accelerates as retail sales and investment lag – recap

2026-01-19 03:26:00

I popped up the data earlier:

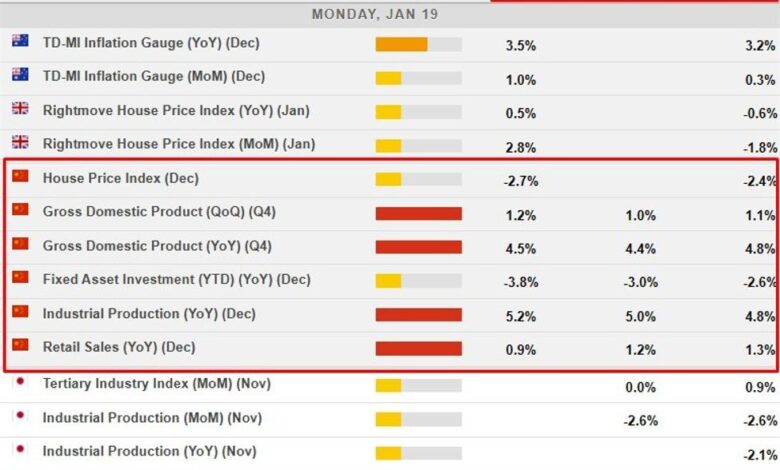

See the screenshot above for the short summary of the main headline data points.

Follow up on the GDP data is here:

Turning to the December data, it showed factory strength masking weak consumption and investment, highlighting an uneven recovery heading into 2026.

Summary:

-

Industrial output accelerates, retail sales disappoint

-

Investment contracts for first time in decades

-

Property downturn continues to weigh on confidence

-

Employment steady despite weak demand

-

Policy support ramps up amid global risks

China’s latest activity data highlight an increasingly unbalanced recovery, with industrial output gaining momentum in December while consumer spending and investment continue to underperform, underscoring the challenges facing policymakers in 2026.

Official figures from the National Bureau of Statistics showed industrial production rose 5.2% year-on-year in December, accelerating from 4.8% in November as manufacturing activity benefited from resilient export demand. In contrast, retail sales grew just 0.9%, slowing from 1.3% the previous month and undershooting market expectations, pointing to persistent weakness in household spending.

The investment picture remains even more fragile. Fixed asset investment fell 3.8% in 2025, marking its first annual contraction since 1998, while property investment slumped 17.2%, reflecting the prolonged downturn in the real estate sector. Falling home prices have continued to erode household wealth, compounding the drag on consumption and confidence.

Despite subdued demand, labour market conditions have remained relatively stable. The nationwide urban survey-based unemployment rate held steady at 5.1% in December, unchanged from November, suggesting that weakness in spending has yet to translate into broad-based job losses.

Looking ahead, the outlook is complicated by rising global trade protectionism and uncertainty around U.S. policy. President Donald Trump has threatened to impose 25% tariffs on countries trading with Iran, adding to external risks for China’s export sector.

Policymakers have moved to provide early support. The People’s Bank of China last week cut sector-specific lending rates and signalled scope for further reductions in banks’ reserve requirements and broader policy rates. Fiscal policy is also set to play a larger role, with Chinese leaders pledging a “proactive” stance this year and analysts expecting Beijing to target growth of around 5% again.

Structural challenges remain unresolved. Household consumption accounts for less than 40% of GDP, well below global norms. Institutions such as the World Bank and the International Monetary Fund have long urged China to rebalance toward consumption-led growth, warning that reliance on investment and exports poses longer-term risks unless income growth and social safety nets are strengthened.