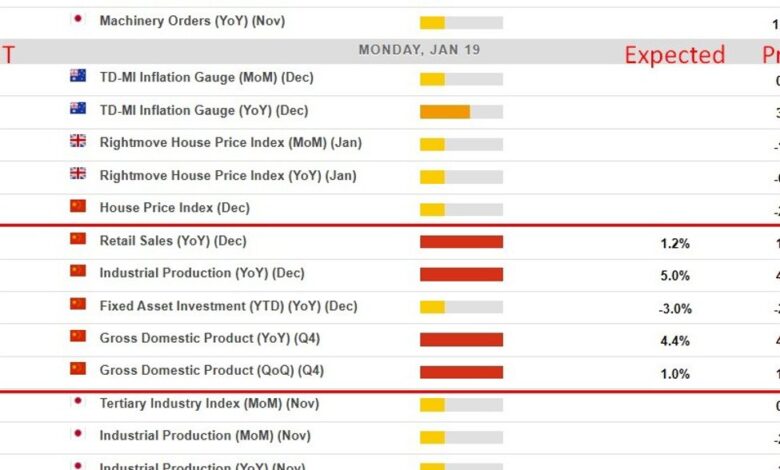

Economic & event calendar Asia Monday, Jan 19, 2026, China Q4 GDP & Dec eco activity data

2026-01-18 21:46:00

This snapshot is from the investingLive economic data calendar.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

The data of most note today is from China, specifically:

- Retail Sales for December

- Industrial Production for December

- Fixed Asset Investment for December

- Gross Domestic Product for Q4 2025

You can see the survey ‘expected’ median consensus and the priors above for all of these. Preview:

-

Q4 GDP seen at 4.5% y/y, weakest in three years

-

Full-year 2025 growth likely meets ~5% target, but nominal growth lags

-

Retail sales and investment remain key drags on activity

-

Industrial production supported by resilient exports

-

Policy stance cautious, with limited appetite for major stimulus

China is expected to have ended 2025 with its weakest quarterly growth in three years, highlighting an increasingly uneven recovery driven by exports rather than domestic demand as the economy heads into 2026.

Data are forecast to show that while overseas demand has remained resilient, consumption and investment continue to drag on growth. Economists expect gross domestic product to have expanded 4.5% y/y in Q4, the slowest pace since the post-pandemic reopening, even as full-year growth reaches around 5%, in line with Beijing’s official target.

The composition of growth remains the key concern. A historic contraction in investment and faltering household demand are expected to offset momentum from exports, which have been boosted by record shipments outside the United States despite renewed trade tensions under U.S. President Donald Trump.

Retail sales growth is forecast to ease to a fresh three-year low in December, reflecting weak income growth, soft labour conditions and ongoing pressure from falling home prices. Fixed asset investment is expected to post its first annual contraction since official records began three decades ago, underscoring the depth of the property downturn and the saturation of infrastructure spending.

By contrast, industrial production is likely to have accelerated in December to its fastest pace since September, supported by strong external demand. That divergence reinforces expectations that China’s two-speed growth model will persist into 2026, with exports carrying the load as domestic demand remains subdued.

Deflation continues to complicate the outlook. While real GDP growth may meet the government’s target, nominal expansion is expected to be significantly weaker, weighing on corporate earnings, household wealth and fiscal revenues.

Policymakers appear reluctant to respond with large-scale stimulus. President Xi Jinping has signalled greater tolerance for slower growth, while concerns around local government debt limit Beijing’s willingness to expand aggressively.

China’s central bank has reinforced that message. The People’s Bank of China has leaned toward targeted easing, recently lowering the cost of structural lending tools while only cautiously flagging scope for broader rate cuts. Officials have increasingly acknowledged that monetary easing is losing effectiveness in an economy constrained by weak demand and structural imbalances.

Retail sales growth is forecast to ease to a fresh three-year low in December