Bitcoin is lagging while metals soar, but this rare divergence preceded every major crypto breakout since 2019

Gold and copper have moved higher even as the Federal Reserve continues to signal patience on rate cuts, a divergence that shows how markets tend to price liquidity conditions ahead of formal policy shifts rather than wait for confirmation from central banks.

These metals are responding to changes in real yields, funding conditions, and forward expectations, and that behavior has often appeared in earlier stages of easing cycles. In previous cycles, Bitcoin reacted later to the same forces, with its strongest advances arriving only after metals had already repositioned for looser financial conditions.

The current setup looks familiar. Gold is attracting defensive capital as real returns on cash and Treasuries compress, while copper is responding to improving expectations for credit availability and global activity. Together, they suggest that markets are adjusting to an environment where restrictive policy is nearing its limit, regardless of how long official rhetoric remains cautious.

Bitcoin has yet to reflect that shift, but history shows that it tends to move only after the underlying liquidity signal becomes harder to ignore.

Metals move before central banks act

Financial markets typically reprice conditions before policymakers acknowledge a turn, especially when the cost of capital begins to shift at the margin.

Gold’s behavior across multiple cycles illustrates this clearly. Data from LBMA pricing and analysis from the World Gold Council show that gold often begins rising months before the first rate cut, as investors respond to peaking real yields rather than the cut itself.

In 2001, 2007, and again in 2019, gold prices moved higher while policy was still “officially” restrictive, reflecting expectations that holding cash would soon offer diminishing real returns.

Copper strengthens the signal even further because it responds to a different set of incentives. Unlike gold, copper demand is tied to construction, manufacturing, and investment cycles, which makes it sensitive to credit availability and funding conditions.

When copper prices rise alongside gold, it points to more than defensive positioning, suggesting that markets expect looser financial conditions to support real economic activity.

Recent moves in CME and LME copper futures show that’s exactly what happened, with prices pushing higher despite uneven growth data and caution from central banks.

This combination carries an outsized influence on the market because it reduces the risk of a false signal. Gold alone can rise on fear or geopolitical stress, while copper alone can react to supply disruptions.

When both move together, it usually reflects a broader adjustment in liquidity expectations, one that markets are willing to price even without explicit policy support.

Real yields shape the cycle more than policy headlines

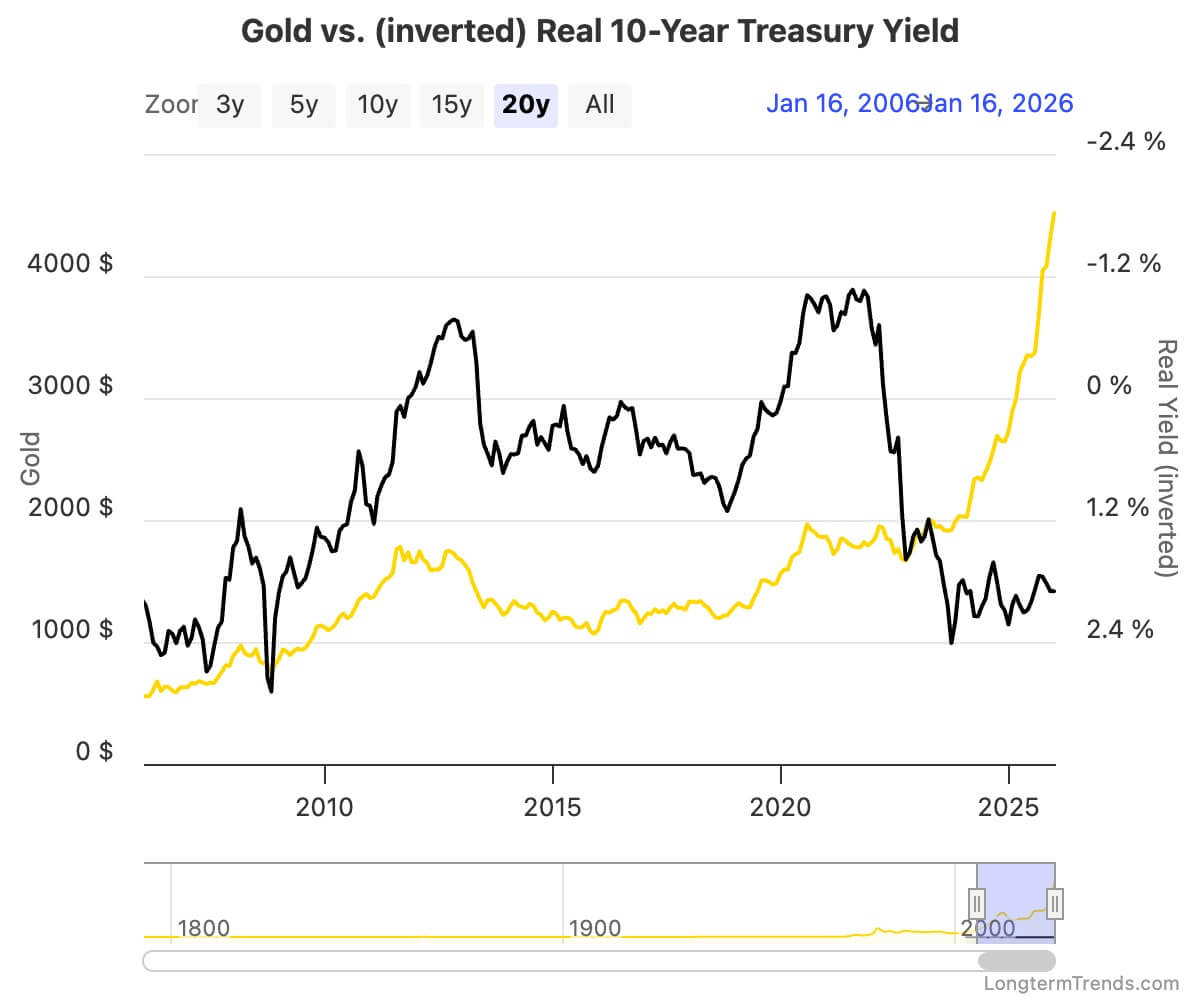

The common driver across gold, copper, and eventually Bitcoin is the real yield on long-dated government debt, particularly the US 10-year Treasury Inflation-Protected Securities yield. Real yields represent the return investors receive after inflation and act as the opportunity cost for holding non-yielding or low-yielding assets.

When those yields peak and begin to decline, the relative appeal of scarce assets improves, even if policy rates remain elevated.

US Treasury data shows that gold prices have tracked real yields closely over time, with rallies often beginning once real yields roll over rather than after rate cuts occur. Hawkish messaging has almost never managed to reverse that relationship once the real return on Treasuries started compressing.

Copper is less directly linked but still responds to the same backdrop, as falling real yields tend to come with easier financial conditions, a softer dollar, and improved access to credit, all of which support industrial demand expectations.

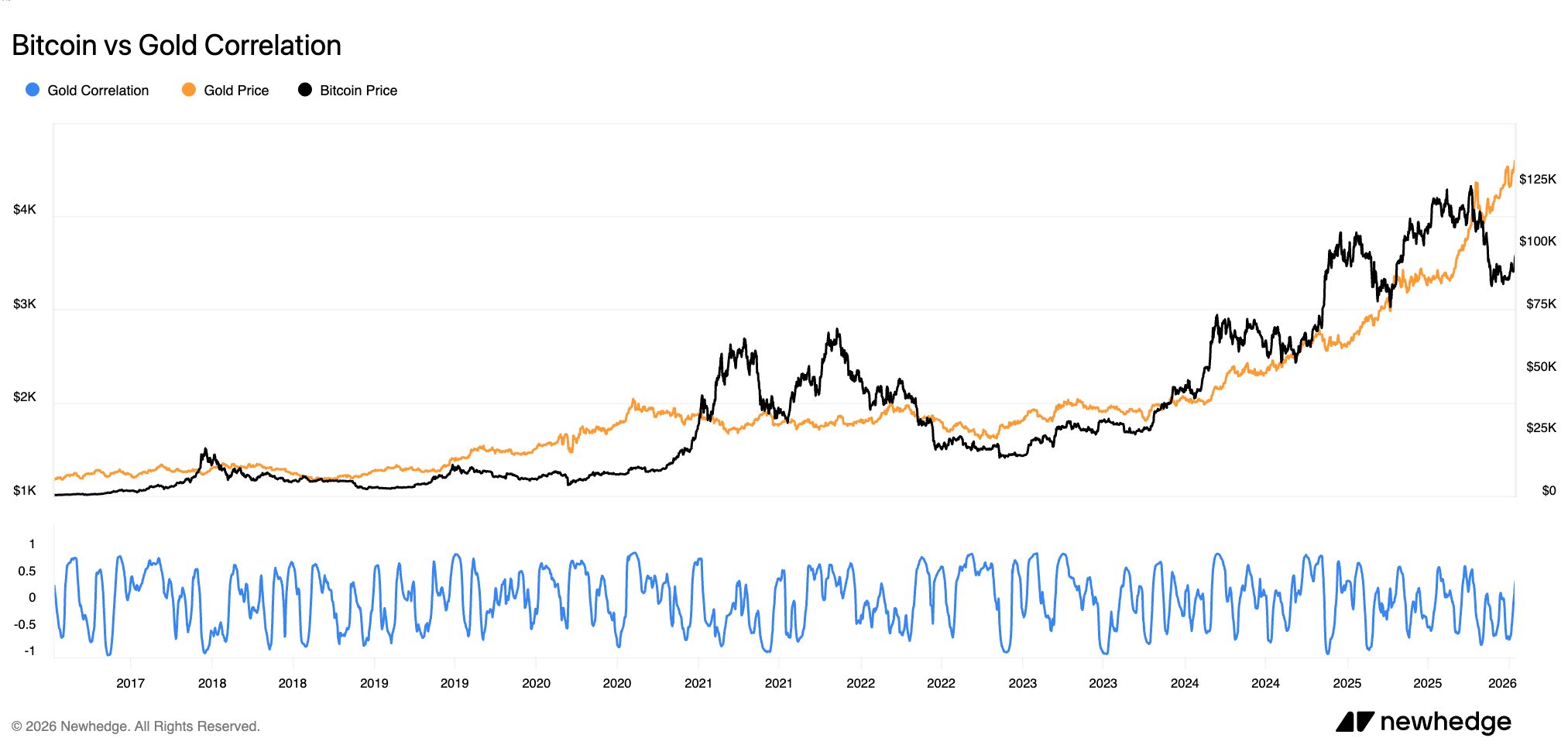

Bitcoin operates within this same framework but reacts later because its investor base tends to respond only after the liquidity shift is clearer. In 2019, Bitcoin’s rally followed a sustained decline in real yields and gathered momentum as the Fed moved from tightening to easing.

In 2020, the relationship became more extreme as real yields collapsed and liquidity flooded the system, with Bitcoin’s performance accelerating well after gold had already repositioned.

This sequencing explains why Bitcoin can appear disconnected during early phases of a cycle. It is not responding to isolated data prints or single-rate decisions, but to the cumulative effect of real-yield compression and liquidity expectations that metals tend to reflect earlier.

Capital rotation explains Bitcoin’s delayed response

The order in which assets respond during easing cycles reflects how different types of capital reposition. Early in the process, investors tend to favor assets that preserve value with lower volatility, which supports demand for gold.

As expectations for easier credit and improved growth strengthen, copper begins to reflect that shift through higher prices. Bitcoin typically absorbs capital later, once markets are more confident that easing will materialize and that liquidity conditions will support riskier, more reflexive assets.

This pattern has repeated across cycles. In 2019, gold’s rally preceded Bitcoin’s breakout, with Bitcoin eventually outperforming once rate cuts became reality. In 2020, the timeline compressed, but the sequence remained similar, with Bitcoin’s strongest gains arriving after policy and liquidity responses were already underway.

Because Bitcoin’s market is smaller, younger, and more sensitive to marginal flows, its moves tend to be sharper once positioning shifts in its favor.

Right now, metals appear to be repricing conditions ahead of confirmation, while Bitcoin remains range-bound. That divergence has often existed in the early stages of easing cycles and has resolved only after real-yield compression became persistent enough to alter capital allocation decisions more broadly.

What would invalidate the setup

This framework depends on real yields continuing to ease. A sustained reversal higher in real yields would undermine the rationale for gold’s advance and weaken the case for copper, while leaving Bitcoin without the liquidity tailwind that has supported past cycles.

An acceleration in quantitative tightening or a sharp appreciation in the dollar would also tighten financial conditions and pressure assets that depend on easing expectations.

A renewed surge in inflation that forces central banks to delay easing materially would pose a similar risk, as it would keep real yields elevated and limit the scope for liquidity to expand. Markets can anticipate policy shifts, but they can’t sustain those expectations indefinitely if the underlying data turns against them.

For now, futures markets continue to price in the eventual easing, and Treasury real yields remain below their cycle highs. Metals are responding to those signals. Bitcoin is yet to do so, but its historical behavior suggests that it tends to move only after the liquidity signal becomes more durable.

If real yields continue to compress, the path that metals are tracing now has often led Bitcoin to follow later, and with considerably more force.