Michael Saylor Pushes Back on Criticism of Bitcoin Treasury Companies

Strategy chairman Michael Saylor defended Bitcoin treasury companies against criticism during a recent appearance on the What Bitcoin Did podcast.

Responding to questions about smaller companies that issue equity or debt to buy Bitcoin (BTC), Saylor said the decision ultimately comes down to capital allocation, arguing that companies with excess cash are better off allocating it to Bitcoin than holding it in Treasurys or returning it to shareholders.

He compared corporate treasury strategies to individual investing, arguing that ownership levels vary but the underlying decision to hold BTC is rational regardless of company size or business model.

Saylor also pushed back on the idea that unprofitable companies should be singled out for criticism, arguing that Bitcoin holdings can help offset weak operating results.

He said a company running at a loss could still improve its overall financial position if the value of its Bitcoin holdings rises faster than its operating losses. “If you’re losing $10 million a year but making $30 million in Bitcoin gains, didn’t I just save the company?” Saylor said.

Saylor contrasted Bitcoin purchases with other uses of excess cash, arguing that buybacks and low-yield Treasurys can worsen outcomes for struggling companies. Buying back shares in a money-losing business “just amplifies your losses faster,” he said, adding that Bitcoin offers a materially different risk-reward profile for corporate balance sheets.

Saylor said companies that hold Bitcoin are often held to a different standard than those that avoid the asset altogether. “The Bitcoin community tends to eat its young,” he said, adding:

You somehow think that it’s OK for 400 million companies to not buy Bitcoin, and somehow that’s okay, and you’re going to criticize the 200 companies that bought Bitcoin.”

Strategy began accumulating Bitcoin in 2020 and is the largest crypto corporate holder. According to BitcoinTreasuries.NET data, the company held 687,410 BTC at time of writing.

Related: Strategy makes biggest Bitcoin purchase since July 2025, adds $1.25B in BTC

More public companies turn to Bitcoin as a treasury asset

Corporate adoption of Bitcoin treasury strategies accelerated in 2025, with a growing number of publicly traded companies adding Bitcoin to their balance sheets as a long-term asset.

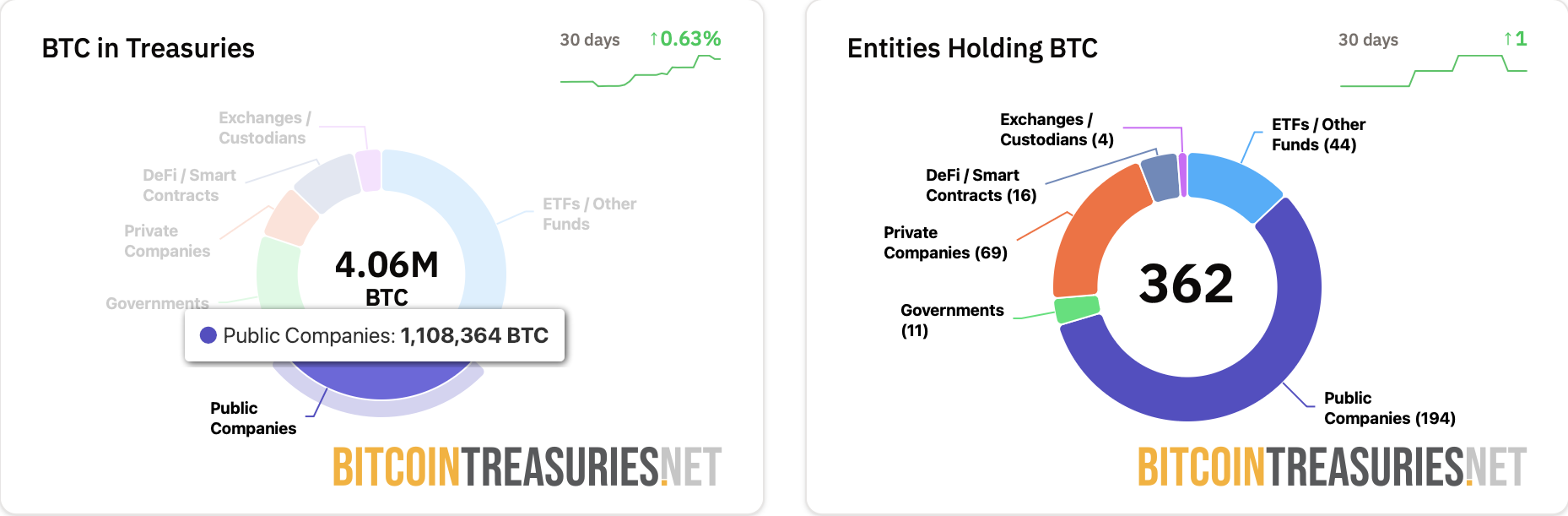

At the time of writing, publicly listed companies collectively held about 1.1 million BTC, representing about 5.5% of the 19.97 million coins in circulation.

Companies that adopted treasury strategies over the past year have done so amid less favorable market conditions.

According to Markus Thiele, founder of 10x Research, many digital asset treasuries saw their net asset values fall in November, constraining capital raising and leaving existing shareholders stuck with mounting paper losses.

Cointelegraph reported that Bitcoin treasury adoption slowed in late 2025, with a total of 117 companies adopting BTC reserves over the year.

However, corporate ownership remains highly concentrated, with MARA Holdings having 53,250 BTC on its balance sheet and Twenty One Capital holding 43,514 BTC, second only to Strategy.

Magazine: Davinci Jeremie bought Bitcoin at $1… but $100K BTC doesn’t excite him