Financial & Forex Market Recap – Jan. 15, 2026

Markets delivered a mixed session on Thursday as a surprisingly robust UK economic rebound clashed with softening manufacturing activity across other regions, while traders parsed Fed commentary that signaled cautious optimism about economic resilience despite ongoing data uncertainty.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Japan PPI for December 2025: 0.1% m/m (0.2% m/m forecast; 0.3% m/m previous); 2.4% y/y (2.5% y/y forecast; 2.7% y/y previous)

- U.K. RICS House Price Balance for December 2025: -14.0% (-16.0% forecast; -16.0% previous)

- Australia Consumer Inflation Expectations for January 2026: 4.6% (4.5% forecast; 4.7% previous)

-

U.K. GDP for November 2025: 0.3% m/m (-0.1% m/m forecast; -0.1% m/m previous); 1.4% y/y (0.8% y/y forecast; 1.1% y/y previous)

- U.K. Industrial Production for November 2025: 1.1% m/m (-0.3% m/m forecast; 1.1% m/m previous); 2.3% y/y (-0.8% y/y forecast; -0.8% y/y previous)

- U.K. Manufacturing Production for November 2025: 2.1% m/m (0.4% m/m forecast; 0.5% m/m previous); 2.1% y/y (-0.8% y/y forecast; -0.8% y/y previous)

- U.K. Balance of Trade for November 2025: -6.12B (-3.5B forecast; -4.82B previous)

-

China Monetary Developments:

- China Outstanding Loan Growth for December 2025: 6.4% y/y (6.6% y/y forecast; 6.4% y/y previous)

- China M2 Money Supply for December 2025: 8.5% (8.0% forecast; 8.0% previous)

- China New Loans for December 2025: 910.0B (910.0B forecast; 390.0B previous)

- China Total Social Financing for December 2025: 2,210.0B (2,920.0B forecast; 2,490.0B previous)

- France CPI Growth Rate Final for December 2025: 0.1% m/m (0.1% m/m forecast; -0.2% m/m previous); 0.8% y/y (0.8% y/y forecast; 0.9% y/y previous)

- Euro area Industrial Production for November 2025: 0.7% m/m (0.2% m/m forecast; 0.8% m/m previous); 2.5% y/y (1.6% y/y forecast; 2.0% y/y previous)

- Euro area Trade Balance for November 2025: 9.9B (19.5B forecast; 18.4B previous)

- Canada Manufacturing Sales Final for November 2025: -1.2% m/m (-1.1% m/m forecast; -1.0% m/m previous)

- Canada Wholesale Sales Final for November 2025: -1.8% m/m (0.1% m/m forecast; 0.1% m/m previous)

- U.S. Import Prices for November 2025: 0.1% y/y (0.4% y/y forecast)

- U.S. Export Prices for November 2025: 3.3% y/y (2.3% y/y forecast)

- U.S. Initial Jobless Claims for January 10, 2026: 198.0k (212.0k forecast; 208.0k previous)

- NY Empire State Manufacturing Index for January 2026: 7.7 (1.0 forecast; -3.9 previous)

- Philadelphia Fed Manufacturing Index for January 2026: 12.6 (-4.0 forecast; -10.2 previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Thursday’s session reflected diverging momentum as markets absorbed the UK’s surprising economic strength alongside better-than-expected manufacturing signals from the U.S., with traders continuing to parse Fed commentary about policy positioning amid improving but still uncertain data quality.

U.S. equities advanced modestly, with the S&P 500 climbing 0.40% to close around 6,949. The index strengthened steadily throughout the London session before rallying further following the stronger-than-expected U.S. manufacturing and jobless claims data released around 8:30 am ET, possibly reflecting relief that regional factory activity showed unexpected resilience. The gain extended through the U.S. afternoon session, but pulled back slowly heading into the daily close.

Treasury yields edged higher, with the 10-year yield climbing 0.85% to approximately 4.20%. Yields traded mostly sideways through the Asian session before rising during London hours, possibly correlating with the UK’s robust GDP data that reduced global easing expectations. The move accelerated during the U.S. session following the manufacturing index releases, suggesting traders were reassessing Fed rate cut probabilities in light of resilient economic activity.

Gold declined 0.23% to settle near $4,616, pulling back from recent levels as improving economic data reduced near-term safe-haven demand. The precious metal weakened early in Asia then traded mostly sideways through the U.S. close. With no direct gold-specific catalysts to point to, the move likely reflected positioning adjustments ahead of the weekend, dollar strength, and profit-taking after recent gains.

WTI crude oil suffered the session’s steepest losses, dropping 2.91% to close around $59.00 per barrel. The decline began during the Asian session and extended through both London and U.S. trading hours. With no specific oil-related catalysts during the trading day, the weakness likely correlated with broader concerns about demand outlook or technical selling pressure, though the magnitude of the move remained somewhat unclear given the absence of major energy-specific news.

Bitcoin fell 1.94% to trade near $95,682, extending its recent decline. The cryptocurrency weakened progressively throughout all three sessions, possibly reflecting continued profit-taking from elevated levels or concerns about tighter financial conditions implied by rising Treasury yields. There were no direct crypto-specific news catalysts to explain the move.

FX Market Behavior: U.S. Dollar vs. Majors

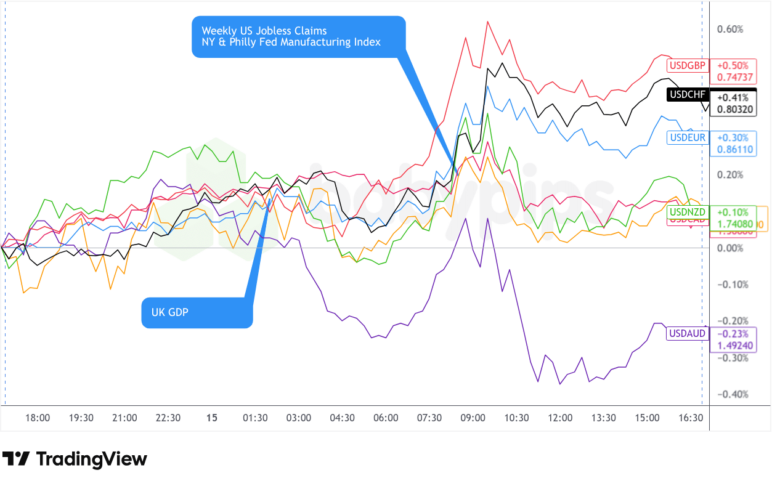

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar experienced notable intraday swings on Thursday, trading net bullish during Asian hours before weakening through morning London, then rallying sharply after the U.S. open only to reverse course after the London close and stabilize through the afternoon.

During the Asian session, the dollar traded with a net bullish lean against major currencies, possibly reflecting overnight positioning or cautious sentiment ahead of the day’s heavy data calendar. Japanese PPI data came in softer than expected at 2.4% year-over-year versus 2.5% forecast, while China’s monetary data showed M2 money supply growing faster than anticipated at 8.5% versus 8.0% forecast, though total social financing disappointed at 2,210.0B versus 2,920.0B expected. Despite the mixed Asian data, the dollar maintained its strength through the session, suggesting traders were positioning defensively ahead of the UK and U.S. economic releases.

The London session brought the day’s most significant economic surprise from the UK, which arguably contributed to the dollar moving net lower during morning hours. Sterling surged on the UK GDP report showing 0.3% monthly growth versus -0.1% forecasts, while manufacturing production jumped 2.1% monthly against 0.4% expectations. The robust UK data marked a sharp reversal from October’s 0.1% contraction and appeared driven by transport equipment manufacturing recovering from earlier cyber-related disruptions. The dollar’s pullback during morning London hours likely reflected this strong sterling bid, combined with eurozone industrial production beating expectations at 0.7% monthly versus 0.2% forecast. Canadian manufacturing and wholesale sales both disappointed, with the latter falling 1.8% versus 0.1% growth expected, but this data arrived later in the London session and failed to prevent the dollar’s weakness against European currencies.

The U.S. session opened with a sharp dollar rally immediately following the domestic data releases around 8:30 am ET. Initial jobless claims surprised to the downside at 198,000 versus 212,000 forecast, signaling continued labor market resilience. More significantly, both the NY Empire State Manufacturing Index and Philadelphia Fed Manufacturing Index delivered substantial upside surprises. The Empire State index surged to 7.7 from -3.9 previous (versus 1.0 forecast), while the Philly Fed index jumped to 12.6 from -10.2 previous (versus -4.0 forecast), marking the strongest regional manufacturing readings in months. The sharp improvement appeared to reflect normalized production conditions and improving new orders, with the data suggesting factory activity may be stabilizing after recent weakness. These results likely reduced near-term Fed easing expectations, driving the dollar sharply higher through mid-morning.

However, the dollar reversed course after the London close around 11:00 am ET, giving back gains and stabilizing through the remainder of the U.S. afternoon session. This reversal occurred despite multiple Fed speakers—including Bostic, Barr, and Barkin—maintaining relatively balanced commentary about the economic outlook. The afternoon pullback possibly reflected profit-taking after the morning’s sharp rally, or alternatively suggested that traders were skeptical about whether the manufacturing data’s strength would prove durable given recent concerns about statistical quality following the government shutdown.

At Thursday’s close, the dollar posted net gains against most major currencies despite the afternoon reversal. The strongest performers against the dollar were the British pound (reflecting the UK’s economic surprise) and the Swiss franc, while the Australian dollar outperformed. The dollar’s volatile intraday journey—from Asian strength through London weakness to U.S. rally and afternoon reversal—highlighted the market’s uncertainty about how to weight improving U.S. data against still-cautious Fed positioning.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand Business NZ PMI for December 2025 at 9:30 pm GMT

- U.S. Fed Balance Sheet for January 14, 2026 at 9:30 pm GMT

- New Zealand Food Price Index for December 2025 at 9:45 pm GMT

- Germany Inflation Rate Final for December 2025 at 7:00 am GMT

- U.K. NIESR Monthly GDP Tracker for December 2025

- Canada Housing Starts for December 2025 at 1:15 pm GMT

- Canada Foreign Securities Purchases for November 2025 at 1:30 pm GMT

- U.S. NY Fed Services Activity Index for January 2026 at 1:30 pm GMT

- U.S. Manufacturing & Industrial Production for December 2025 at 2:15 pm GMT

- NAHB U.S. Housing Market Index for January 2026 at 3:00 pm GMT

- Fed Bowman Speech at 4:00 pm GMT

- Fed Jefferson Speech at 8:30 pm GMT

Friday’s calendar features U.S. industrial production data at 2:15 pm GMT that will provide crucial insight into whether Thursday’s strong regional manufacturing surveys translate to broader factory sector strength, following the NY and Philly Fed indexes’ surprising jump into expansion territory. The manufacturing production report could spark volatility if it confirms the regional surveys’ optimistic signal or alternatively raises questions about data consistency given recent concerns about statistical quality following the government shutdown.

During the U.S. session, the NAHB Housing Market Index at 3:00 pm GMT will offer perspective on homebuilder sentiment as the sector continues navigating elevated mortgage rates, while two Fed speeches—from Bowman and Jefferson—may provide additional color on how policymakers are weighing the improved manufacturing data against persistent inflation and labor market uncertainties heading into the final weeks of January.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!