YZi Labs Backs Genius as Trading Shifts Onchain

YZi Labs, an independent investment firm led by Binance founder Changpeng Zhao, has invested in onchain trading terminal Genius Trading, highlighting growing investor attention on cross-chain trading infrastructure.

While financial terms were not disclosed, YZi Labs said Tuesday that it made an eight-figure investment in the company. Zhao is also joining Genius Trading as an advisor, according to the announcement.

The investment suggests that cross-chain trading terminals are increasingly being viewed as core market infrastructure rather than purely user-facing tools, as activity continues to spread across multiple blockchains and liquidity venues.

Genius Trading is not a decentralized exchange, but a trading interface designed to aggregate execution across blockchains and decentralized venues. The investment points to increasing emphasis on execution-focused infrastructure, such as routing, performance and workflow tools for large traders, rather than liquidity alone.

Genius said it has processed more than $160 million in trading volume across ten blockchains prior to launch. Tuesday’s announcement also marked the platform’s public debut, with support for spot trading, perpetual futures and copy trading.

YZi Labs manages approximately $10 billion in assets and focuses on venture-stage investments across Web3, artificial intelligence and biotechnology. The firm operates as Zhao’s family office and evolved from Binance’s former venture arm.

Related: Binance expands into precious metals with gold, silver futures settled in USDT

The emergence of trading terminals in DeFi

As decentralized finance has expanded across multiple blockchains, cross-chain trading has become increasingly important, enabling traders to move and manage assets across different networks.

Much of the focus to date has been on cross-chain functionality within decentralized exchanges (DEXs), while trading terminals have emerged as a separate category — software interfaces that connect to multiple venues and chains to support more advanced trading workflows.

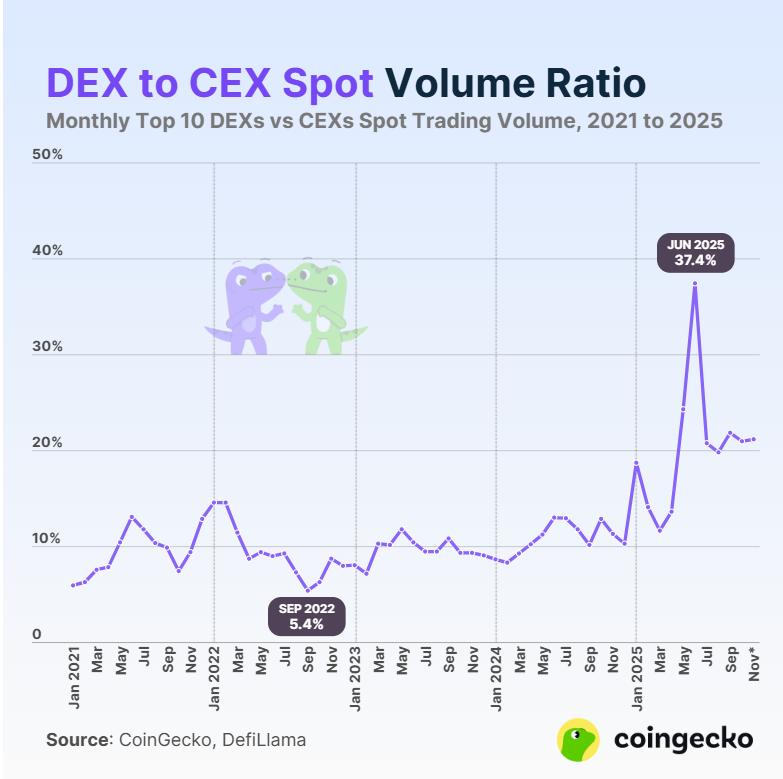

YZi Labs highlighted this shift in its announcement, noting that a growing share of trading activity is moving from centralized exchanges (CEXs) to decentralized venues. While this transition offers greater transparency and self-custody, the firm said it also introduces what it described as a “transparency bug,” referring to the difficulty of executing large trades on public blockchains without signaling intent to the broader market.

YZi Labs cited this dynamic as one of the reasons it backed Genius Trading, which aims to consolidate trading across major blockchain networks while prioritizing execution quality and privacy for professional traders.

Related: Crypto enters round 2 of institutional adoption, led by Morgan Stanley: Binance