Financial & Forex Market Recap – Jan. 12, 2026

Markets traded cautiously on Monday ahead of Tuesday’s critical December inflation data, with price action reflecting trader positioning around Federal Reserve Chair Jerome Powell’s extraordinary weekend disclosure that the Justice Department served grand jury subpoenas threatening criminal indictment over his congressional testimony on headquarters renovations.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Monday’s trading session revealed markets in a holding pattern as traders likely positioned ahead of Tuesday’s December Consumer Price Index release at 8:30 AM ET, while simultaneously processing the implications of an unprecedented escalation in tensions between the Trump administration and Federal Reserve leadership.

US equities advanced modestly, with the S&P 500 gaining 0.20% to close around 6,976, extending its recent strength into the new trading week. The index opened lower in Asia (likely due to Powell related risk-off flows), but found support throughout the London session, rallying steadily through the US morning before consolidating into the afternoon close. The advance appeared disconnected from any specific economic catalyst, possibly reflecting technical momentum and continued optimism around artificial intelligence infrastructure investments that have dominated market sentiment in early 2026.

WTI crude oil posted gains of 1.45%, closing near $59.38 per barrel. The advance built on strong momentum from the prior week, when Brent surged nearly 6% over Thursday and Friday on escalating civil unrest in Iran. Mass protests triggered by a currency crisis and economic collapse have posed the biggest threat to Iran’s clerical establishment in decades, with more than 500 people killed in a deadly crackdown according to rights groups. Monday’s gains likely reflected continued supply risk concerns despite Iranian government claims of having “total control” over the situation. Oil traders remain focused on potential disruptions to Iran’s approximately 2 million barrels per day of exports or the possibility of shipping disruptions through the Strait of Hormuz, a critical waterway for Middle Eastern energy flows. President Trump said the US is monitoring the Iranian protests and considering “strong options,” adding geopolitical risk premium to crude prices.

Gold climbed 1.83% to trade around $4,592, marking the precious metal’s strongest performance among major assets. Gold experienced significant volatility during Asian hours—initially spiking sharply higher around 19:00 ET Sunday evening likely as markets processed Powell’s weekend statement about DOJ subpoenas, before pulling back through the overnight session. The metal found renewed buying interest during London hours and strengthened into the US close, possibly reflecting safe-haven demand amid concerns about Federal Reserve independence and political pressure on monetary policy. The advance came despite the dollar’s modest strength during the U.S. session, suggesting gold’s move was driven primarily by institutional concerns rather than currency dynamics.

Bitcoin advanced 0.95% to close near $91,271. The cryptocurrency traded with choppy price action through Asian hours, experiencing sharp swings that likely corresponded with traders’ reactions to the Powell subpoena news. Bitcoin found consistent buying interest through London and US sessions, though the advance remained modest compared to recent volatility in the crypto space, possibly reflecting caution ahead of Tuesday’s inflation data that could influence Fed policy expectations.

Treasury yields advanced 0.43% with the 10-year note trading around 4.19%. Yields opened the session slightly lower before climbing steadily through London hours and into the US session. The move higher likely reflected traders reducing expectations for aggressive Fed rate cuts in 2026, possibly on the view that political pressure on Powell could make the Fed less willing to ease policy preemptively. The bond market positioning suggests traders are parsing multiple competing narratives—inflation data uncertainty, political interference risks, and the Fed’s potential policy response—with Monday’s action tilting toward a more hawkish repricing.

FX Market Behavior: U.S. Dollar vs. Majors

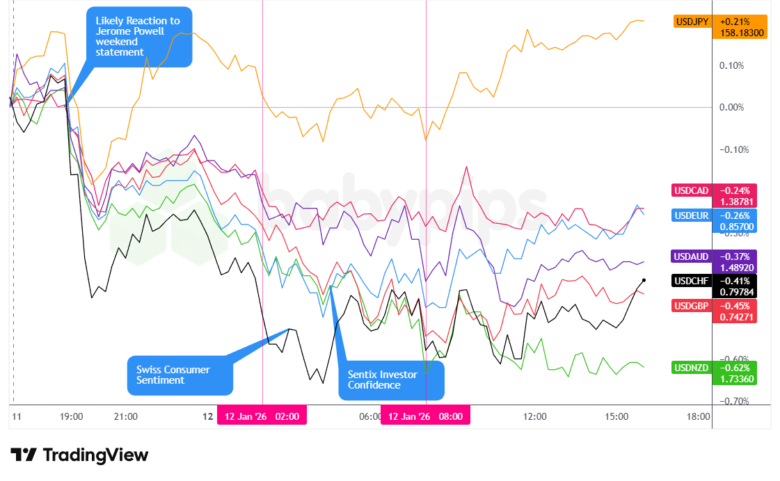

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar experienced mixed and choppy trading throughout Monday, ultimately closing net bearish against major currencies as traders positioned ahead of Tuesday’s critical December CPI release while processing the unprecedented political pressure on Federal Reserve Chair Powell.

During the Asian session, the dollar came under significant selling pressure, trading with a clear bearish lean throughout the overnight hours. The weakness appeared to correlate with traders’ reactions to Powell’s Sunday evening statement disclosing DOJ grand jury subpoenas, as concerns about Federal Reserve independence and political interference weighed on dollar sentiment. The currency pairs showed sharp directional moves around 19:00 ET on Sunday, with the dollar weakening substantially and continuing to decline through the Asian trading session. Australian household spending data came in stronger than expected at 1.0% monthly versus 0.7% forecast, providing additional support to the Australian dollar against the weakening greenback.

The London session brought continued pressure on the dollar, with the greenback maintaining its bearish trajectory through early European trading hours. Swiss consumer confidence improved more than expected to -31.0 from -34.0, while Sentix Investor Confidence for the eurozone showed a significant improvement to -1.8 from -6.2 previously. These better-than-expected European readings possibly provided additional support to European currencies against the weakening dollar. The euro and Swiss franc both posted solid gains during London hours as the dollar’s weakness from the Asian session extended into European trading, likely reflecting ongoing concerns about the DOJ investigation into Powell and its implications for Federal Reserve independence.

The U.S. session saw the dollar stabilize somewhat after its Asian and London weakness, though it continued trading with a modest bearish lean. With no US economic data releases on Monday’s calendar, the dollar’s recovery attempt appeared to reflect some profit-taking on the earlier decline rather than a fundamental shift in sentiment. Price action remained choppy as traders positioned ahead of Tuesday’s 8:30 AM ET CPI release. Market commentary throughout the day focused heavily on the implications of the DOJ investigation into Powell and whether political pressure could influence Federal Reserve decision-making. Some analysts suggested the unprecedented legal threat might actually make the Fed less likely to cut rates in order to maintain credibility around policy independence, though this view provided only limited support to the dollar during the US session.

At Monday’s close, the dollar posted net losses against most major currencies, with its weakest performance coming against the New Zealand dollar and British pound. The greenback’s modest decline likely reflected multiple crosscurrents—pre-CPI positioning, concerns about political interference with Fed independence, and general caution about taking aggressive directional bets ahead of potentially market-moving inflation data.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand NZIER Business Confidence for December 31, 2025 at 9:00 pm GMT

- U.S. Fed Williams Speech at 11:00 pm GMT

- Australia Westpac Consumer Confidence Change for January 2026 at 11:30 pm GMT

- Japan Monetary Developments for December 2025 at 11:50 pm GMT

- U.K. BRC Retail Sales Monitor for December 2025 at 12:01 am GMT

- China Trade Balance for December 2025

- Japan Eco Watchers Survey Outlook for December 2025 at 5:00 am GMT

- NFIB U.S. Business Optimism Index for December 2025 at 11:00 am GMT

- ADP U.S. Employment Change Weekly for December 27, 2025 at 1:15 pm GMT

- Canada Building Permits for November 2025 at 1:30 pm GMT

- U.S. CPI Growth Rate for December 2025 at 1:30 pm GMT

- U.S. New Home Sales for October 2025 at 3:00 pm GMT

- U.S. Fed Musalem Speech at 3:35 pm GMT

- U.S. Monthly Budget Statement for December 2025 at 7:00 pm GMT

- U.S. Fed Barkin Speech at 9:00 pm GMT

- U.S. API Crude Oil Stock Change for January 9, 2026 at 9:30 pm GMT

Tuesday’s calendar is dominated by the December Consumer Price Index release at 8:30 AM ET, which will provide the first clean look at inflation since the October 2025 government shutdown disrupted data collection. Consensus forecasts call for headline CPI of 0.3% monthly and 2.7% year-over-year, with core CPI also expected at 0.3% monthly and 2.7% annually. However, significant uncertainty surrounds these estimates as some analysts anticipate a mechanical “payback” effect from the shutdown-distorted November data.

The CPI release arrives at a moment of extreme sensitivity for markets, coming just hours after Powell’s disclosure of Justice Department subpoenas that threaten the institutional independence of the Federal Reserve. A hot inflation print above consensus could strengthen the case for the Fed to hold rates steady at its January 27-28 meeting—currently priced at 95% probability—while also intensifying political pressure from an administration that has repeatedly called for lower interest rates. Conversely, a softer-than-expected reading could provide cover for eventual rate cuts while potentially de-escalating tensions between the central bank and executive branch.

Multiple Fed speakers throughout the day—including New York Fed President Williams, Cleveland Fed President Musalem, and Richmond Fed President Barkin—will be closely monitored for any commentary on both the inflation outlook and the unprecedented legal pressure facing Chair Powell. Markets remain on edge about whether the DOJ investigation represents a genuine legal concern or a pressure tactic aimed at influencing monetary policy decisions.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!