Macro Volatility Clouds are Gathering for Bitcoin This Week

Bitcoin (BTC) bounces into a new week as volatility catalysts multiply worldwide.

Bitcoin sees a trip above $92,000 after the weekly open, but traders are preparing for short opportunities.

Liquidity hunts are the name of the game when it comes to short-term BTC price action.

Geopolitics, the Fed and inflation data converge to produce a potential macro volatility shock.

Bitfinex whales are signalling that a new BTC price uptrend is due next.

2026 may end up a year of consolidation with a battle at $65,000, analysis predicts.

Traders fade another weekend BTC price pump

Bitcoin began the weekly candle on a high thanks to some volatility into the Asia market open.

Data from TradingView showed BTC/USD hitting local highs of $92,392 on Bitstamp.

The timing of the headline-driven move, however, immediately made traders suspicious. Bitcoin, they noted, tends to cancel out gains made before the start of a new TradFi trading week.

Over the past 6 Asian session pumps, 4 out of 6 were fully retraced.

The last two times price pumped into a Monday, it marked a local top and fully reversed the move, giving back even more.

We’re once again pumping into Monday. Keep the Jan 13th pivot in mind. pic.twitter.com/XLM9oDLSe8

— LP (@LP_NXT) January 12, 2026

“Hopefully, like we’ve seen many weeks, we’ll get a scam-pump on Sunday so we can look for shorts early in the week. With the weak ~$87,600 monthly open as final target,” trader Lennaert Snyder told X followers in advance of the weekend.

“Needless to say with current headlines today is going to be super interesting,” trader Skew predicted Monday.

“Commodities as a whole are getting bid here including BTC with some spot buying lifting price here.”

On higher time frames, trader CrypNuevo focused on the 50-week exponential moving average (EMA) at $97,400 as a potential upside target before new lows.

“My main scenario over the past month is that price will revisit the range lows before it can go higher – I expect Bitcoin to go back to low $80’s,” he confirmed.

CrypNuevo remained bullish on 2026 as a whole, considering optimal market entries and $73,000 as a “worst case scenario.”

“Sudden squeezes” become standard

Multiple classic BTC price metrics are aligning to predict a fresh round of market volatility.

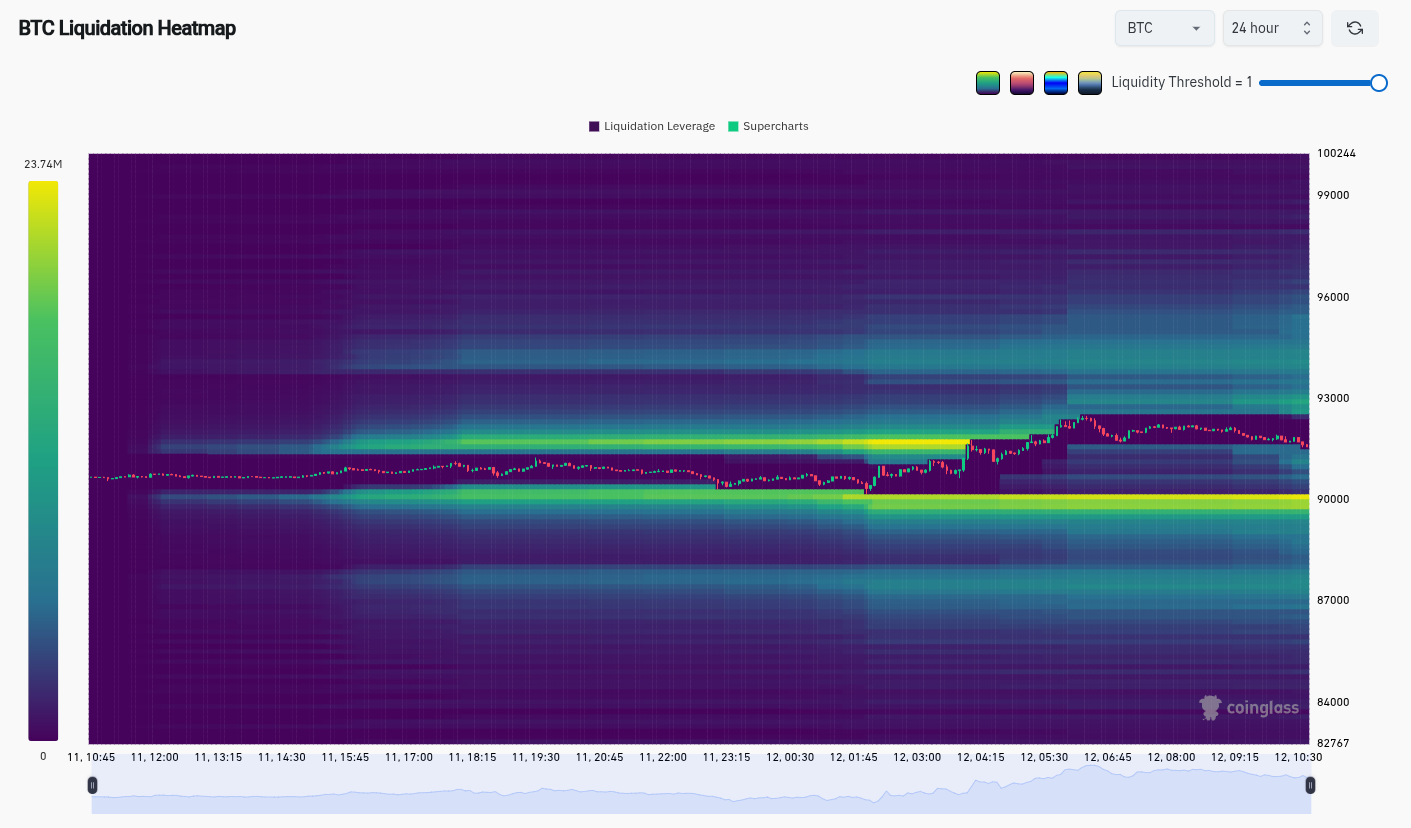

New findings from onchain analytics platform CryptoQuant put exchange order-book liquidity in the firing line.

“Liquidation spikes on both the long and short side align closely with sharp wicks and fast reversals. This behavior is typical of liquidity hunts, where overleveraged positions are forced out during periods of compressed price action,” contributor The Alchemist 9 wrote in a “Quicktake” blog post Sunday.

The post described BTC price action as “increasingly shaped by liquidation events rather than organic spot demand.”

Open interest, funding rates and the Bollinger Bands volatility indicator all point to “sudden squeezes” taking place on lower timeframes.

“Volatility here appears to be manufactured by leverage resets rather than sustained spot buying or selling,” The Alchemist 9 commented.

CryptoQuant acknowledged that liquidity hunts do not imply a strong upward or downward trend.

The latest liquidity data from monitoring resource CoinGlass, meanwhile, shows a key area of interest at $90,000.

Macro volatility cocktail arrives

A big week for US inflation data could become even more volatile as geopolitics meets a showdown between the government and the Federal Reserve.

The latest releases of the Consumer Price Index (CPI) and Producer Price Index (PPI) come as markets assess the fallout from the US quasi-takeover of Venezuela and threats to intervene in Iran.

At the same time, the US Supreme Court is due to rule on the legality of the international trade tariffs imposed by President Donald Trump last year.

As Cointelegraph reported, crypto markets remain highly sensitive to any new events related to tariffs and their implications for liquidity trends.

“Early-January volatility has created some exceptional trading conditions for investors,” trading resource The Kobeissi Letter summarized on X.

A weekend curveball came in the form of Fed Chair Jerome Powell, who became the subject of a criminal investigation — allegedly over the handling of a renovation project.

In a statement, Powell openly suggested that the motives for the move by the Department of Justice (DoJ) lay elsewhere, specifically interest rates not falling as quickly as Trump wanted.

“This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings. It is not about Congress’s oversight role; the Fed through testimony and other public disclosures made every effort to keep Congress informed about the renovation project. Those are pretexts,” he said.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Stock market futures fell immediately after the statement went public, while gold hit new all-time highs of $4,601 per ounce.

The timing of the debacle is notable, coming just weeks before the Fed is due to avoid another rate cut at its Jan. 28 meeting.

“Trump vs Powell will result in even more volatility,” Kobeissi added.

Multiple senior Fed officials are set to take to the stage for public speaking engagements this week.

Bitfinex whales’ Bitcoin longs roll over

Bitfinex whales continue to point the way forward when it comes to BTC price trends — if history is a guide.

Whales’ BTC long positions continue to shrink this week after reaching a local high near 73,000 BTC.

Throughout much of the bull cycle, whales pivoting in this way preceded periods of price upside, and market participants are hoping that this time will be no different.

“From a long-term perspective, a bull market is already underway,” pseudonymous crypto investor and data analyst CW, a contributor to onchain analytics platform CryptoQuant, commented on the topic Monday.

“While the short-term may be confusing, the current situation is a little noise in the long run.”

The last reversal from local highs came in April last year, around the time that BTC/USD saw long-term lows near $75,000. In the coming weeks, the pair gained 50%.

In his own analysis at the weekend, commentator MartyParty employed the Wyckoff method to predict history repeating, calling for a swing low, known as the “spring,” to emerge next.

“This precedes the Wyckoff Spring,” he told X followers.

Bitfinex longs currently total around 71,800 BTC, marking their lowest levels since Dec. 15.

Bear market still a 2026 reality

Bitcoin maturing as an asset has not made it immune from bear markets — and 2026 could easily prove that, new analysis says.

Related: Trump rules out SBF pardon, Bitcoin in ‘boring sideways’: Hodler’s Digest, Jan. 4 – 10

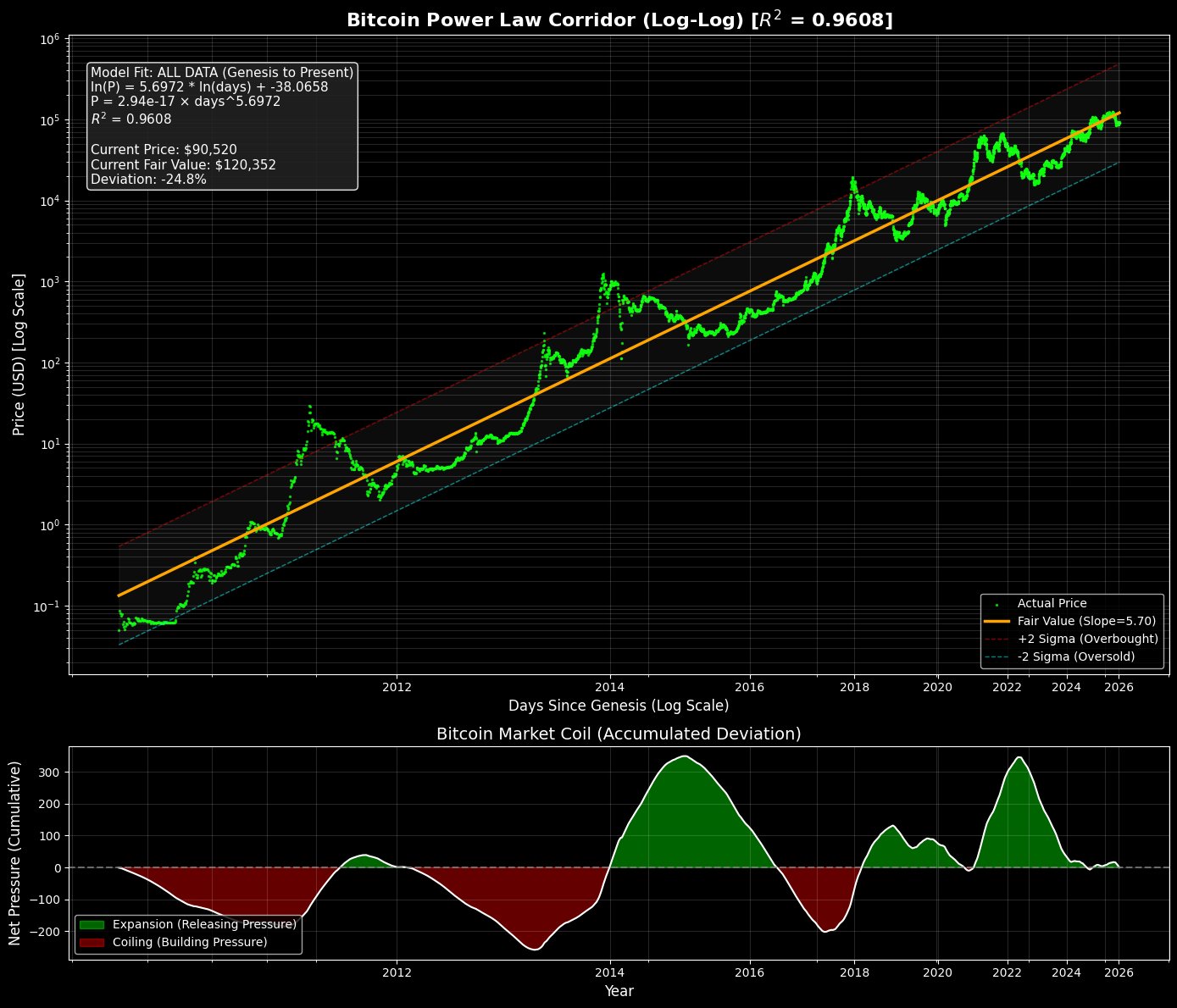

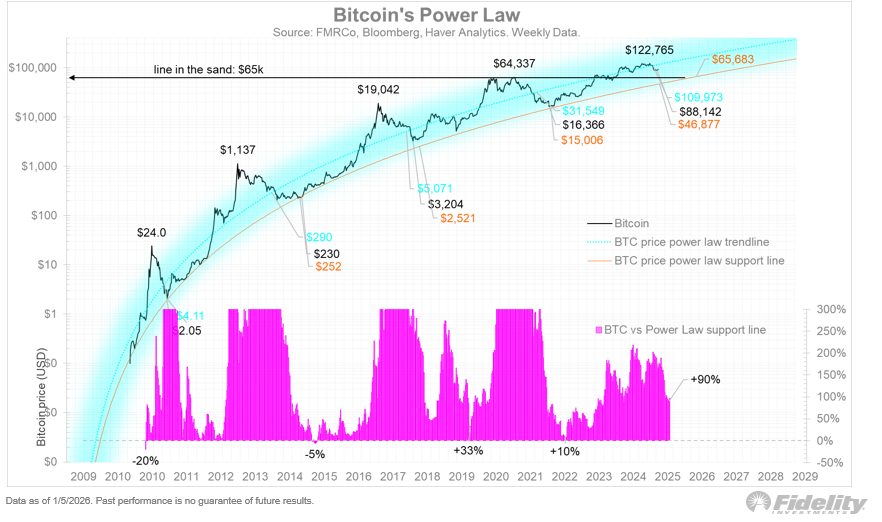

Updating followers on Bitcoin’s power law price model, Jurrien Timmer, director of global macro at Fidelity Investments, said that this year could end up as a giant consolidation period for BTC/USD, followed by a new bear market low.

“It’s interesting that a lot of Bitcoin folks are proclaiming that the four year cycle is dead and a new structural up wave is at hand,” he wrote.

“I’m skeptical, not about the waning power of the halving cycle (with which I agree), but the idea that bear markets are no longer going to happen.”

Power law trendlines currently envisage a battle taking place at $65,000 if the price consolidates.

As Cointelegraph reported late last year, BTC price hugging its power law trendline for much of the bull market was already giving rise to calls for major upside.

Now, executive David Eng describes price as “coiling below” its long-term growth trajectory, with only one viable outcome.

“Bitcoin is Compressed Below Its Growth Law, and Compression Always Resolves Upward,” he summarized on X.

Eng added that “history says resolution comes by price catching up, not the law giving way.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.