Financial & Forex Market Recap – Jan. 5, 2026

Markets opened the first full trading week of 2026 with a risk-on rally despite geopolitical tensions, as traders looked past the weekend’s US military operation in Venezuela to focus on upcoming economic data releases, while weaker-than-expected manufacturing activity had limited impact on sentiment.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Monday’s session delivered a notable divergence between geopolitical headlines and market behavior, as traders demonstrated resilience by pushing risk assets higher despite the weekend’s extraordinary US military operation capturing Venezuela’s president. The risk-on tone suggested that markets viewed the Venezuela situation as largely contained, with participants instead positioning ahead of this week’s critical services PMI and employment data.

US equities rallied broadly, with the S&P 500 climbing 0.63% to close around 6,901. The index rallied from the Asia open and traded with consistent strength throughout the session, breaking through prior resistance levels near 6,900. The move appeared to reflect traders prioritizing domestic economic resilience over geopolitical concerns, possibly interpreting the Venezuela operation as having limited direct economic impact while anticipating favorable upcoming data releases.

WTI crude oil advanced 2.12% to settle near $58.20 per barrel. The energy complex initially spiked during early Asian trading hours following news of the Venezuela raid, climbing from around $56.40 to test $57.50. However, rather than extending gains on supply disruption fears, oil volatility declined and prices pulled back heading into the London session. The muted response likely reflected market views that Venezuela’s oil production—already severely diminished by years of sanctions and underinvestment—wouldn’t meaningfully tighten global supply. But shifted bullish during the London and U.S. sessions, possibly on traders focusing more on OPEC+ plans to pause supply increases in the first quarter as global markets face a surplus, versus the prospect of Venezuelan production increasing to add to global supply.

Bitcoin surged 4.56% after topping out near $94,832 before pulling back to $94,100, marking the session’s strongest performance among major assets. The cryptocurrency rallied sharply during Asian hours, climbing from around $91,600 to breach $93,300, before consolidating through the London session. Bitcoin caught a second wind during US trading hours, pushing above $94,800 at its peak. The strength appeared disconnected from the Venezuela news and instead possibly reflected renewed appetite for alternative assets amid geopolitical uncertainty, though the lack of crypto-specific catalysts suggested the move was primarily technical in nature or linked to broader risk-on sentiment.

Gold gained 1.88% to close around $4,444 per ounce. The precious metal rallied steadily throughout the session, climbing from approximately $4,372 at the Asian open to test $4,456 during US morning trading. The advance likely correlated with safe-haven demand triggered by the Venezuela operation, though the measured pace of gains—rather than a sharp spike—suggested markets weren’t pricing significant escalation risk.

Treasury yields declined 0.91% to settle around 4.155% on the 10-year note. Yields traded mostly sideways through Asian and early London sessions before weakening before and after the 10:00 am ET ISM Manufacturing release. The bond market move appeared to reflect positioning ahead of this week’s services PMI and employment data, with traders possibly interpreting the continued manufacturing contraction as evidence supporting the Fed’s patient approach to policy, despite Kashkari’s comments that the Fed may be close to neutral CNBC.

The Dollar Index weakened 0.14% to close near 98.30. The greenback’s modest decline despite geopolitical tensions represented a noteworthy divergence from typical safe-haven dynamics, suggesting traders may have viewed the Venezuela situation as already priced in or unlikely to significantly impact the US economy.

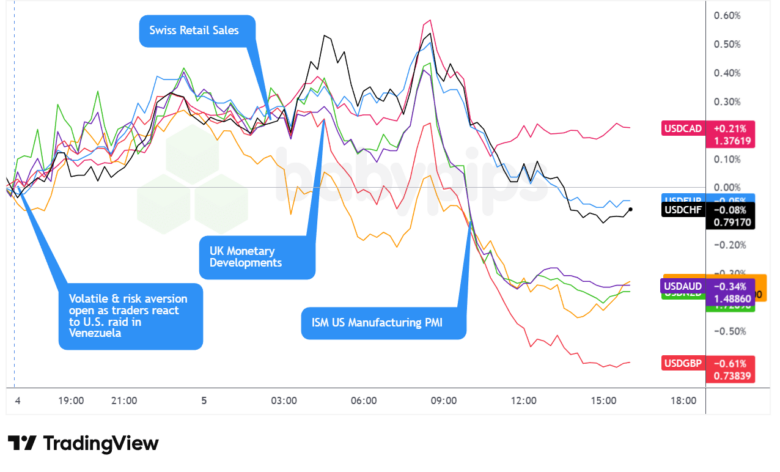

FX Market Behavior: U.S. Dollar vs. Majors

The US dollar started strong but then traded with a net bearish lean through the rest of the Monday’s session, closing lower against most major currencies in a pattern that defied typical safe-haven dynamics following the weekend’s Venezuela operation. The subdued dollar response appeared to signal market confidence that geopolitical tensions would remain contained, while traders positioned ahead of this week’s more consequential economic releases.

During the Asian session, the dollar opened with choppy but with a clear bullish lean, likely a safe haven reaction to the Venezuela headlines dominating weekend news flow. The limited strength in the greenback’s possibly reflected Asian traders’ assessment that the operation’s economic impact would be limited, or alternatively represented positioning adjustments following the New Year holiday period.

The London session brought increased volatility and a slight mixed but bearish tilt for the dollar. Currency pairs exhibited divergent moves across the board, with the pound strengthening modestly on firmer UK consumer credit data, while the euro and Swiss franc also gained ground. The dollar’s weakness during European hours occurred despite the lack of major regional economic catalysts, suggesting broad-based dollar selling rather than strength in specific currencies driving the moves.

The US session saw the dollar extend its net bearish trajectory following the 10:00 am ET ISM Manufacturing release. The PMI falling to 47.9%—the lowest reading of 2025 and marking the 10th consecutive month of contraction—initially triggered notable dollar weakness. However, the currency’s decline remained measured rather than accelerating sharply, possibly because markets had largely anticipated continued manufacturing sector struggles. The dollar traded choppy and mixed through the afternoon, stabilizing near session lows into the close.

At Monday’s close, the dollar posted net losses against most major currencies. The pound emerged as the strongest performer against the greenback, while the Canadian dollar was the weakest performer among the majors, possibly on the prospect of potentially lower oil prices (Canada’s biggest export), in the medium to longer-term.

The dollar’s inability to rally on Venezuela-related geopolitical tensions represented a notable shift from typical market behavior. This dynamic likely reflected traders’ assessment that the operation—while dramatic—posed limited near-term economic risks, particularly given the Trump administration’s stated intentions to eventually increase Venezuelan oil production. Market participants instead appeared focused on this week’s more material catalysts: Wednesday’s ISM Services PMI and Friday’s employment report, both of which could provide clearer signals for Federal Reserve policy trajectory.

Upcoming Potential Catalysts on the Economic Calendar

- Australia S&P Global Services PMI Final for December 2025 at 10:00 pm GMT

- Japan Monetary Base for December 31, 2025 at 11:50 pm GMT

- U.K. BRC Shop Price Inflation for December 2025 at 12:01 am GMT

- France Inflation Rate Prel for December 2025 at 7:45 am GMT

- Euro area HCOB Services PMI Final for December 2025 at 9:00 am GMT

- U.K. New Car Sales for December 2025 at 9:00 am GMT

- U.K. S&P Global Services PMI Final for December 2025 at 9:30 am GMT

- Germany Inflation Rate Prel for December 2025 at 1:00 pm GMT

- New Zealand Global Dairy Trade Price Index for January 6, 2026

- U.S. Fed Barkin Speech at 1:00 pm GMT

- Canada S&P Global Services PMI for December 2025 at 2:30 pm GMT

- U.S. S&P Global Services PMI Final for December 2025 at 2:45 pm GMT

- U.S. API Crude Oil Stock Change for January 2, 2026 at 9:30 pm GMT

Tuesday’s calendar centers around global services PMI releases, particularly the US update, which carries more weight than Monday’s manufacturing data given the services sector’s dominant share of the US economy. Following manufacturing’s 10th consecutive month of contraction, markets will closely scrutinize whether the larger services sector continues showing resilience or exhibits signs of cooling that could influence Federal Reserve rate cut expectations.

European inflation updates from France and Germany will provide insight into the ECB’s policy path, though traders’ primary focus remains squarely on US data given Fed officials’ recent messaging about being close to neutral on policy rates CNBC.

The combination of services activity data and Fed speaker commentary could generate elevated volatility if either suggests a material shift in the inflation-growth balance that has kept policymakers cautious. Markets remain particularly sensitive to any indications that services sector strength—which has supported the broader economy despite manufacturing weakness—may be fading, as this would carry more significant implications for growth and employment than continued factory sector struggles.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!