PEPE Soars 23% as Market Cap Hits Two-Week High

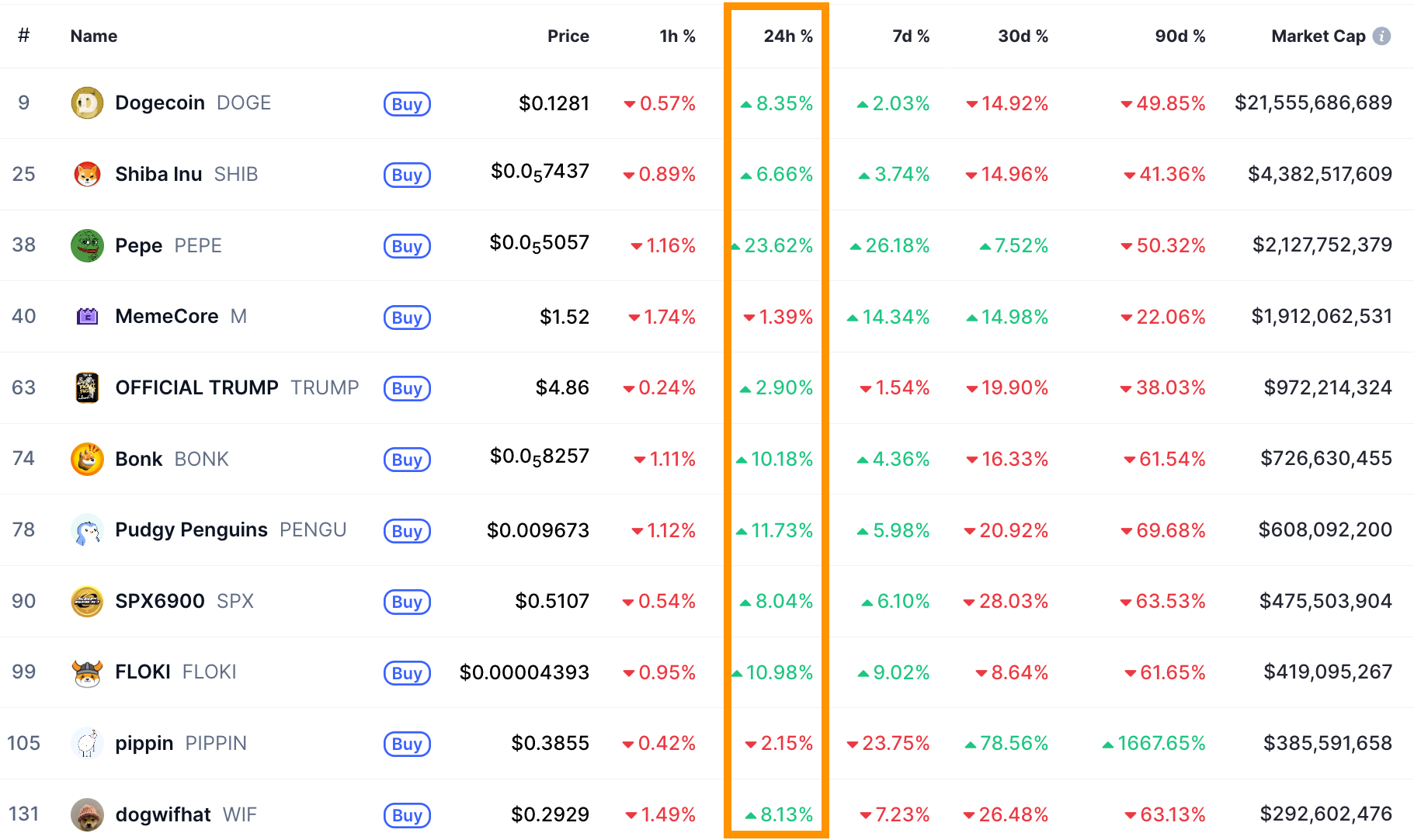

Memecoins like Pepe (PEPE), Bonk (BONK), and Dogecoin (DOGE) were among the best-performing cryptocurrencies on Friday, posting significant gains as the market geared up for 2026.

Key takeaways:

Memecoin market cap surged 8% to $39.45 billion, a two-week high, signalling strong demand.

PEPE led gains with 23.6%, BONK +10%, DOGE +8%; fueled by influencer hype and bold 2026 predictions.

Spike in memecoin open interest over the last 24 hours reflects growing bullish bets.

Memecoin market cap adds $3 billion

The latest rise in memecoin prices has seen the total market capitalization reach a two-week high of $39.45 billion on Friday as Ethereum cofounder Vitalik Buterin switched his profile picture to a meme NFT.

🚨 LATEST: Vitalik Buterin switching his profile picture to a Milady NFT reportedly sent the collection’s floor price up around 50%. pic.twitter.com/o2jLYlSDPW

— Cointelegraph (@Cointelegraph) January 2, 2026

The last time the memecoin market cap was above $39 billion was on Dec. 20. The aggregate market value of cryptocurrencies in this sector is up 8% over the last 24 hours.

PEPE, the Ethereum-based memecoin, led the gains, rising 23.6% over the last 24 hours. Pepe’s rival on Solana, BONK, recorded 10% daily gains, while DOGE, the largest memecoin by market cap, jumped 8% over the same time frame.

While not a full-blown rally, this performance hints at a possible “meme season” driven by a mix of factors, including the buzz around MemeMax_Fi, a perp DEX for memecoins, allowing users to trade with 100x leverage.

“What I like about @MemeMax_Fi is how it understands attention as capital,” trader @ken_w3b3 said in a recent X post, adding:

“Memes aren’t just culture here, they’re liquidity, momentum, and community energy rolled into one system.”

Memecoins OI and trading volume rise sharply

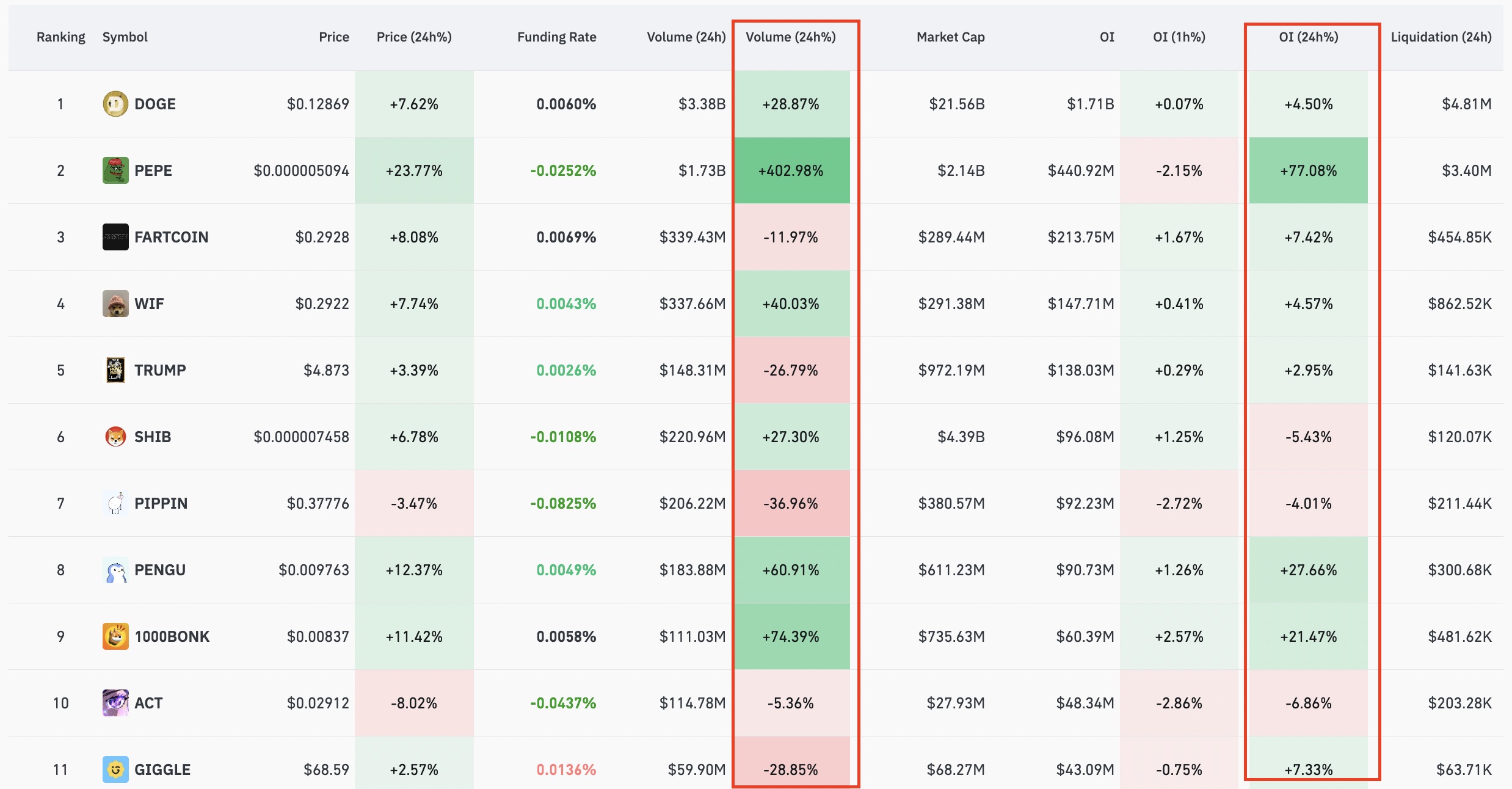

The rise in memecoins on Friday was preceded by an increase in open interest (OI), with PEPE gaining 77% in OI over the last 24 hours to $441 million.

Open interest refers to the total amount of pending derivative contracts that have not yet been settled. In a futures contract, for every seller, a buyer is required to settle the contract.

Related: Can Solana shed its memecoin image in 2026?

PENGU saw its OI jump by over 27% on the day to $90.73 million, while DOGE’s OI was standing at $1.71 billion, up about 4.5%.

The chart above also revealed a notable increase in the daily trading volume of memecoins in the derivatives market, with PEPE leading the jump by 402%. Overall, the daily trading volume of memecoins has risen 35% in the past 24 hours to $4.75 billion.

The rise in OI and trading volume for memecoins usually indicates bullish momentum in the market as leverage traders open more contracts in anticipation of price increases.

Technical rally for memecoins

The current bullishness in memecoin prices is preceded by a strong technical structure by TOTAL3, or the total market cap of all cryptocurrencies excluding Bitcoin (BTC) and Ether (ETH), which has experienced a significant rise over the last two days.

The chart below shows that TOTAL3 has increased by 22% since Wednesday, to an intra-day high of $848 billion on Friday. This rise happened within an ascending parallel channel on the four-hour chart, as shown below.

Traders bought the dips as the relative strength index (RSI) fell to oversold levels of 25 in mid-December. The RSI’s reading is currently 65, suggesting that trader interest in altcoins is increasing as momentum picks up.

If TOTAL3 manages to overcome the strong resistance at $848 billion, embraced by the triangle’s upper trendline and the 200 SMA, it will rise toward the measured target of the triangle at $900 billion. If this happens, altcoins, including major memecoins, may continue rallying over the next few weeks.

As Cointelegraph reported, crypto sentiment has finally moved out of the “extreme fear” territory, suggesting that the market is primed for a recovery.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.