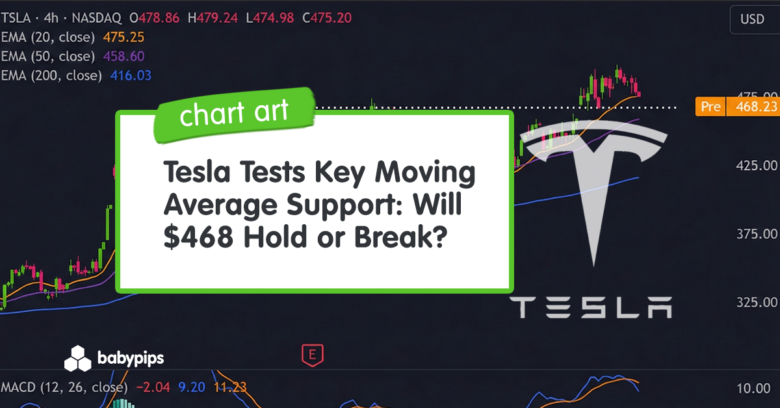

Chart Art: Tesla Tests Key Moving Average Support: Will $468 Hold or Break?

2025-12-29 13:12:00

Article Highlights

- Momentum Warning at Record Highs: MACD bearish crossover at all-time highs. Price touched $498.83 before pullback. Indicator readings suggest correction risk.

- Critical Support Zone in Play: $468-$475 confluence of 20 EMA and horizontal support. Break below targets 50 EMA at $458. Bulls must defend or face deeper decline.

Tesla (TSLA) is trading around $475, pulling back slightly from its record intraday high of $498.83, with the stock now testing critical support at the convergence of the 20-period EMA and a key horizontal resistance level.

The EV giant has delivered a stunning 2025 performance, rallying over 45% from September lows around $330 to recent all-time highs.

However, the recent MACD bearish crossover, combined with price testing support at the 20 EMA suggests Tesla is at a decisive level.

The stock will either maintain its momentum into 2026 or pull back toward the 50 EMA at $458.

But now the question is:

Can Tesla defend the $468-$475 support zone and resume its march toward $500, or will the MACD bearish crossover trigger a correction toward the $450 level or deeper?

TSLA (Tesla): 4-Hour Chart

Trend and Market Structure

The 4-hour chart reveals a stock that experienced a powerful rally followed by consolidation near all-time highs, with Tesla now testing whether the recent breakout has staying power or needs a deeper retracement.

Tesla’s 2025 rally accelerated dramatically in the second half of the year, surging from the September lows near $330 to the December 22 record high of $498.83.

This represents a gain of over 50% in just three months, driven by a fundamental shift in how the market values the company, from traditional automaker to AI and robotics powerhouse.

Moving Average Structure

Price currently sits right at the 20 EMA ($475.25), which has provided dynamic support throughout the December rally.

The tight convergence between the current price and the 20 EMA creates a critical decision point.

A hold above this level would keep the near-term uptrend intact, while a break below would signal the first crack in bullish momentum.

The 50 EMA at $458.60 sits approximately 3.5% below the current price and represents the next major support level if the 20 EMA fails.

This moving average provided strong support during the October-November consolidation and would likely attract buyers on any pullback.

Most importantly, Tesla trades well above the 200 EMA at $416.03, confirming the long-term uptrend remains firmly intact.

The distance between price and the 200 EMA (approximately 14%) indicates healthy momentum without excessive overextension seen in prior parabolic moves.

Key Resistance Level

The horizontal dotted line at approximately $468 marks a key technical level. This area served as resistance during previous consolidation phases and now acts as immediate support.

The fact that this level aligns closely with the 20 EMA creates a confluence support zone that magnifies its importance.

Above the current price, the psychological $500 level looms as the next major barrier.

Tesla briefly touched $498.83 but failed to close above $490, suggesting selling pressure intensifies as the stock approaches round number resistance.

A convincing break above $500 would likely trigger another wave of momentum buying and short covering.

Volume Analysis

Recent volume patterns show lighter participation during the consolidation near all-time highs compared to the heavy volume that drove the initial breakout from $400 to $470.

This diminishing volume at higher prices is a cautionary signal. Healthy uptrends typically see volume expand on rallies and contract on pullbacks.

The current pattern of lighter volume near highs suggests buyers are becoming hesitant at current valuations, waiting for either a catalyst to push higher or a pullback to provide a better entry.

Momentum and MACD Analysis

The MACD indicator currently reads -2.04, having recently generated a bearish crossover that serves as the primary warning signal on this chart.

MACD Structure and Crossover

The MACD histogram has turned negative (red bars), indicating the 12-period EMA has crossed below the 26-period EMA.

This bearish crossover occurred after the stock reached its all-time high, a classic momentum divergence pattern where price makes new highs but momentum fails to confirm.

Looking at the MACD’s trajectory throughout 2025 reveals important context.

During the powerful September-November rally from $330 to the upper $400s, the MACD surged deeply into positive territory (green histogram bars), reaching levels above +10. This strong momentum reading confirmed the strength of the uptrend and validated the breakout.

However, as Tesla pushed from $470 to the final highs near $499, the MACD began losing steam.

The histogram bars grew smaller despite the price making new highs, creating a bearish divergence. This divergence suggested that each incremental gain required less buying conviction, a warning sign that often precedes corrections.

The current negative MACD histogram reading of -2.04, while not deeply oversold, indicates momentum has shifted from bullish to neutral-bearish.

The crossover from positive to negative territory typically signals at minimum a pause in the uptrend, if not a near-term correction.

Signal Line Analysis

The MACD’s signal line (orange) sits well above the MACD line (blue), creating significant separation.

This gap suggests the bearish momentum shift has room to run before reaching oversold conditions that would typically attract buyers.

For bulls to regain control, the MACD needs to bottom and generate a bullish crossover back above the signal line.

This would require either strong buying pressure to resume or a period of sideways consolidation that allows the indicator to reset without significant price damage.

Momentum Context

The current MACD setup is particularly concerning because it’s occurring at all-time highs after an extended rally.

Bearish crossovers near major highs carry more weight than those occurring mid-trend, as they often mark exhaustion points where early buyers begin taking profits.

Additionally, the September-November rally saw the MACD remain in positive territory for an extended period, reflecting sustained momentum.

The quick shift to negative after reaching new highs suggests this momentum phase has concluded, at least temporarily.

Key Support and Resistance Levels

Resistance levels to watch:

- Immediate resistance: $480-$485 (recent consolidation highs)

- Psychological resistance: $490-$500 (round number, prior high at $498.83)

- Breakout level: $505-$510 (would signal continuation of parabolic move)

Critical support levels:

- Immediate support: $468-$475 (horizontal level + 20 EMA, critical confluence zone)

- Secondary support: $458-$462 (50 EMA, major dynamic support)

- Strong support: $440-$450 (prior consolidation zone from November)

- Major support: $416-$425 (200 EMA area, long-term trend support)

- Bull market support: $390-$410 (previous breakout zone, deep retracement level)

The $468-$475 Critical Zone

The convergence of the 20 EMA at $475 and the horizontal resistance-turned-support at $468 creates the most important near-term technical level on the chart.

This 1.5% zone represents the line in the sand for the current uptrend structure.

A hold above this zone with a reversal candle would validate the bullish case and suggest Tesla is merely consolidating gains before another leg higher.

The tight stop-loss level makes this an attractive risk-reward setup for bulls willing to exit quickly if support breaks.

However, a decisive break below $468 on a closing basis would confirm the MACD bearish signal and likely trigger algorithmic sell orders and stop losses. This could accelerate selling toward the 50 EMA at $458, representing a 3.5% decline from current levels.

The 50 EMA Make-or-Break Level

The $458-$462 zone, where the 50 EMA resides, represents the next major line of defense.

This moving average provided strong support during the October-November period when Tesla was building its base for the final rally phase.

A pullback to the 50 EMA would constitute a roughly 6% decline from the all-time high, which would be considered healthy profit-taking after a 50%+ rally.

50 EMA retests are ideal entry points in strong uptrends, suggesting institutional buyers would likely emerge at this level.

However, a break below the 50 EMA with heavy volume would be a more concerning development. It would suggest the uptrend structure has been damaged and could target the $440-$450 zone or potentially the 200 EMA at $416.

Resistance at $500

The psychological barrier at $500 represents the key upside level. Tesla’s failure to close above $490 despite reaching $498.83 intraday suggests significant selling pressure at round numbers.

Options market activity typically concentrates around round numbers, with heavy call selling creating supply.

A convincing daily close above $500 would be a major technical and psychological breakthrough. It would likely trigger renewed FOMO buying, force additional short covering, and potentially target $550-$600 as the next objective.

However, reaching $500 first requires successfully defending current support and reclaiming the $485-$490 zone.

Trading Outlook and Risk Assessment

Risk-reward currently favors either waiting for a successful 20 EMA defense with reversal confirmation or anticipating a pullback to the 50 EMA for better entry.

Bearish/Correction Scenario

The technical evidence leans bearish for the near term:

MACD bearish crossover, diminishing volume at highs, failure to close above $490, and price testing support rather than resistance.

The MACD crossover at all-time highs is particularly significant. This pattern has historically preceded corrections of 5-15% as momentum traders exit and early buyers take profits.

The current reading suggests the indicator has room to decline further before reaching oversold conditions.

If Tesla breaks below the $468-$475 support zone on a closing basis, the technical setup would favor a move toward the 50 EMA at $458.

While the company is increasingly valued on AI and autonomy potential rather than car sales, near-term catalysts must deliver to justify current valuations.

Q4 2025 delivery numbers (expected January 1-2, 2026) could disappoint if they show continued year-over-year declines.

Bullish Scenario

The bull case requires Tesla to defend the $468-$475 support zone and generate a reversal pattern that reclaims the $485-$490 area.

If this occurs with expanding volume, it would suggest the MACD crossover was a false signal and the uptrend remains intact.

The fundamental backdrop for bulls remains compelling. The December catalysts represent genuine progress on Tesla’s autonomous driving ambitions:

- Unsupervised FSD testing in Austin marks an important milestone toward commercialization.

- Cybercab production scheduled for April 2026 provides a near-term catalyst.

- Energy division growing 81% year-over-year and becoming highly profitable.

- Three Fed rate cuts making vehicles more affordable to the broader market.

Bulls should watch for a bounce off the 20 EMA at $475, accompanied by a strong reversal candle (long lower wick, green close).

If this occurs with the MACD beginning to flatten or turn up, it would be the signal that buyers are defending support.

The ideal bullish entry would be a quick dip to $465-$470 that holds with a strong reversal, allowing entry with stops below $460 and targeting a retest of $490-$500. This provides approximately 2:1 reward-to-risk.

Even if Tesla corrects to the 50 EMA at $458, bulls have a strong secondary entry zone.

That level provided excellent support during prior consolidations and would offer much better risk-reward for longer-term positions, especially ahead of the January 28 earnings report.

Consolidation Scenario

The most likely near-term outcome may be continued consolidation between $465-$490 as the market digests the rapid gains and awaits upcoming catalysts.

This would allow the MACD to work off overbought conditions through time rather than price, a healthier resolution for bulls.

Key events that could break Tesla out of consolidation:

- Q4 Delivery Numbers (January 1-2, 2026): Projections exceed 2 million units for the full year 2025. Strong numbers could reignite momentum.

- Q4 Earnings (January 28, 2026): Guidance on Cybercab production timeline and FSD monetization plans will be critical.

- Robotaxi Expansion News: Announcements of California or Florida permits would be major catalysts.

- Model 2/Model Q Details: Information on the affordable vehicle platform targeting BYD.

Until these catalysts arrive, Tesla may CHOP between support and resistance, frustrating both bulls and bears.

Day traders might consider range-bound strategies, while swing traders should wait for clear directional breaks.

Longer-Term Considerations

Despite near-term technical warnings, Tesla’s longer-term narrative underwent a fundamental shift in 2025.

Tesla’s 2025 investment story has shifted from vehicle sales to AI, autonomy, robotics, and energy storage.

The stock hit new highs late in the year, even as analysts flagged Q4 delivery risks, a sign that markets are pricing in FSD progress, robotaxi potential, and Optimus more than near-term auto margins.

- On autonomy, Tesla launched a robotaxi pilot in Austin and began limited unsupervised testing without in-car safety monitors.

- A dedicated “Cybercab” and an affordable next-gen platform are planned, with production expected around 2026, though timing, final specs, and rollout depend on regulatory and engineering outcomes.

- The Optimus humanoid program continues advancing. Musk has argued robots could eventually represent a major share of Tesla’s value, though this remains aspirational rather than a formal forecast.

- Meanwhile, Tesla’s energy business is already delivering: Q3 2025 saw record storage deployments with 81% year-over-year growth, and Megapack has become a leading grid-scale solution globally.

Risks remain substantial. Scaling from a single pilot city to a commercial robotaxi network requires regulatory approval, proven safety, and heavy capital investment.

Tesla also faces Waymo, which already provides hundreds of thousands of paid driverless rides weekly, plus competition from Chinese and other global players.

The valuation premium (forward P/E above 300, 15.4x forward sales) prices in optimistic assumptions about future success

⚠️ Any delays in Cybercab production, regulatory setbacks, or disappointing FSD adoption could trigger significant multiple compression.

From a technical perspective, as long as Tesla holds above the 200 EMA at $416, the long-term uptrend structure remains intact. That level, currently 14% below price, represents the ultimate line of defense for bulls.

A break below would challenge the entire 2025 rally thesis and potentially target $360-$390!

Watch the $468 support and $500 resistance levels closely in the coming sessions.

How Tesla resolves this range will likely set the tone for early 2026.

- A break above $500 signals momentum continuation toward $550+.

- A break below $468 suggests a healthy correction toward $440-$460 to consolidate gains before the next move.

For long-term investors believing in the autonomous and AI story, pullbacks to the 50 EMA ($458) or even 200 EMA ($416) would provide attractive entry points with better risk-reward than current levels.

For traders, the technical setup favors caution until the MACD and price action provide clearer directional signals.