NFT Market Slides to 2025 Lows as Buyers and Sellers Pull Back

تكنلوجيا اليوم

2025-12-25 10:04:00

Non-fungible tokens (NFTs) extended their year-end slide in December, with total market valuations falling to their lowest level in 2025.

According to data from CoinGecko, the overall valuation of the NFT sector fell to $2.5 billion in December. This represented a 72% decline from a peak of $9.2 billion in January.

The decline came as NFT sales activity remained subdued following a weak November performance. In December, weekly NFT sales failed to surpass $70 million during the first three weeks of the month, falling below November’s pace.

December is on track to reinforce late 2025’s downward trend as year-end liquidity thins. The NFT market has not been able to return to its former glory, despite renewed use-case interest driven by a surge in physical collectibles including Labubu and Pokémon cards earlier in the year.

Fewer market participants drive NFT sales decline

The slowdown in NFT sales coincided with a sharp drop in market participation, with both buyers and sellers retreating in December.

CryptoSlam data showed that unique buyers declined to 184,302 in the first week of December from 204,032 in November’s last week. Buyer participation continued falling throughout the month, reaching 135,120 on the third week.

Sellers followed the decline. Data showed that unique sellers dropped 35.6% over the same period to fall below the 100,000 mark for the first time since April 2021.

Transactions also suffered. According to CryptoSlam, total NFT transactions in the third week of December declined to 800,000, after the month’s opening week recorded fewer than 1 million transactions.

Related: NFTs shifted to utility and culture as price faded in 2025

Blue-chip NFT prices slide despite pockets of resilience

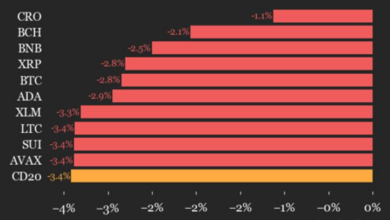

Floor price performances among leading NFT collections mirrored the broader market slowdown, with most of the top 10 projects by market capitalization posting double-digit declines in the last 30 days.

CoinGecko data showed that flagship collections like CryptoPunks, Bored Ape Yacht Club and Pudgy Penguins had 30-day price drops ranging from 12% to 28%, signaling downward pressure even with established NFT brands.

Despite this, art-focused collections like Autoglyphs, Fidenza by Tyler Hobbs and Chromie Squiggle by Snowfro held up better, posting modest gains in the same time frame.

Most notably, a collection called Sports Rollbots entered the top 10 NFT collections by market cap, showing a floor price of $5,800 and a valuation above $58 million. The entry of the new contender pushed the Mutant Ape Yacht Club outside the top 10.

Magazine: Digital art will ‘age like fine wine’: Inside Flamingo DAO’s 9-figure NFT collection