Bitcoin Trips On $90K As CPI Shows Cooling US Inflation

Bitcoin (BTC) moved closer to reclaiming $90,000 after US inflation cooled more than expected, with the November CPI coming in at 2.7% year-over-year versus forecasts of 3.1%. The softer print narrows the gap to the Federal Reserve’s 2% target, easing near-term inflation pressure and reviving risk appetite across markets.

Key takeaways:

The lower-than-expected CPI print generated a positive response from Bitcoin as new positions opened versus the usual short covering.

Onchain data shows “balance-sheet” repair and loss absorption for BTC, not capitulation.

CPI print lifts BTC price as positioning rebuilds near $90,000

According to crypto trader Back, Bitcoin’s post-CPI bounce has been accompanied by rising open interest, pointing to fresh positioning rather than a simple squeeze of short sellers. Options gamma exposure remains relatively balanced around spot, implying that price is less constrained and able to move if liquidity expands.

However, the move was still viewed as an impulsive act rather than the beginning of a new trend. Early upside has been largely liquidity-driven, leaving room for short-term pullbacks, as traders reassess positioning after the initial reaction.

The final macroeconomic event for the year is the Bank of Japan’s (BOJ) interest rate decision on Dec. 19. While BOJ policy shifts can influence global liquidity via yen funding markets, recent price action suggests much of this risk may already be reflected in Bitcoin’s range-bound behavior over the past few sessions. If the outcome is non-disruptive, it could remove one of the last hurdles of near-term uncertainty for BTC.

Related: Bitcoin’s volatility below Nvidia in 2025 as investor base grew: Bitwise

BTC onchain data points to stabilization, not distribution

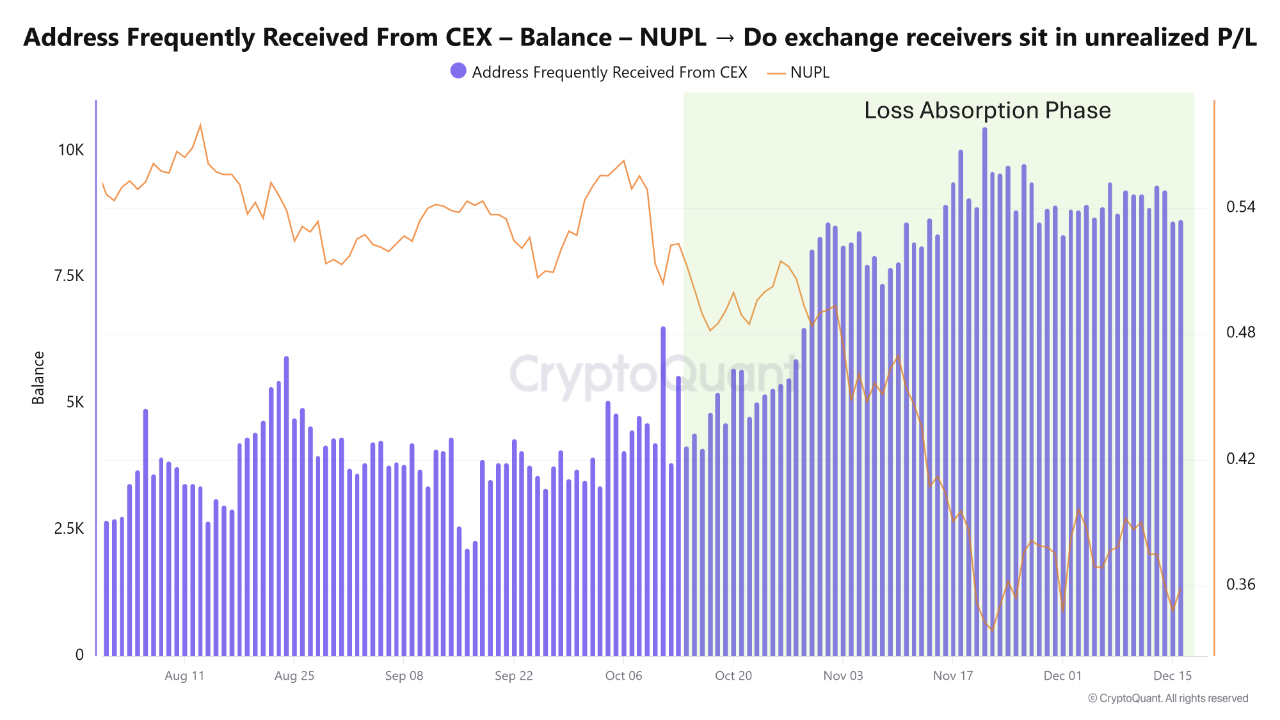

Data from CryptoQuant indicated Bitcoin transitioning into a repair phase since October. Exchange metrics such as net-unrealized profit/loss (NUPL) indicate that unrealized losses have stopped deepening, while the inflow spent-output profit ratio (SOPR), hovering near breakeven, suggested coins are being sold close to cost rather than in panic.

Deposit activity on major exchanges spikes mainly during brief downside moves and fades as price stabilizes, reinforcing the view that selling pressure is reactive, not structural. Meanwhile, highly active address inflows remain elevated, but MVRV has flattened, signaling trade within a range rather than renewed speculative excess.

However, the latest inflation data could now tilt conditions more favorably. If dollar pressure eases and real yields drift lower in the days ahead, Bitcoin’s ongoing stabilization may transition into a more durable upside move, especially if $90,000 is reclaimed.

From a technical standpoint, BTC needs to clear $90,000 and reclaim a position above the monthly VWAP (volume-weighted average price) to exhibit buyer’s conviction. A daily close above the level would be pivotal, with immediate sell-side liquidity available between the fair value gap (FVG) of $90,500 and $92,000.

A rejection and increase in short positioning would keep BTC inline to test the swing lows at $83,800.

Related: Bitcoin hunts liquidity as US CPI inflation drops to lowest since 2021

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.