Bank of England (BoE) set to cut rates as inflation slows, but easing seen as limited

2025-12-18 03:41:00

BoE expected to cut rates 25bp to 3.75%

- Inflation fell to 3.2% in November

- Growth and labour market weakening

- Services inflation remains sticky

- Further cuts likely limited

The Bank of England is widely expected to cut interest rates at its final policy meeting of the year today, following a sharper-than-anticipated slowdown in inflation and mounting evidence that economic momentum is weakening.

Markets are pricing a 25 basis point reduction in Bank Rate to 3.75% from 4%, which would take borrowing costs to their lowest level since early 2023. The case for easing has strengthened after headline CPI inflation fell to 3.2% in November from 3.6% in October, an eight-month low and a larger drop than economists had forecast. The decline was driven mainly by easing food and drink inflation, alongside softer price pressures in alcohol and tobacco.

The inflation data come on the heels of other signs of cooling activity. Labour-market indicators have softened, with unemployment at its highest level since 2021, while economic growth contracted slightly in the three months to October as businesses delayed investment decisions ahead of November’s budget. Together, these developments have bolstered the argument that restrictive policy settings are weighing on demand.

Even so, policymakers are expected to strike a cautious tone. Inflation remains well above the Bank’s 2% target, and services-sector price growth continues to show signs of persistence. Business surveys also point to renewed inflation pressures in parts of the economy, suggesting the disinflation process may not be linear.

As a result, while a December cut appears likely, expectations for a sustained easing cycle remain limited. Investors are currently pricing only one further rate cut in 2026, with uncertainty over whether a second move will materialise. Any reduction this week is likely to be framed as a measured adjustment rather than the start of aggressive loosening.

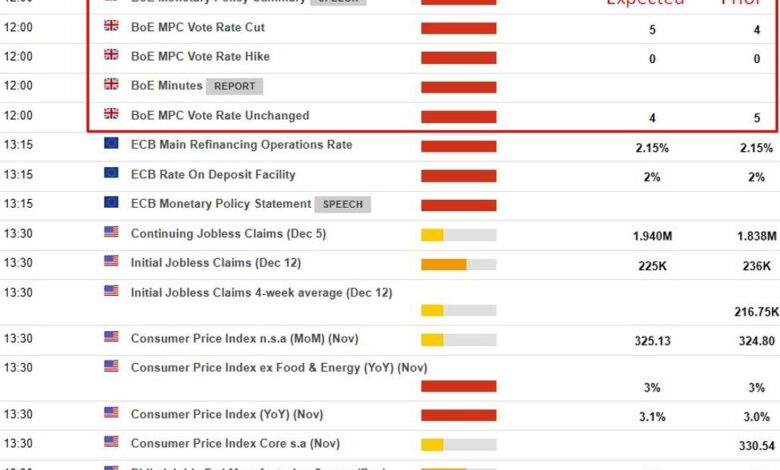

Attention will also be on the voting split and guidance. The Monetary Policy Committee has been narrowly divided in recent meetings, and even with softer inflation data, policymakers are expected to maintain language emphasising a gradual and risk-managed path lower in rates. With global peers nearing the end of their own easing cycles, the BoE appears keen to retain flexibility rather than commit to a clearly defined trajectory.