Hyperliquid plans bold $1 billion HYPE burn to tackle market doubts

Hyperliquid is learning how quickly sentiment can turn in crypto.

According to CryptoSlate data, HYPE, the token that powers the decentralized perpetuals exchange, has dropped to seven-month lows in December after a year in which Hyperliquid looked like the default venue for on-chain leverage.

During this period, the platform’s trading volumes have stalled just as newer platforms have surged on the back of incentives and points campaigns. As a result, it looks like a market share story that has flipped against Hyperliquid.

However, two new forces are now trying to rewrite that narrative.

On Wall Street, Cantor Fitzgerald has stepped in with a 62-page initiation report that treats Hyperliquid less as a reflexive DeFi token and more as an exchange with cash flows.

On-chain, the Hyper Foundation has proposed effectively burning roughly $1 billion worth of HYPE from a fee-funded treasury, a move designed to make scarcity as visible as the price chart.

Together, the defense and the burn sketch out a simple argument: Hyperliquid is not losing its core franchise, its token is structurally mispriced, and the market is staring at the wrong metrics.

The growth wall

Hyperliquid’s immediate problem is not its model but the market scoreboard.

For much of the last year, the exchange could credibly claim to be the dominant perpetual futures DEX.

However, that edge has narrowed in the second half of 2025. Aster, Lighter, and edgeX have flooded their platforms with points programs and airdrop promises, pulling in what Cantor calls “point tourists.” These are traders who churn volume to farm rewards rather than express views.

As a result, the combined monthly perp volume of Aster, Lighter, and edgeX, which was about $103 billion in June, has shot up to $638 billion by November. Over the same period, Hyperliquid’s volume barely moved, edging from roughly $216 billion to $221 billion.

In a market where liquidity usually follows the loudest incentives, that flat line looks like lost share.

However, Cantor argues that this view is misleading.

The firm stated that the rival platforms are inflating activity with circular wash-like flows, while Hyperliquid hosts “organic” trading that shows up in open interest, not just notional turnover.

By comparing volume to open interest, the bank tries to show that Hyperliquid’s users deploy real leverage rather than gaming the scoreboard.

Notably, this logic has market precedent. Earlier cycles saw NFT marketplace Blur and several Solana-based DEXs bootstrapping explosive volume with reward schemes that didn’t always survive once incentives tapered.

Still, the quantum of the shift is hard to ignore. Even if a portion of Aster’s or Lighter’s volume vanishes when rewards reset, they will likely retain some percentage of their new flow.

Indeed, Hyperliquid also used a points system before its token generation event, which blunts the claim that it stands apart from the incentive game.

For now, traders are voting with their keyboards. The protocol may have higher-quality flow, but the visible top-line growth sits elsewhere.

A $1 billion HYPE ‘burn’

Against that backdrop, the Hyper Foundation’s move to “burn” its Assistance Fund looks less like a routine governance tweak and more like an attempt to rewrite the supply story.

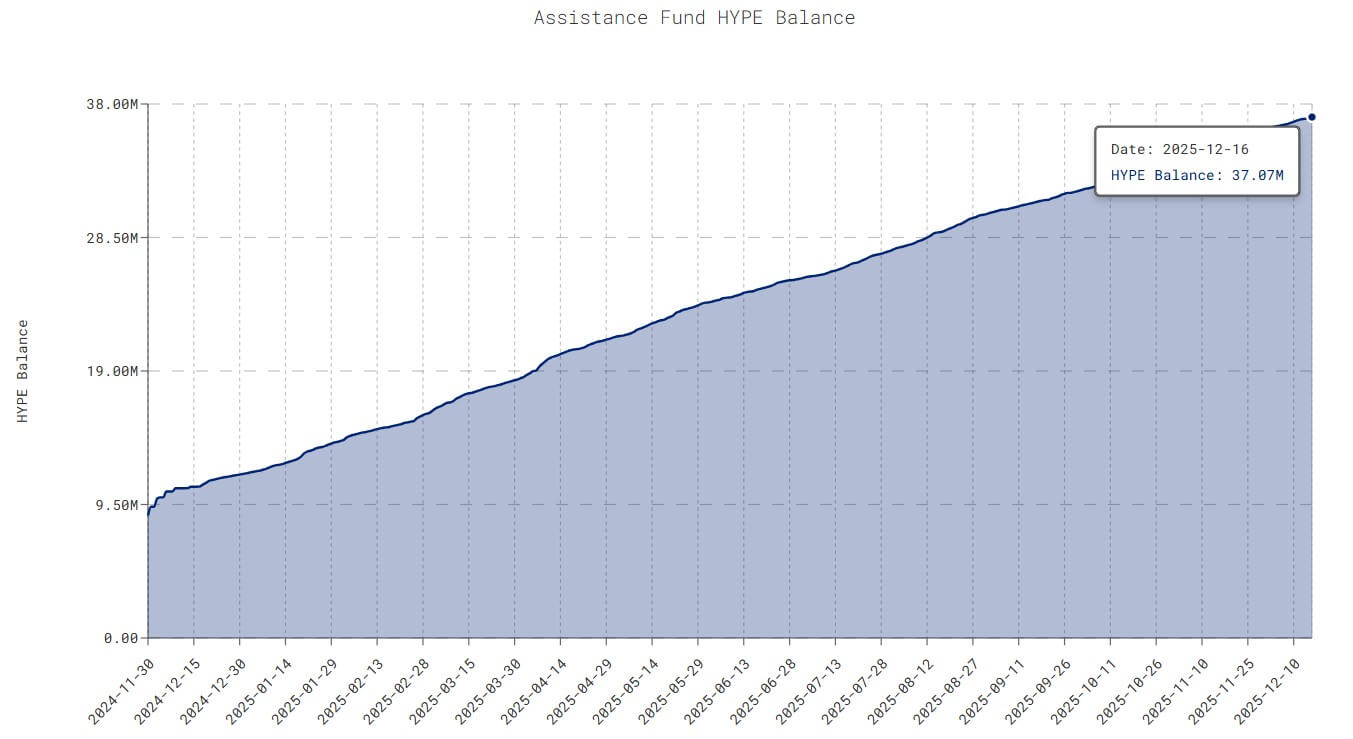

The fund accumulates HYPE that the protocol repurchases with fees. By mid-December, it held about 37 million tokens, primarily funded by roughly $874 million in fees generated year-to-date in 2025, according to Cantor.

Those tokens sit in a special system address that has never had a private key. So, recovering them would require a hard fork.

The new proposal asks validators to formalize what is already true in practice. By voting to treat the Assistance Fund address as a dead wallet and pledging never to approve an upgrade that touches it, they transform a technical detail into explicit social consensus.

On paper, that removes roughly $1 billion from the fully diluted supply and erases almost 13% of circulating tokens.

The mechanics don’t change the economic reality that serious analysts already model. Most fundamental investors treat the Assistance Fund tokens as effectively out of circulation, since no one can spend them without an explicit protocol-level break.

But optics matter in crypto. Data aggregators and retail dashboards still count those tokens in headline FDV. Reclassifying them as burned forces those screens to converge with Cantor’s “adjusted” figures, instantly making the token screen cheaper per unit.

Is that cosmetic? Partly. The vote doesn’t mint new demand, and it doesn’t fix flatlining volume. But it does harden the commitment that future stewards will not reach for that pool in a downturn.

And in a market that obsessively tracks circulating supply and burn rates, tightening the denominator can still move the narrative, if not the fundamentals, in the short run.

The “exchange of exchange” thesis

Cantor’s report is designed to do the rest of the work because when prices and volumes look weak, the bank leans on cash flow math.

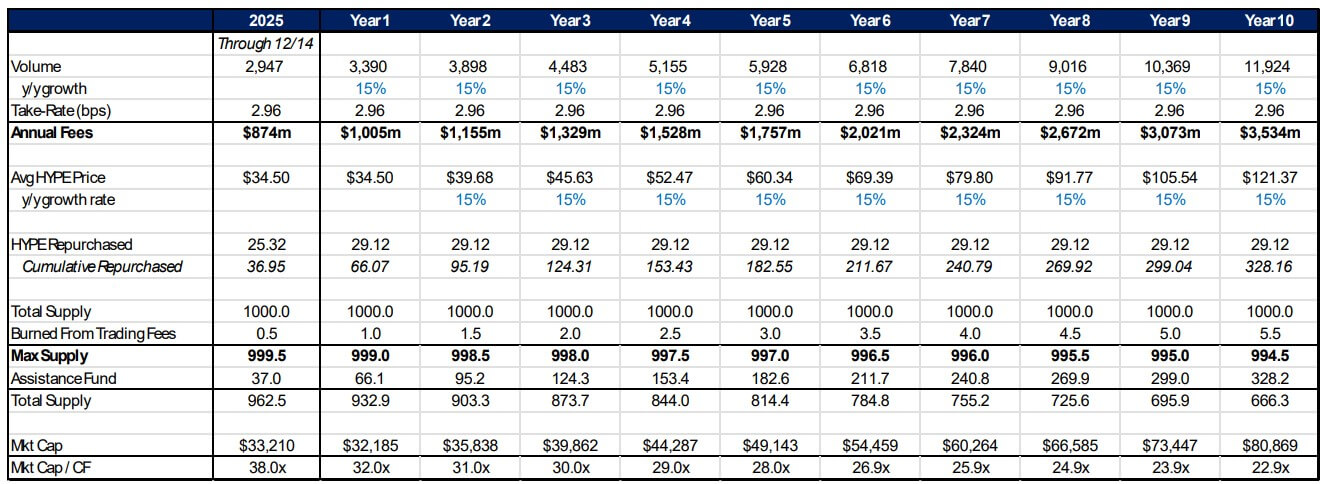

It starts with Hyperliquid’s fee engine. Year-to-date, the protocol has processed close to $3 trillion in trading volume and generated roughly $874 million in fees, much of which is returned to HYPE through repurchases.

Considering this, the bank analysts treat that loop as the on-chain equivalent of an exchange buying back its own stock. Over the long run, they argue, nearly all economic value accrues to token holders.

From there, the model becomes simple: if Hyperliquid can grow its perps and spot business at around 15% a year for the next decade, annual volume reaches roughly $12 trillion.

At current fee schedules, that equates to more than $5 billion in yearly protocol revenue. Apply a 25x multiple, comparable, in Cantor’s view, to a high-growth exchange or fintech, and you arrive at a potential market capitalization of $125 billion, versus a fully diluted value near $16 billion today.

The thesis rests on three pillars: that Hyperliquid reclaims share in perps once points campaigns elsewhere fade; that its new spot venue can push into double-digit DEX market share; and that its buyback engine continues to retire a meaningful chunk of supply each year.

Cantor calculates that, under its assumptions, the Assistance Fund could repurchase about 291 million tokens over a decade, cutting total supply to roughly 666 million and pushing HYPE above $200 in ten years.

That is a generous outcome in a sector where few projects sustain fee growth through a full cycle. Crypto markets rarely reward discounted cash-flow logic during drawdowns; they trade on flows, narratives, and funding conditions.

For Cantor’s approach to work, more investors have to start treating HYPE as an equity proxy, not just another altcoin with a buyback story.

RWAs, synthetic stocks, and the regulatory ceiling

The largest gap between the current price and Cantor’s target sits in the roadmap, not the present.

Hyperliquid already uses HIP-3 to turn itself from a single exchange into what its backers call an “exchange of exchanges”: a base orderbook where outside teams can launch perp markets if they stake 500,000 HYPE and accept slashing risk.

The next step, in the bullish script, is to extend that model to real-world assets.

Cantor sketches a future in which Hyperliquid lists tokenized stock indices, private company exposure, and commodities, undercutting traditional brokers with fees that can fall 90% below incumbent levels.

Spot trading already carries a higher take-rate than perps, and the bank argues that if Hyperliquid wins even 20% of DEX spot flow and a sliver of synthetic equity trading, spot alone could become a billion-dollar fee line.

However, history counsels caution. Prior attempts to bring on-chain US equity exposure, such as Mirror Protocol, ran into securities-law headwinds long before they became systemic.

Tokenized RWAs frequently face questions about licensing, disclosure, custody, and investor protection. So, even if Hyperliquid sticks to synthetic exposures rather than custodial tokens, success at scale would almost certainly draw scrutiny from regulators who care more about economic effects than protocol design.

That is the core disconnect in the current market pricing. Bulls see an enormous total addressable market and a protocol willing to compress fees to capture it.

However, skeptics see a regulatory ceiling that may not appear in a spreadsheet but weighs on every attempt to bring Apple or Nvidia exposure to a permissionless chain.

For now, the tension remains unresolved. The foundation has offered a burn to sharpen the scarcity story. Cantor has supplied a model that treats HYPE as a cash-flowing exchange business with room to grow several times over.

The charts, meanwhile, still show a token under pressure and a venue fighting to keep its place in a market obsessed with incentives.

Until Hyperliquid can prove it can grow again on terms closer to its own, investors are likely to treat the burn and the bullish note as a defense of the floor, not yet a catalyst for a new high.