Bitcoin Treasury Kindly MD Faces Potential Delisting After Nasdaq Notice

Bitcoin treasury company Kindly MD has received a Nasdaq notice after its shares traded below the exchange’s $1 minimum bid price for 30 consecutive business days, starting a six-month window to regain compliance or risk being delisted.

The notice, which was issued Wednesday, does not immediately affect trading, but gives the company until June 8, 2026, to lift its share price above $1 for at least 10 consecutive trading days, according to a regulatory filing from the Securities and Exchange Commission (SEC).

If the company fails to regain compliance within the initial 180-day period, it may seek an additional extension by transferring its listing to the Nasdaq Capital Market, subject to meeting other listing requirements, the according to the filing. Nasdaq could ultimately delist the shares if the company fails to satisfy the bid price rule or pursue available remedies.

Kindly MD, a Utah-based healthcare services provider, announced on May 12 plans to merge with Nakamoto Holdings, marking a shift toward a Bitcoin treasury strategy. The company’s shares surged to a peak of around $25 by May 27, and the merger was closed on Aug. 14.

The stock, trading under the ticker NAKA, has since fallen by more than 98% and was at $0.39 a share at the time of writing, according to Yahoo Finance data.

Related: Trump-backed American Bitcoin flips ProCap in corporate BTC treasury race

PIPE financing weighs on Nakamoto shares

Nakamoto Holdings was founded in 2025 by Bitcoin Magazine CEO David Bailey and is structured as a Bitcoin-native holding company building a network of crypto treasury businesses in partnership with BTC Inc., the parent company of Bitcoin Magazine and the Bitcoin Conference.

The sharp drop in Kindly MD’s share price, which fell below $1 in October, has been linked to the company’s financing strategy, which relied on selling discounted shares to private investors through $563 million in private investment in public equity (PIPE) deals to fund BTC purchases.

Those PIPE deals created sharp downward pressure when a large portion of the shares became eligible for resale in September. The surge in sell orders drove a steep drop in the share price, CEO David Bailey told Forbes in October.

Bailey also said he plans to bring Bitcoin Magazine, the Bitcoin Conference and hedge fund 210k Capital under Nakamoto Holdings as part of an effort to strengthen the company’s cash flow.

Kindly MD still holds 5,398 Bitcoin, ranking it as the 19th largest public company by BTC holdings, according to data from BitcoinTreasuries.NET. Back in August, the company said one of its goals was to acquire 1 million Bitcoin (BTC).

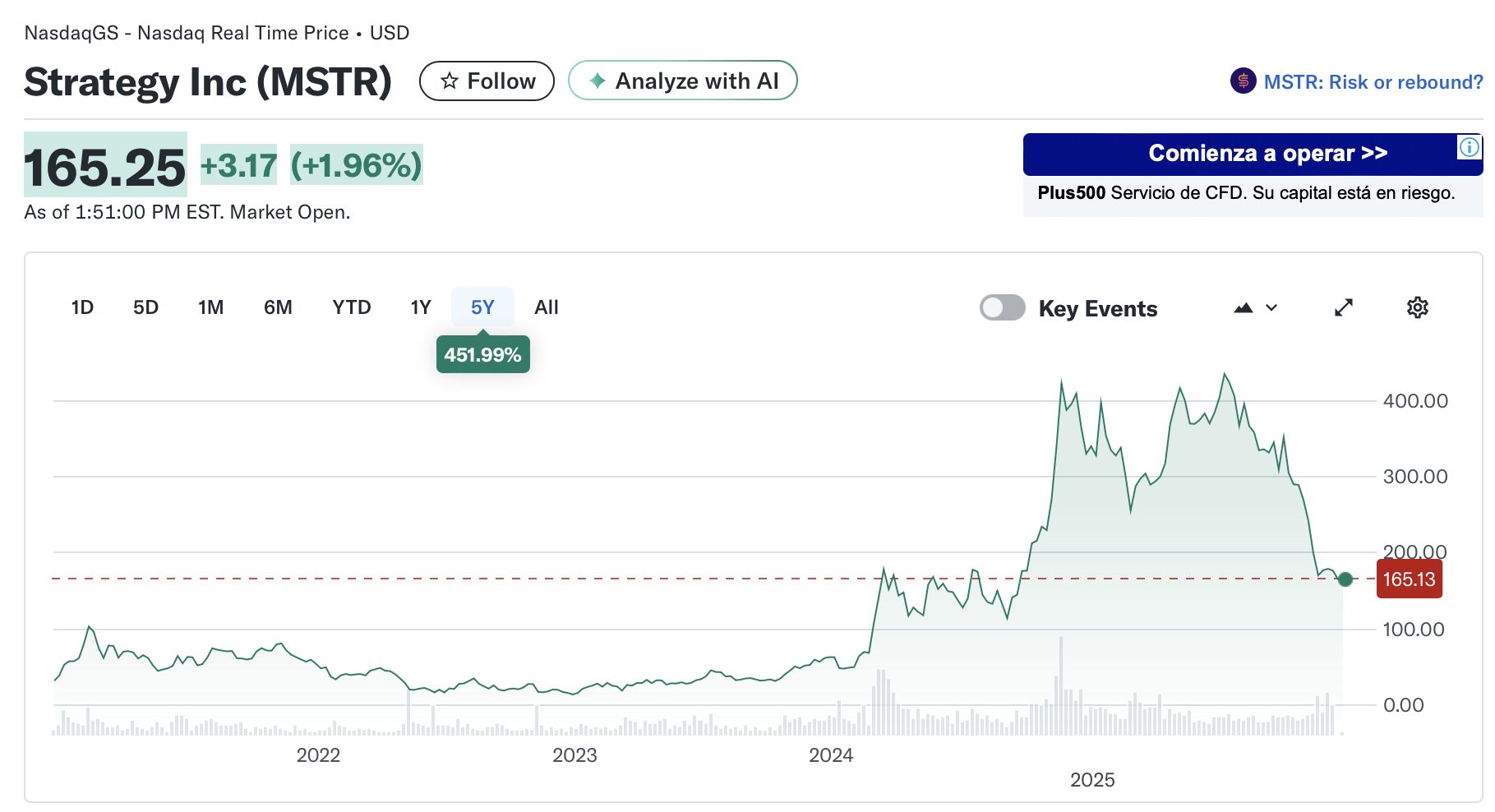

By comparison, Strategy, the first Bitcoin treasury company, holds 671,268 BTC. Although its stock (MSTR) is down over 40% year-to-date, it’s still up 452% since the company began buying BTC in 2020.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?