Brace for volatility as U.S. jobs data loom: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Crypto traders, brace for potential volatility because the pivotal U.S. nonfarm payroll report for November is set to be released later today alongside October retail sales.

The employment data will offer further insight into the extent of cooling in the U.S. labor market, shaping expectations for the Fed’s rate-cutting trajectory.

“A weaker-than-expected NFP report could reinforce the view that the U.S. economy is slowing more noticeably, thereby strengthening expectations for more aggressive monetary easing,” Linh Tran, a senior market analyst at XS.com, said in an email.

Lower rates mean weak data could revive risk-taking, potentially yielding a bounce in bitcoin and the wider crypto market, especially because the pain trade — that’s the transaction that is most expensive for participants’ current positions — could be on the higher side, given the persistent dour market mood of late.

Heading into the release, due at 8:30 a.m., the digital asset market is holding onto Monday’s losses, with total market cap steady around $3 trillion and bitcoin trading near $86,400, down nearly 4% over 24 hours.

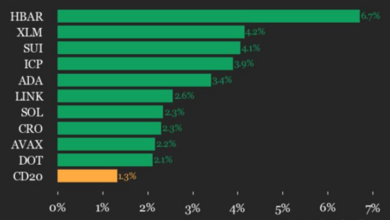

The CoinDesk 20 (CD20) and CoinDesk 80 (CD80) index are both more than 5% lower, and the CoinDesk bitcoin trend indicator (BTI) is suggesting a significant downtrend for the fourth straight day. Volmex’s one-day implied volatility index for BTC remains locked in recent ranges of an annualized 40%-60%, indicating the market is not yet seeing outsized moves in the next 24 hours.

BTC has been bogged down by weaker institutional demand for alternative investment vehicles. On Monday, the U.S.-listed spot ETFs registered a net outflow of $357 million, the highest since Nov. 20.

In addition, stablecoin growth has slowed sharply, signaling a pullback in fresh fiat inflows to crypto.

“Even if absolute growth remains respectable, deceleration in stablecoin growth rates points to a less bullish liquidity backdrop for crypto markets than many had anticipated,” crypto financial services platform Matrixport said.

The delay in the U.S. crypto market structure bill may be adding to the bearish sentiment.

In traditional markets, the Chinese yuan hit a two-month high of 7.0417 per dollar. Crypto bulls have long associated periods of a weak yuan with increased capital outflows from China into cryptocurrencies. So it’s likely a strong yuan has the opposite effect, although there has been little evidence of direct links between the two assets.

That said, a sustained yuan rally could drag the dollar index (DXY) lower (just as a depreciating yuan is said to boost DXY), creating a tailwind for risky assets, including BTC.

Meanwhile, gold’s ascent has stalled, pulling back to $4,277 an ounce from $4,350 on Monday, just shy of the record price of $4,381.48 set on Oct. 20. The U.S. 10-year Treasury yield remains sticky above 4% despite last week’s Fed rate cut. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Macro

- Dec. 16, 8:15 a.m.: U.S. ADP Employment Change Weekly Prev. 4.75K.

- Dec. 16, 8:30 a.m.: U.S. Nov. employment data. Nonfarm Payrolls Est. 40K; Unemployment Rate Est. 4.4%.

- Dec. 16, 9:45 a.m.: S&P Global (Flash) U.S. Dec. PMI Composite (Prev. 54.2), Manufacturing Est. 52, Services Est. 54.1.

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Governance votes & calls

- Moons DAO is voting to elect an Ecosystem Growth Officer to manage strategic partnerships and expand the DAO’s reach. Voting ends Dec. 16.

- Dec. 16: Aerodrome to host an X spaces session with the head of global capital at Nasdaq.

- Unlocks

- Dec. 16: to unlock 1.9% of its circulating supply worth $19.88 million.

- Token Launches

- Dec. 16: Neiro Woofer Pack NFT collection launches in collaboration with OpeanSea.

- Dec. 16: Dash to be listed on Binance TR.

- Dec. 16: Magma Finance (MAGMA) to be listed on Binance Alpha, Bitget, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Market Movements

- BTC is up 0.18% from 4 p.m. ET Monday at $86,363.38 (24hrs: -3.07%)

- ETH is down 0.61% at $2,927.41 (24hrs: -6.72%)

- CoinDesk 20 is down 0.19% at 2,696.69 (24hrs: -4.31%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.84%

- BTC funding rate is at 0.0017% (1.8615% annualized) on Binance

- DXY is down 0.12% at 98.19

- Gold futures are down 0.66% at $4,306.80

- Silver futures are down 0.76% at $63.10

- Nikkei 225 closed down 1.56% at 49,383.29

- Hang Seng closed down 1.54% at 25,235.41

- FTSE is down 0.3% at 9,722.49

- Euro Stoxx 50 is down 0.14% at 5,744.63

- DJIA closed on Monday down 0.09% at 48,416.56

- S&P 500 closed down 0.16% at 6,816.51

- Nasdaq Composite closed down 0.59% at 23,057.41

- S&P/TSX Composite closed down 0.14% at 31,483.44

- S&P 40 Latin America closed up 0.17% at 3,178.81

- U.S. 10-Year Treasury rate is down 0.2 bps at 4.18%

- E-mini S&P 500 futures are down 0.19% at 6,809.75

- E-mini Nasdaq-100 futures are down 0.3% at 25,266.00

- E-mini Dow Jones Industrial Average Index futures are down 0.12% at 48,778.00

Bitcoin Stats

- BTC Dominance: 59.25% (+0.29%)

- Ether-bitcoin ratio: 0.03386 (-1.31%)

- Hashrate (seven-day moving average): 1,047 EH/s

- Hashprice (spot): $36.86

- Total fees: 2.78 BTC / $244,700

- CME Futures Open Interest: 122,980 BTC

- BTC priced in gold: 20.3 oz.

- BTC vs gold market cap: 5.82%

Technical Analysis

- The chart shows BTC’s daily price swings in candlestick format.

- Monday’s candle closed below the support level for the mini-bullish trendline connecting Nov. 21 and Dec. 1 lows.

- The breakdown is consistent with the broader downtrend since early October and indicates scope for a re-test of recent lows near $80,000.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $250.42 (-6.37%), -0.36% at $249.51 in pre-market

- Circle (CRCL): closed at $75.46 (-9.60%), -0.99% at $74.71

- Galaxy Digital (GLXY): closed at $24.54 (-8.26%), -0.61% at $24.39

- Bullish (BLSH): closed at $42.43 (-2.55%), -1.44% at $41.82

- MARA Holdings (MARA): closed at $10.70 (-7.12%), -0.47% at $10.65

- Riot Platforms (RIOT): closed at $13.71 (-10.39%), -0.88% at $13.59

- Core Scientific (CORZ): closed at $15.28 (-7.56%), -1.24% at $15.09

- CleanSpark (CLSK): closed at $11.91 (-15.07%), -1.38% at $11.75

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $37.93 (-11.25%)

- Exodus Movement (EXOD): closed at $13.56 (-10.97%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $162.08 (-8.14%), unchanged in pre-market

- Semler Scientific (SMLR): closed at $16.03 (-10.8%)

- SharpLink Gaming (SBET): closed at $9.51 (-9.51%), -0.11% at $9.50

- Upexi (UPXI): closed at $2.04 (-9.73%),+1.96% at $2.08

- Lite Strategy (LITS): closed at $1.53 (-10.53%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$357.6 million

- Cumulative net flows: $57.53 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: -$224.8 million

- Cumulative net flows: $12.88 billion

- Total ETH holdings ~6.3 million

Source: Farside Investors