Bitcoin Sharks Accumulate at Fastest Pace Since 2012 as BTC Slides

Bitcoin (BTC) is down 30% from its $126,200 peak, trading just above the $85,000 support and fueling concerns of a deeper pullback toward the $70,000 region. Still, onchain data showed institutions and high-net-worth individuals are accumulating BTC.

Key takeaways:

Bitcoin sharks accumulated aggressively at 2012-level speeds, signaling a dip-buying trend.

Heavy selling by long-term and OG whales continues to cap upside, keeping near-term downside risks elevated.

Mid-sized Bitcoin traders add 54,000 BTC in a week

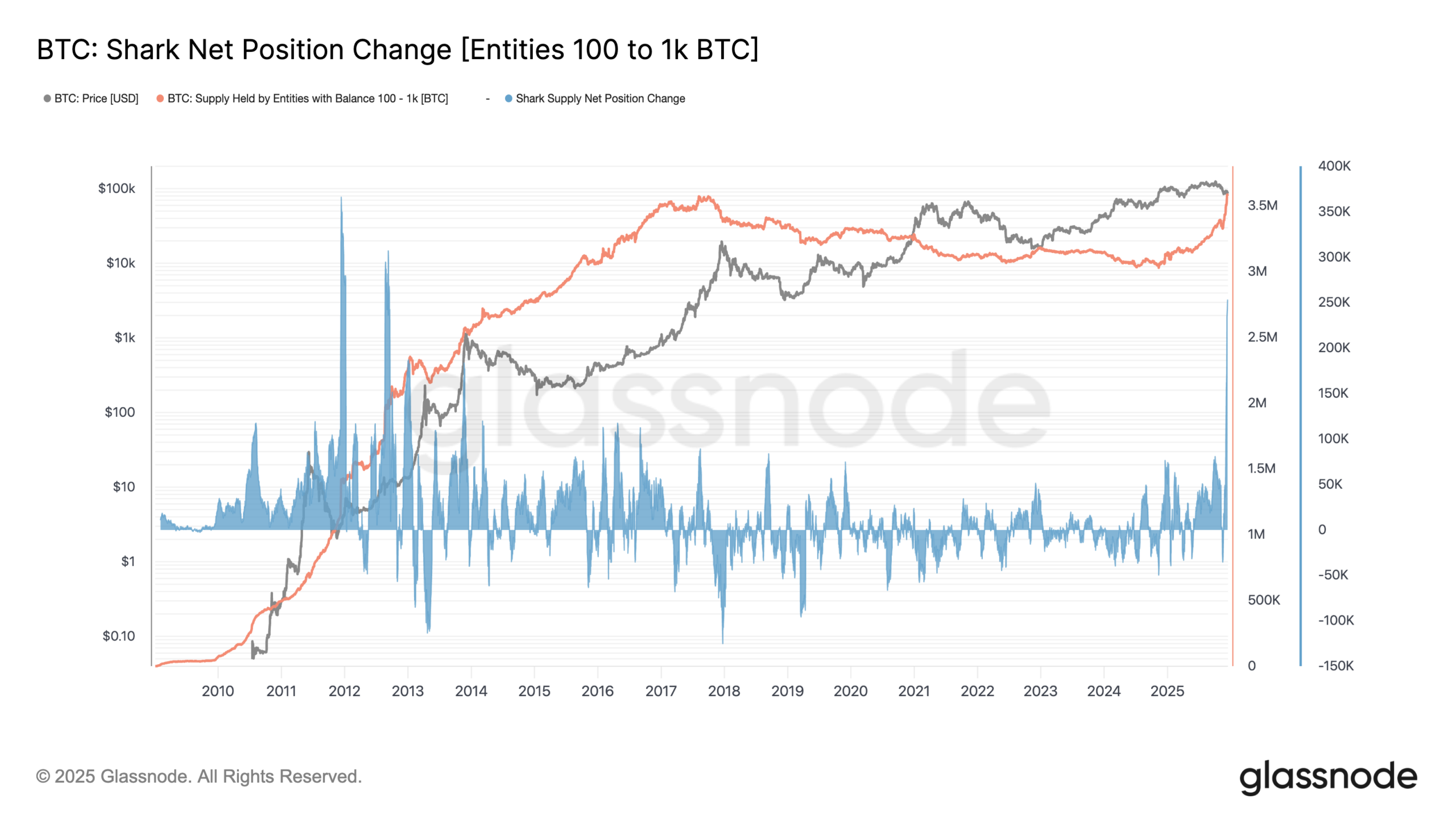

Bitcoin “sharks,” entities holding between 100 and 1,000 BTC, increased their collective holdings to about 3.575 million BTC from roughly 3.521 million BTC over the past seven days, absorbing around 54,000 BTC from smaller holders, according to Glassnode.

The move marked the fastest pace of shark accumulation since 2012, suggesting strong bullish conviction among higher-net-worth individuals and institutional players despite BTC’s 30% drawdown.

Related: Bitcoin to hit new all-time high within 6 months: Grayscale

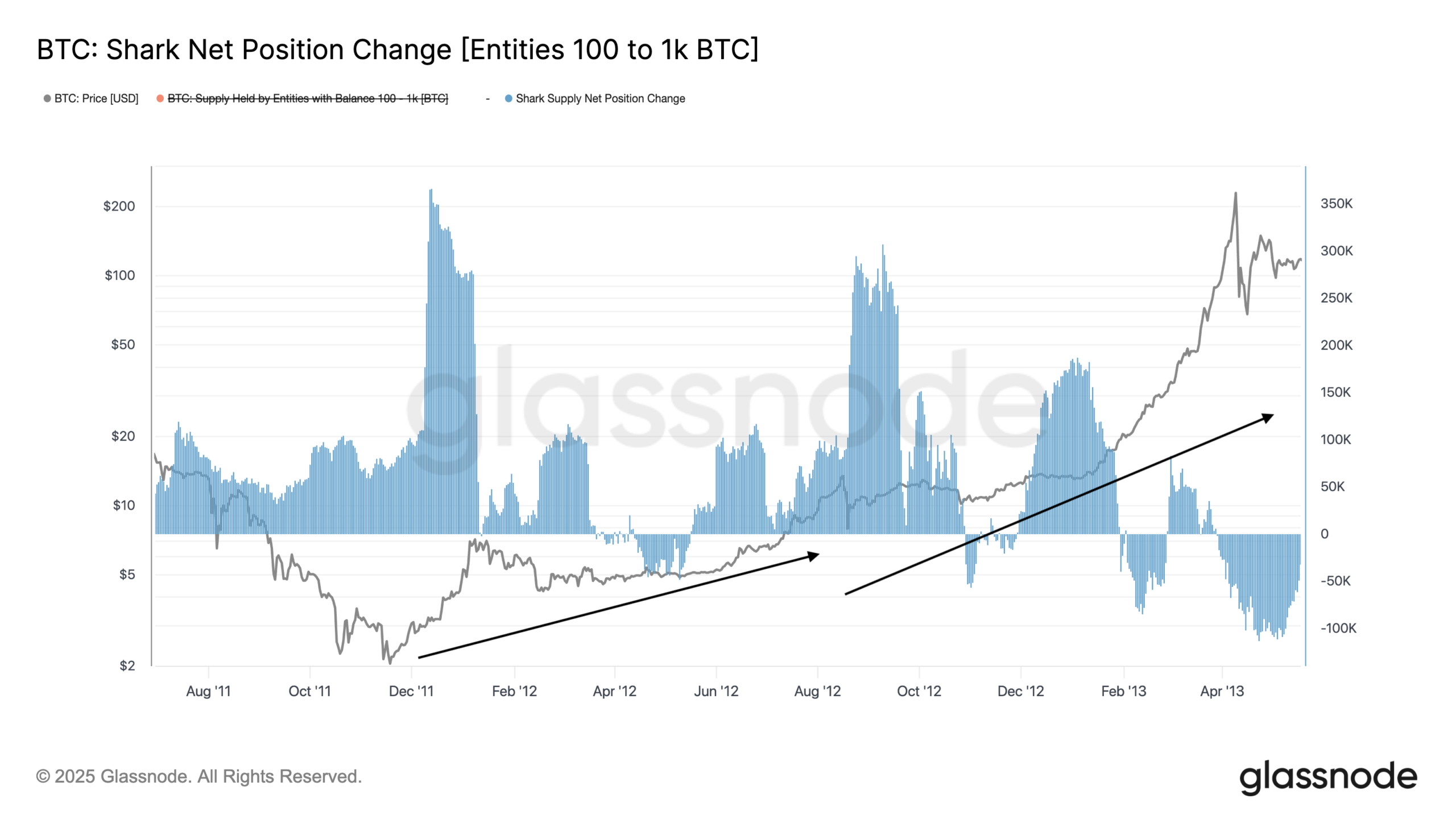

In 2012, a comparable surge in Bitcoin accumulation preceded one of its earliest major rallies, with BTC climbing to above $100 from roughly $10 within a year, marking an approximately 900% increase.

A similar pattern played out in 2011, when aggressive accumulation by mid-sized holders followed Bitcoin’s 350% rise to over $14 from below $3.

A repetition of this historical fractal would favor further upside.

Bitcoin faces sell pressure from long-term holders

Whales with holdings over 10,000 BTC emerged as the major driver behind the sell-off over the past two months, highlighting that the buying power of sharks was insufficient.

That imbalance aligned with Capriole Investments’ assessment that record institutional buying has been met by equally historic long-term holder distribution.

Founder Charles Edwards wrote in a Tuesday post:

“While institutional buying on Coinbase has reached unprecedented levels (Z-score 15.7), it is being absorbed by ‘OG’ whales and long-term holders selling at rates not seen in years (Hodler Growth Rate at 0.6th percentile).”

The price appreciation may be capped until the heavy distribution from older coins subsides, he added.

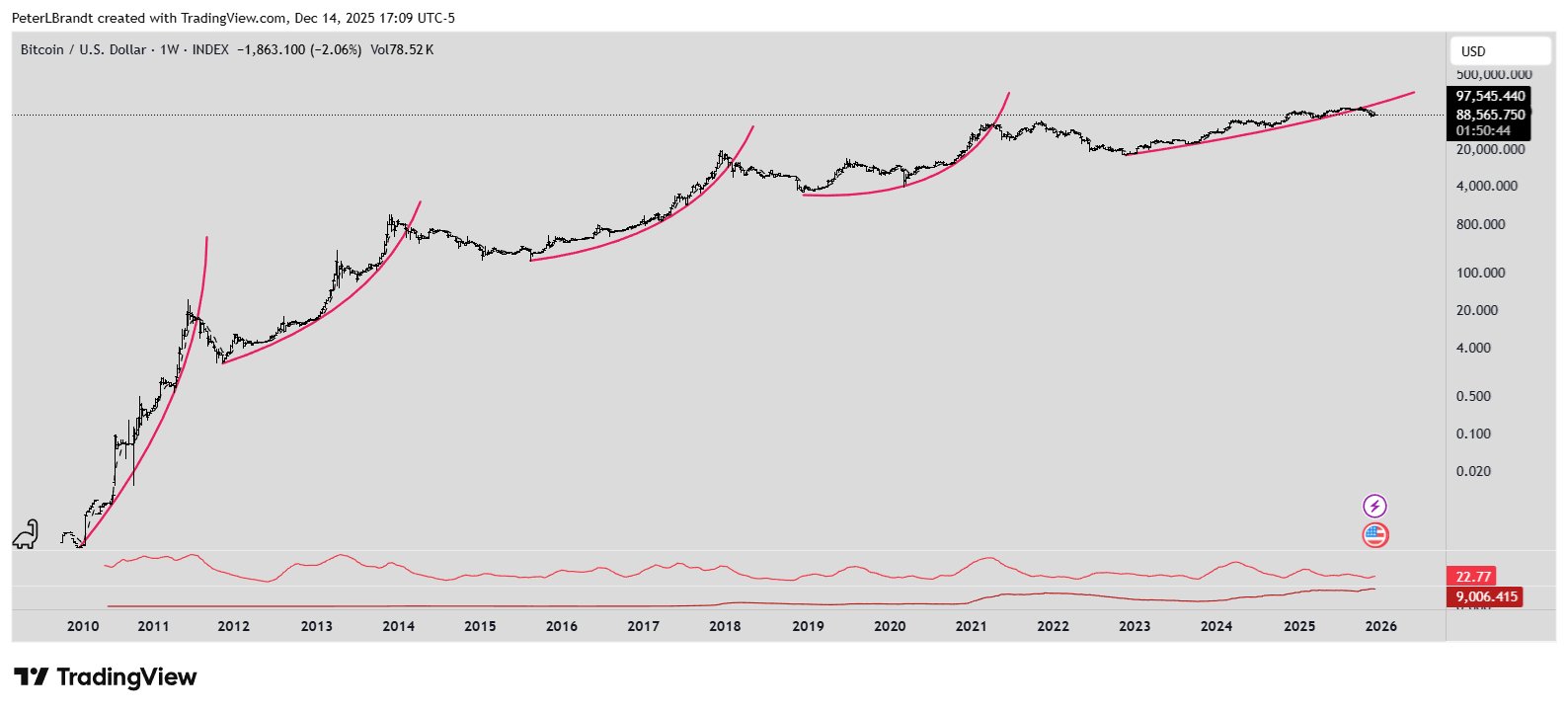

Adding to the downside outlook, veteran trader Peter Brandt highlighted Bitcoin’s recent breakdown below its parabolic support, a move that historically led prices down by around 80%. In other words, BTC price could reach as low as $25,000 if the fractal repeats.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.