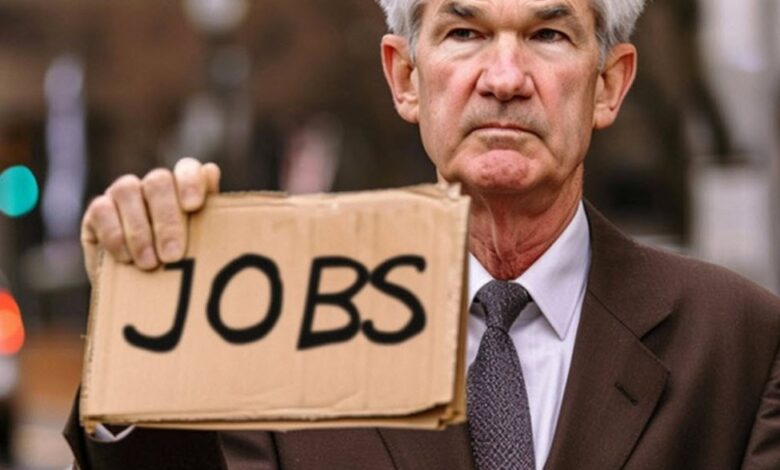

Reminder: US jobs data will be due today

2025-12-16 04:30:00

So, what’d I miss during the break? 😉

There was no shortage of action in markets in the past week, not least with the Fed delivering one final 25 bps rate cut to wrap up the year. Now, the race for Fed chair is also reportedly heating up with Kevin Warsh pipped to be the favourite – ousting Hassett. A battle between the two Kevins is what’s left now.

But for today, the drama will center on the release of the much delayed US labour market report. That’s right. The non-farm payrolls data for November was not released on the first week of December but instead pushed to today. And to make things more complicated, it will be combined with the October job numbers as well.

If that is already not messy enough for you, the BLS also announced that there will be “higher-than-usual variances” in the jobs data for this month and following months as well.

This comes as they implement statistical weighting changes to account for the missing October panel and also as November saw some data collection issues.

All of this just means it won’t be easy and it might take some time – not necessarily this week or this month – to read into the numbers and make sense of the labour market outlook. The existing narrative is that we should continue to see signs of weakening in the landscape, and it will make more sense for market players to judge that in early next year and not on this mess of a release.

Still, it doesn’t mean traders and investors will not react to the data and brush it aside. There will be volatility and reactions to it for sure. But if you’re expecting any firm conclusions from the numbers today, you might not want to hold your breath on that one.

In any case, headline non-farm payrolls for November is estimated at 50k with the jobless rate at 4.4%. So, those will remain key benchmark figures to be mindful of ahead of the release later.