Financial & Forex Market Recap – Dec. 11, 2025

Markets navigated a turbulent session on Thursday, with growing concerns about AI infrastructure spending creating early volatility before dip-buyers emerged to push equities into the green, while the U.S. dollar weakened following Fed Chair Powell’s dovish commentary on Wednesday and softer-than-expected labor market data.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- New Zealand Manufacturing Sales for September 30, 2025: 0.9% y/y (-0.3% y/y forecast; -0.6% y/y previous)

- Japan BSI Large Manufacturing for December 31, 2025: 4.7% q/q (1.0% q/q forecast; 3.8% q/q previous)

- RICS U.K. House Price Balance for November 2025: -16.0% (-20.0% forecast; -19.0% previous)

-

Australia Employment Change for November 2025: -21.3k (5.0k forecast; 42.2k previous)

- Australia Unemployment Rate for November 2025: 4.3% (4.3% forecast; 4.3% previous)

- Swiss National Bank Interest Rate Decision for December 11, 2025: 0.0% (0.0% forecast; 0.0% previous); doesn’t see the weakened inflation outlook as enough to move to negative interest rates

- Bank of England Governor Andrew Bailey commented on Thursday that there’s still a need to keep reducing the Bank of England’s balance sheet

- Canada Balance of Trade for September 2025: 0.15B (-6.0B forecast; -6.32B previous)

- U.S. Balance of Trade for September 2025: -52.8B (-57.0B forecast; -59.6B previous)

- U.S. Initial Jobless Claims for December 6, 2025: 236.0k (205.0k forecast; 191.0k previous)

- U.S. Wholesale Inventories for September 2025: 0.5% m/m (-0.3% m/m forecast; 0.0% m/m previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Thursday’s session showcased markets’ resilience in the face of mounting uncertainty about AI investment returns, as equities ultimately shrugged off Oracle-induced concerns to close at record highs while safe-haven assets diverged in their responses.

The S&P 500 demonstrated remarkable buying interest throughout the day, recovering from Oracle-related weakness to climb 0.2% and close at a fresh record high near 6,898. The index initially dipped during Asian hours, possibly correlating with overnight Oracle earnings digestion, then experienced renewed pressure at the U.S. open around 09:00 GMT as the disappointing jobless claims data hit. Despite these headwinds and Oracle’s 10% plunge erasing over $100 billion in market value, dip-buyers emerged consistently throughout the session, with the final two hours of trading seeing particularly strong accumulation. The rally seemed to reflect trader confidence in the post-FOMC dovish outlook from Chair Powell, who had emphasized labor market stabilization over inflation concerns the previous day, outweighing near-term worries about AI capital efficiency.

Gold extended its impressive run, gaining 1.07% to close around $4,274 after briefly touching levels above its prior session close. The precious metal caught a bid during the London session around 06:00 GMT and accelerated higher following the weak U.S. jobless claims print at 09:00 GMT, correlating with the data’s reinforcement of Fed rate cut expectations. Despite the equity market’s risk-on finish, gold maintained its gains throughout the U.S. afternoon, suggesting continued demand for portfolio diversification amid questions about tech valuations and sustained expectations for monetary easing. The move higher came even as real yields remained relatively stable, indicating safe-haven flows may have played a role alongside rate cut positioning.

WTI crude oil experienced a mostly bearish session, but recovered slightly to near $57, extending its recent weakness. Oil traded lowr through the Asian and early London sessions, and than an additional decline during the early U.S. session. There were no direct energy-specific catalysts to point to, so it’s possible that broader risk-off sentiment from the Oracle concerns early in the day contributed to the selloff, though the commodity failed to recover all the way back even as equities bounced later. The persistent weakness may also reflect ongoing concerns about demand outlook despite OPEC+ production discipline.

Bitcoin posted a volatile but ultimately negative session, declining 0.79% to close near $91,668 after experiencing sharp intraday swings. The cryptocurrency suffered its most pronounced selloff during the Asian session around 21:00 GMT on December 10, plunging roughly 3% in a move that coincided with the disappointing Australian employment data release showing a loss of 21,300 jobs versus expectations for a 5,000 gain. Bitcoin attempted a recovery during the London session but remained under pressure until the afternoon U.S. session, possibly reflecting profit-taking after recent gains or concerns that weakening labor markets could eventually impact risk appetite for speculative assets despite near-term Fed easing expectations.

The 10-year Treasury yield declined 0.24% to settle around 4.10%, continuing its post-FOMC retreat as bond buyers emerged following Chair Powell’s dovish press conference. Yields fell further at the U.S. open correlating with the weaker-than-expected jobless claims data, which reinforced market expectations for continued Fed easing in 2026. Despite the equity market’s strong finish, Treasury yields remained near session lows into the close, suggesting bond markets are pricing in a higher probability of rate cuts than the Fed’s own dot plot projections of just one cut next year.

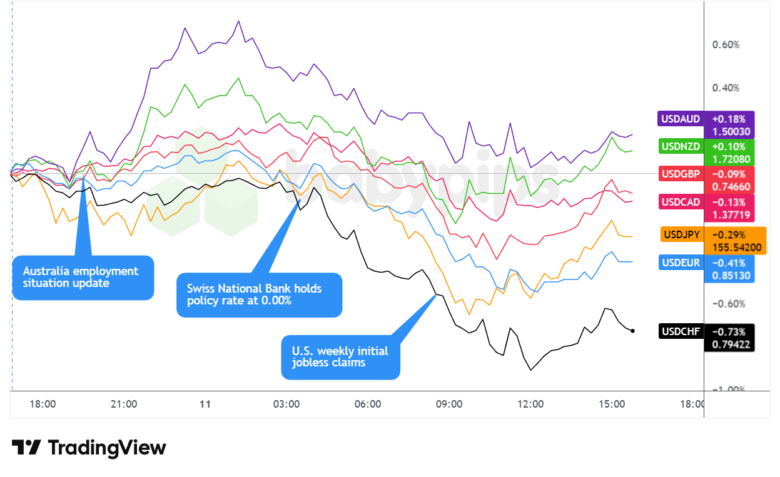

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar posted net losses against major currencies on Thursday, extending its post-FOMC weakness as traders continued to digest Chair Jerome Powell’s dovish messaging while processing mixed economic data that reinforced expectations for Federal Reserve easing in 2026.

During the Asian session, the dollar traded net higher against most major currencies in what appeared to be a technical bounce following Wednesday’s sharp post-FOMC selloff. The greenback’s gains proved short-lived, however, as the momentum from Powell’s emphasis on labor market concerns over inflation risks continued to weigh on rate expectations. The Australian dollar experienced elevated volatility, dropping roughly 20 pips immediately following the release of disappointing November employment data showing a loss of 21,300 jobs versus expectations for a 5,000 gain, with full-time employment falling 56,500. The AUD’s decline was contained to that initial reaction, however, sellers came quickly later in the session to further Aussie weakness overall.

The London session marked the dollar’s decisive turn lower, with the greenback posting net losses against major currencies from the European open through the morning U.S. session. The Swiss National Bank’s 03:00 GMT policy decision provided minimal market impact despite the central bank downgrading its inflation forecasts for 2026 and 2027, as the 0.00% rate hold was universally expected and SNB President Martin Schlegel reiterated the higher bar for moving to negative territory. The Swiss franc was largely unchanged following the announcement and subsequent press conference, with USD/CHF declining 0.73% on the day—a move that seemed more connected to broad dollar weakness than SNB-specific factors.

The dollar’s continued weakness through the London morning likely reflected ongoing positioning adjustments following Wednesday’s Fed decision, where policymakers left the door open to further easing despite projecting only one cut in their 2026 dot plot. Market participants appeared to be pricing in a more dovish path than the Fed’s official projections, with traders maintaining expectations for two rate cuts next year.

At the U.S. open around 13:30 GMT, the dollar extended its losses following the release of weekly jobless claims data showing initial claims surged to 236,000 versus expectations for 205,000—a significant miss that marked a sharp increase from the prior week’s 191,000. The claims data seemed to outweigh the better-than-expected U.S. trade deficit figures and Canadian trade surplus, as the labor market weakness reinforced Powell’s Wednesday commentary about the Fed’s focus on maintaining employment stability.

The greenback bottomed out ahead of the London close around 16:00 GMT and managed a modest rebound into the daily close, possibly reflecting profit-taking on short dollar positions or month-end flows. Despite the late-session stabilization, the dollar closed as a net loser against major currencies, with the DXY index finishing down 0.34% near 98.3.

The session’s price action underscored the dollar’s vulnerability to U.S. economic data as markets increasingly focus on the Fed’s dual mandate balance, with any signs of labor market cooling potentially triggering additional dollar weakness even as inflation remains above target.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand Electronic Card Retail Sales for November 2025 at 9:45 pm GMT

- Japan Industrial Production Final for October 2025 at 4:30 am GMT

- Germany Inflation Rate Final for November 2025 at 7:00 am GMT

- U.K. GDP for October 2025 at 7:00 am GMT

- U.K. Manufacturing Production for October 2025 at 7:00 am GMT

- France Inflation Rate Final for November 2025 at 7:45 am GMT

- China Monetary Developments for November 2025

- U.K. NIESR Monthly GDP Tracker for November 2025 at 12:00 pm GMT

- Germany Current Account for October 2025 at 1:00 pm GMT

- U.S. Fed Paulson Speech at 1:00 pm GMT

- Canada Wholesale Sales Final for October 2025 at 1:30 pm GMT

- Canada Building Permits for October 2025 at 1:30 pm GMT

- Canada New Motor Vehicle Sales for October 2025 at 1:30 pm GMT

- U.S. Fed Hammack Speech at 1:30 pm GMT

- U.S. Fed Goolsbee Speech at 3:35 pm GMT

Friday’s calendar features critical U.K. economic data that could drive volatility in sterling, particularly the October GDP print and manufacturing production figures. Following recent weak employment data from the U.K., these growth indicators will be closely scrutinized for signs of economic resilience or further deterioration that could influence Bank of England policy expectations. Germany’s final inflation reading will provide insight into the European Central Bank’s policy path, though as a final figure it’s unlikely to surprise materially.

The trio of Federal Reserve speakers—Paulson, Hammack, and Goolsbee—will be watched for any elaboration on the central bank’s policy outlook following Chair Powell’s dovish Wednesday press conference. Markets will be particularly sensitive to any commentary about the pace of easing in 2026 or reactions to Thursday’s weak jobless claims data. China’s monetary developments data could also influence commodity currencies and broader risk sentiment if credit growth shows unexpected strength or weakness.

Following Thursday’s Oracle-driven concerns about AI infrastructure spending, markets may remain sensitive to any fresh commentary from tech sector executives or analysts regarding the return-on-investment timeline for massive AI capital expenditures, though no major tech earnings are scheduled for Friday. The relatively light U.S. data calendar suggests trading could be driven more by technical factors and position squaring ahead of the weekend.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!