Atlanta Fed GDPNow Upgrade: Q3 Growth Hits 3.6% as Net Exports Surge

2025-12-11 17:04:00

Key Takeaways:

-

GDPNow Upgrade: The Atlanta Fed raised its Q3 2025 GDP estimate to 3.6% (up from 3.5%).

-

Trade to the Rescue: A surge in net exports offset weaker government spending and private investment numbers.

-

Fed Optimism: Federal Reserve officials revised their 2026 GDP growth projections sharply higher to 2.3%.

-

Productivity Boom: Chair Powell points to increased productivity as a key tailwind supporting this higher growth trajectory.

Atlanta Fed GDPNow: Economy Accelerates to 3.6%

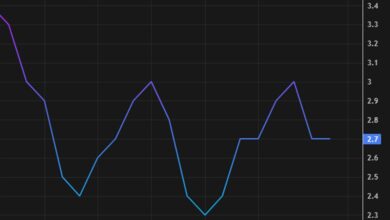

The U.S. economy continues to defy slowdown expectations. On December 11, the Federal Reserve Bank of Atlanta’s GDPNow model ticked its estimate for Q3 2025 real GDP growth up to 3.6%, a modest but meaningful increase from the previous 3.5% reading on December 5.

While headline growth is robust, the internal drivers have shifted. According to the latest data from the US Census Bureau and the Bureau of Economic Analysis, domestic demand has softened slightly, but this was more than compensated for by a booming trade balance.

The Data Breakdown:

-

Net Exports (The Bullish Driver): The contribution of net exports to GDP was revised upward significantly, jumping from 0.86 percentage points to 1.01 percentage points. This implies that the U.S. is exporting more (or importing less) than previously modeled, acting as a major buffer for the economy.

-

Domestic Investment (The Drag): Real gross private domestic investment growth was revised down to 2.3% (from 3.0%).

-

Government Spending: Real government expenditures growth also saw a downward revision to 1.6% (from 1.7%).

Essentially, while businesses and the government pulled back slightly on spending, the external trade sector stepped in to push overall growth higher.

Federal Reserve Signals “Stronger for Longer” in 2026

The resilience seen in the GDPNow data aligns with the Federal Reserve’s updated economic projections released yesterday. In a move that surprised some analysts, Fed members significantly upgraded their outlook for the U.S. economy heading into 2026.

The median projection for 2026 GDP growth rose to 2.3%, a sharp upward revision from the 1.8% projected just three months ago in September.

Why This Matters:

A revision of this magnitude (0.5%) suggests that the Fed no longer sees the current growth spurt as a temporary “sugar high” but rather as a durable trend. It signals that policymakers believe the economy can sustain higher growth rates without necessarily reigniting inflation—a “Goldilocks” scenario for risk assets.

Powell’s “Productivity” Tailwind

During yesterday’s press conference, Fed Chair Jerome Powell provided the narrative backbone for these higher numbers. He explicitly cited increases in productivity as a potential tailwind for growth.

When productivity rises—meaning workers produce more output per hour—the economy can grow faster without overheating or driving up wages to inflationary levels. This supports the “soft landing” (or even “no landing”) thesis, where the U.S. avoids recession entirely while maintaining robust expansion.

Upcoming Key Dates

Traders should mark their calendars for the final data releases of the year, which will confirm if this momentum can carry into 2026:

-

Next GDPNow Update: Thursday, December 16.

-

First Q4 2025 Nowcast: Tuesday, December 23.