Are markets doomed to rise without Powell?

2025-12-11 06:12:00

The U.S. market isn’t in a panic, and there are no immediate strategic threats, aside from concerns about a potential AI bubble, but several restraining factors remain. Beyond broader systemic issues, such as the country’s rapidly growing debt and the rising cost of servicing it, the Fed’s restrictive monetary policy continues to weigh on the market.

Rates have already been cut twice this year, but the pace has been slower than Donald Trump has been pushing for. Highly leveraged companies are also hoping for further reductions in borrowing costs. Additionally, cheaper credit can serve as a strong economic stimulus, potentially boosting overall market sentiment.

So why don’t Powell and the rest of the Fed simply give in, cut rates more aggressively, and let the S&P 500, Nasdaq, and other indexes climb to new highs?

Because the Fed’s dual mandate is to maximize employment and maintain price stability, rather than boost stock market gains or GDP growth, the two goals currently guiding its decisions are actually pulling in opposite directions.

On the labor front, momentum is clearly fading. ADP estimates that U.S. private companies cut 32,000 jobs in November, a sharp reversal from October’s 47,000 increase and far below Wall Street’s expectation of 40,000 new jobs. That alone is an argument in favor of a rate cut.

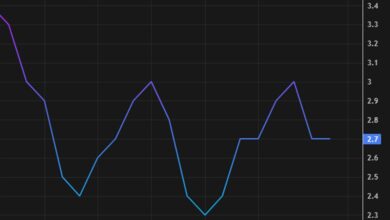

On the other hand, inflation remains stubbornly high. The headline CPI stands at 0.3% month-on-month and 2.8% year-on-year, the core CPI at 0.2% month-on-month and 2.8% year-on-year, and the “supercore” services index, favored by Powell, remains at 3.3% year-on-year. This presents a compelling argument for maintaining the current rates.

Now imagine Powell resigns tomorrow and is replaced by a more aggressively dovish Fed chair, with the rest of the committee backing this approach. Even if the inflation data call for caution, what could go wrong?

First, it could reignite inflation. Second, it could erode confidence in the U.S. dollar and U.S. debt, potentially destabilizing the financial market as a whole. Stocks might initially surge, but the long-term consequences could be much worse. We have seen similar examples before: when gold prices surged alongside U.S. Treasury yields and the dollar index fell, following a presidential attack on Powell, urging him to make faster and deeper rate cuts.

In short, anyone expecting Powell’s replacement by a more moderate chair to give a clear boost to the markets may see a short-term improvement, but over time, the costs could be much higher.