Chart Art: Is Bitcoin (BTC/USD) Ready to Extend Its Downtrend?

2025-12-11 03:41:00

Bitcoin (BTC/USD) just turned lower from a potential trend resistance zone!

Think the crypto is ready to extend a longer-term downtrend in the next trading sessions?

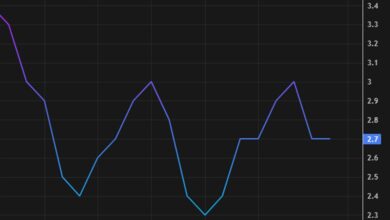

Here’s what we’re seeing on the 4-hour time frame:

In case you missed it, bitcoin capped Wednesday lower than its open price as the Fed’s “hawkish cut” event turned out bearish for risk assets like cryptos.

The U.S. dollar has not been looking great either, but it may soon catch a bit of support from FOMC’s dot plot projections that were not as dovish as traders hoped and from safe haven demand as U.S. fiscal worries rise and tensions with Russia and Ukraine and the U.S. and Venezuela keep heating up.

Remember that directional biases and volatility conditions in market price are typically driven by fundamentals. If you haven’t yet done your homework on the U.S. dollar and the bitcoin, then it’s time to check out the economic calendar and stay updated on daily fundamental news!

BTC/USD has been printing higher lows on the 4-hour chart, but it ran into a ceiling near $93,000. That area lines up with the 200 SMA, the 50% Fibonacci retracement of the November downswing, and a trend line resistance that has held since early October.

If BTC/USD stays under the $90,000 psychological level, the Pivot Point line, and the 100 SMA, the tone could turn bearish and open the door for a move below $88,000. If sellers keep drawing in bearish pressure, the pair could even revisit the $84,000 or $80,000 support zones.

But if yesterday’s drop was just a blip and BTC/USD pushes on to new December highs, a longer-term breakout could take shape and send the pair toward higher targets like $100,000 or even $104,000.

Whichever bias you end up trading, don’t forget to practice proper risk management and stay aware of top-tier catalysts that could influence overall market sentiment!

Disclaimer:

Please be aware that the technical analysis content provided herein is for informational and educational purposes only. It should not be construed as trading advice or a suggestion of any specific directional bias. Technical analysis is just one aspect of a comprehensive trading strategy. The technical setups discussed are intended to highlight potential areas of interest that other traders may be observing. Ultimately, all trading decisions, risk management strategies, and their resulting outcomes are the sole responsibility of each individual trader. Please trade responsibly.