BOC Holds at 2.25% As Canadian Economy Shows Resilience Despite Trade Uncertainty

2025-12-11 02:29:00

As widely expected, the Bank of Canada (BOC) kept interest rates unchanged at 2.25% in December, maintaining its stance that the current policy rate is “at about the right level” to support the economy through ongoing trade-related uncertainty while keeping inflation close to target.

This decision marked the bank’s second consecutive hold after delivering a combined 100 basis points in cuts earlier in the year, with Governor Tiff Macklem emphasizing that recent economic data shows Canada’s economy proving “resilient overall” despite the impact of U.S. tariffs.

Key Takeaways

- Rate held as expected: Overnight rate unchanged at 2.25%, with Bank Rate at 2.50% and deposit rate at 2.20%

- Economic resilience acknowledged: Q3 GDP grew surprisingly strong at 2.6%, though largely reflecting trade volatility with flat final domestic demand

- Labor market improving: Employment gained 180,000+ jobs over three months, unemployment declined to 6.5% in November

- Inflation near target: Headline CPI at 2.2% in October, underlying inflation assessed around 2.5%

- Extended pause likely: Current rate viewed as appropriate for “lower end of neutral range” to support structural adjustment

- High uncertainty persists: BOC prepared to respond if outlook changes, particularly around CUSMA renegotiation

Link to BOC official statement (December 2025)

The bank noted that Canada’s stronger 2.6% growth in Q3 came mostly from choppy trade numbers, not real underlying strength. Final domestic demand was flat, and officials expect Q4 to be weak as falling net exports likely cancel out modest gains elsewhere in the economy.

Macklem said there was “clear consensus” to keep rates steady, but admitted it has been tough to read the true pace of the economy because trade data and quarterly GDP have been volatile. He reminded everyone that the bank is not setting a timeline for policy changes and will continue making decisions one meeting at a time.

He also pointed to recent GDP revisions as a reason the economy appears more resilient than earlier thought, saying Canada was in better shape heading into the U.S. trade conflict. Even though some sectors are hit hard by tariffs, the average tariff on Canadian goods is still about 6% and much of the economy continues to trade normally with the U.S.

Macklem acknowledged that many households still feel squeezed by affordability pressures. He added that while inflation has eased, the bank doesn’t want prices to fall outright because deflation can signal a weak economy and encourages people to delay spending, which makes things worse.

Link to BOC Press Conference (December 2025)

Market Reactions

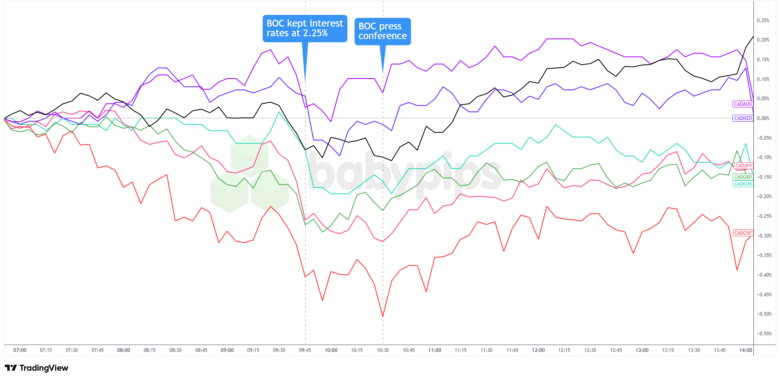

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies Chart by TradingView

The Canadian dollar initially weakened after the announcement as investors reacted to the bank’s comment that rates are “at the lower end of the neutral range,” which leaned dovish.

CAD briefly clawed back some losses but dipped again when Governor Macklem declined to offer a policy timeline and stressed the “unusual uncertainty” surrounding the outlook. His remarks about divided council views and readiness to adjust policy “if the outlook changes” likely kept the idea of future rate cuts on the table.

After the press conference, CAD traded slightly firmer as position squaring took over, giving the move a muted feel. But after the FOMC decision, the Loonie still ended the day broadly weaker, except when compared with the stronger U.S. dollar.

Market pricing now suggests the BOC is expected to stay on hold through at least the first half of 2026, with only light positioning for possible hikes late next year. Macklem’s cautious tone seemed aimed at keeping those expectations in check.