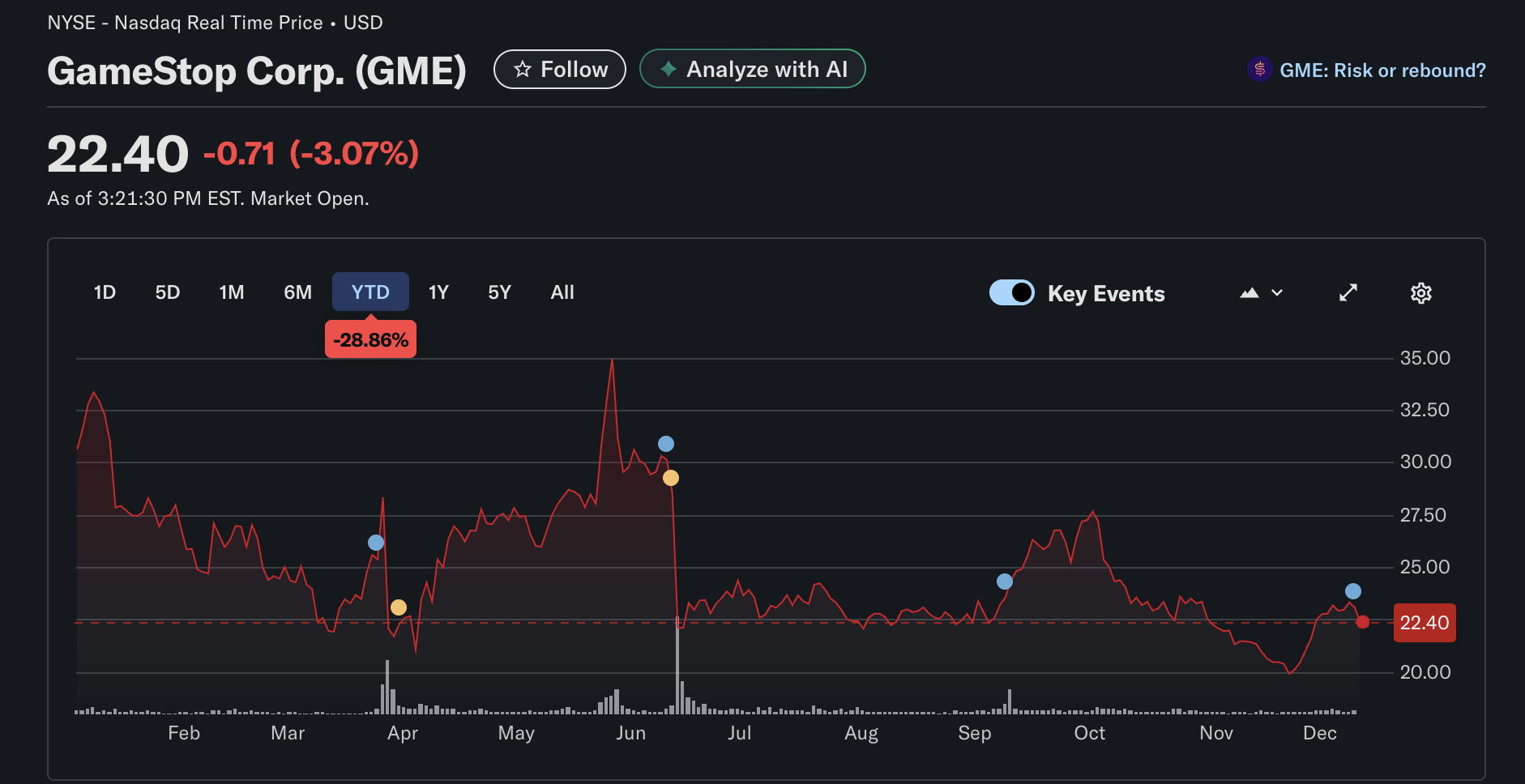

GameStop Discloses Weaker Than Expected Q3 Financial Figures

GameStop missed analyst estimates in the third quarter of 2025, dragging shares down over 4% on Wednesday, as declining core sales and reduced Bitcoin gains weighed on the quarter.

The company’s Q3 revenue of $821 million fell short of analyst expectations of $987.29 million, according to Seeking Alpha.

GameStop’s Q3 report also shows that it holds 4,710 Bitcoin (BTC), with unrealized losses during the quarter totaling $9 million, though its BTC position remains up $19.4 million for the year.

The company also missed analyst expectations in Q1, posting revenue of about $732 million, falling short of estimates of $754 million.

GameStop continues to struggle despite adopting a BTC treasury strategy in March. The move briefly lifted the stock by about 12% to $35 per share, but those gains quickly reversed.

Related: Bitcoin treasury firms enter a ‘Darwinian phase’ as premiums collapse: Galaxy

GameStop sees little relief from its Bitcoin treasury strategy

GameStop’s business model relies on physical video games and the reselling of used games, which have been impacted by the decline of physical media.

The company raised $1.5 billion in April to finance Bitcoin purchases and bought 4,710 BTC in May as part of its strategic pivot to a digital asset treasury company.

However, GameStop shares slid by 11% the day after the company announced the treasury pivot, as investors voiced concerns over the digital asset strategy.

In July, GameStop CEO Ryan Cohen said crypto and BTC are hedges against inflation and teased plans to accept crypto as payment at its stores.

“The ability to actually use crypto within transactions is something that is an opportunity, and it’s something that we’re looking at,” Cohen said.

He added that the company is attempting to reduce reliance on physical hardware and game sales due to rising costs and focus on collectibles like trading cards.

The decline of GameStop’s stock is part of a broader downturn in digital asset treasury companies, which is attributed to market saturation and investor caution, according to Standard Chartered.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary