The line-by-line comparison of the October and the December FOMC statements

2025-12-10 19:21:00

A line by line comparison of the October FOMC statement to the December statement.

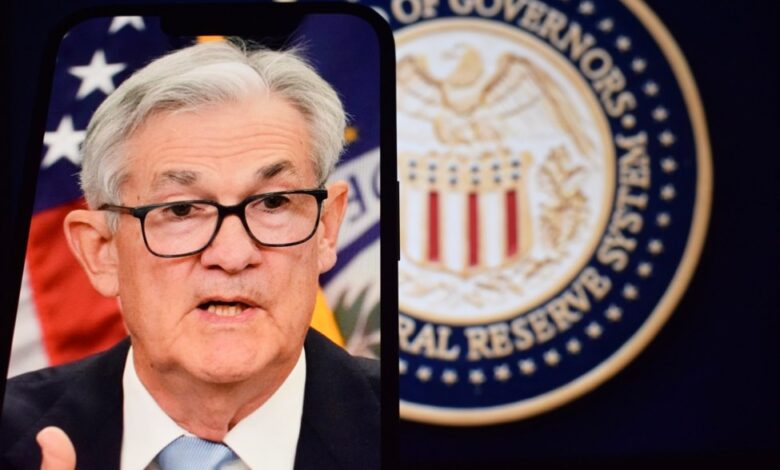

The Federal Reserve cut rates by 25 basis points at the December meeting as expected. The vote was 9-3 with 2 members voting to keep rates unchanged, and 1 voting to cut by 50 basis points. Below is a line-by -line comparison of the October vs the December statement.

October 29,

2025

Federal

Reserve issues FOMC statement

For release at 2:00 p.m. EDT

Available indicators suggest that economic activity has been

expanding at a moderate pace. Job gains have slowed this year, and the

unemployment rate has edged up but remained low through

August; more

recent indicators are consistent with these developments. Inflation has moved

up since earlier in the year and remains somewhat elevated.

The Committee seeks to achieve maximum employment and

inflation at the rate of 2 percent over the longer run. Uncertainty about the

economic outlook remains elevated. The Committee is attentive to the risks to

both sides of its dual mandate and judges that downside risks to employment

rose in recent months.

In support of its goals and in light of the shift in the

balance of risks, the Committee decided to lower the target range for the

federal funds rate by 1/4 percentage point to 3-3/4

to 4 percent. In considering additional adjustments to the target

range for the federal funds rate, the Committee will carefully assess incoming

data, the evolving outlook, and the balance of risks. The CommitteeThe Committee is strongly committed to supporting

decided to conclude the reduction of its aggregate securities holdings on

December 1.

maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the

Committee will continue to monitor the implications of incoming information for

the economic outlook. The Committee would be prepared to adjust the stance of

monetary policy as appropriate if risks emerge that could impede the attainment

of the Committee’s goals. The Committee’s assessments will take into account a

wide range of information, including readings on labor market conditions,

inflation pressures and inflation expectations, and financial and international

developments.

Voting for the monetary policy action were Jerome H. Powell,

Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan

M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N.

Jefferson; Alberto G. Musalem; and Christopher J. Waller. Voting against this

action were Stephen I. Miran, who preferred to lower the target range for the

federal funds rate by 1/2 percentage point at this meeting, and Jeffrey R. Schmid, who preferred no

change to the target range for the federal funds rate at this meeting.