Bitcoin (BTC) Price Volatility Is Still Compressing, Dimming Santa Rally Chances

تكنلوجيا اليوم

2025-12-10 13:05:00

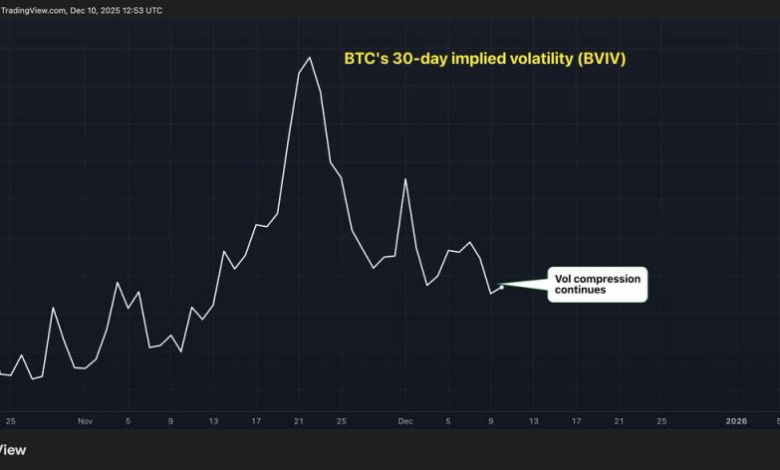

Bitcoin’s volatility indexes are still declining, mirroring those of the S&P 500, bringing a price stability that weakens the case for a year-end rally, according to one analyst.

BTC’s annualized 30-day implied volatility, as measured by Volmex’s BVIV index, has dropped to 49%, nearly reversing the spike to 65% from 46% over the 10 days through Nov. 21, according to TradingView data.

Implied volatility is an options-based measure that represents the market’s outlook for price swings over a specific period. The drop from 65% to 49% means expected price turbulence over the 30 days has declined from as much as 5 percentage points to 14%.

The VIX index, which represents the 30-day implied volatility in the S&P 500, has also dropped, reaching 17% from 28% since Nov. 20.

According to Matrixport, the so-called volatility compression suggests low odds of a year-end rally.

“Implied volatility continues to compress, and with it, the probability of a meaningful upside breakout into year-end,” the firm said in a market update Wednesday. “Today’s FOMC meeting represents the final major catalyst, but once it passes, volatility is likely to drift lower into the year-end.”

Matrixport’s view aligns with bitcoin’s historical positive price-volatility correlation, though this relationship has gradually shifted toward the negative since November 2024.

On Wall Street, implied volatility compression is typically associated with a bullish reset in the market sentiment.