Premium Watchlist Recap: Australia GDP Report (Q3 2025)

Australia’s Q3 GDP report delivered a notable miss, sparking initial Aussie weakness before the currency staged a rapid recovery on resilient domestic fundamentals and persistent Fed easing expectations.

Which AUD strategies moved beyond the watchlist stage, and how did the neutral-to-positive market environment impact the outcomes?

Watchlists are price outlook & strategy discussions supported by both fundamental & technical analysis, a crucial step towards creating a high-quality discretionary trade idea before working on a risk & trade management plan.

If you’d like to follow our “Watchlist” picks right when they are published throughout the week, check out our BabyPips Premium subscribe page to learn more!

We’re breaking down our Aussie setups this week and examining how each pair performed after Australia’s growth disappointment while markets maintained their Fed-easing narrative through the first trading week of December.

The Setup

What We Were Watching: Australia’s Quarterly GDP (Q3 2025)

- Expectation: Australia to maintain a quarterly growth of 0.6%, and annual growth to accelerate from 1.8% to 2.2%

- Data outcome: The economy grew just 0.4% q/q and 2.1% y/y, missing forecasts

- Market environment surrounding the event: Broad risk-on sentiment as traders interpreted mounting evidence of U.S. labor market weakness as clearing the path for Federal Reserve rate cuts, despite policymakers’ stated concerns about inflation.

Event Outcome

Australia’s economic growth disappointed market expectations in Q3 2025, with GDP expanding 2.1% year-over-year compared to forecasts of 2.2%.

On a quarterly basis, the economy grew 0.4%, missing the 0.7% Reuters poll estimate, according to data released by the Australian Bureau of Statistics.

Key Takeaways:

- Business investment surged 2.9%, the strongest quarterly increase since March 2021, driven by massive data center investments across New South Wales and Victoria

- Household consumption rose 0.5%, with essential spending up 1.0% offsetting weakness in discretionary categories

- Net trade subtracted 0.1 percentage points as import growth of 1.5% outpaced export gains of 1.0%

- Inventory drawdowns detracted 0.5 percentage points, as mining companies ran down stockpiles despite subdued production

- Dwelling investment climbed 1.8%, reflecting momentum in residential construction in eastern states

The GDP miss triggered immediate Aussie selling, with AUD dropping sharply across the board within minutes of the release. However, the currency recovered quickly—within hours, returning to pre-GDP levels against most counterparts—as traders focused on the underlying strength in business investment and persistent price pressures that kept RBA hawkish expectations intact.

Fundamental Bias Triggered: Bearish AUD setups

(Monday-Tuesday): Traders adjusted positions in reaction to mostly weak Chinese PMI figures before BOJ Governor Ueda stole the show with his hawkish commentary, restoring some JPY strength while USD drew a bit of support from PMI-related safe-haven flows.

Midweek Dollar Slump (Wednesday): Disappointing U.S. ADP jobs data and renewed focus on Trump’s possible Fed Chair pick revived December Fed rate cut expectations, triggering a massive USD selloff and pickup in risk-taking.

Short-lived USD Reprieve (Thursday-Friday): Stronger than expected U.S. initial jobless claims, followed by a broadly upbeat core PCE price index, sparked a rebound for the dollar towards the end of the week but seemingly not enough to dampen the likelihood of another 0.25% rate cut as the FOMC decision drew near.

AUD/NZD: Bearish Event Outcome + Risk-On Scenario = Arguably good odds of a net positive outcome

AUD/NZD 1-hour Forex Chart by TradingView

With the pair testing resistance from a converging triangle pattern and trading near the 100 SMA, our watchlist anticipated a potential downside break if Australia’s GDP disappointed and risk-on sentiment prevailed.

The weaker-than-expected GDP print (0.4% q/q versus 0.8% forecast) initially triggered the anticipated selloff, pushing AUD/NZD lower during Wednesday’s Asian session. However, the bearish momentum proved remarkably short-lived—the pair found support around the 100 SMA/rising lows trendilne and quickly reversed higher.

The turnaround likely stemmed from several factors converging: RBA Governor Bullock’s midweek comments emphasizing that inflation had “surprised to the upside” and the labor market remained “a bit tight” reinforced hawkish RBA expectations despite the GDP miss. More critically, Thursday’s stronger-than-expected Australian trade balance (A$4.39B versus A$4.2B forecast) and robust household spending data (1.3% m/m versus 0.2% expected) probably convinced traders that underlying domestic demand remained resilient.

The pair extended its recovery through Friday, breaking above the triangle resistance and climbing toward R1 (1.1502) as markets positioned ahead of the December 9 RBA meeting. By week’s end, AUD/NZD had essentially reversed all GDP-related losses and closed higher than pre-event levels—invalidating the bearish setup as the Aussie’s fundamental resilience overwhelmed the initial growth disappointment.

Given that the pair spent less than a few hours in bearish territory post-GDP before reversing decisively higher, we’d classify this as “not likely to neutral” supportive of a net positive outcome—profitable only with pinpoint short entries (post event and at 50% Fib resistance) and executing short-term profit taking/risk reduction strategies and adjustments.

Not Eligible to move beyond Watchlist – AUD/JPY & Bullish NZD Setups

AUD/JPY: Bearish Event Outcome + Risk-Off Scenario

AUD/JPY 1-hour Forex Chart by TradingView

AUD/JPY had been trending higher within an ascending channel ahead of the GDP release, with our watchlist eyeing potential short-term upper range reversal behavior should the data disappoint in a risk-off environment where safe-haven yen demand might offset Aussie weakness.

However, the setup was invalidated due to the arguably risk-on broad market environment driven by expectations of Fed rate cuts coming very soon. Also, the concerns from the RBA on persistent inflation pressure arguably reduced the odds of a sustained bearish bias on the Australian dollar significantly throughout the week.

From Wednesday onward, AUD/JPY did see several attempts to decline from the noted technical area of bearish interest (top of the range), but the risk-on environment and the renewed focus on Australian inflation persistence likely brought in fundamental buyers to this pair through the rest of the week.

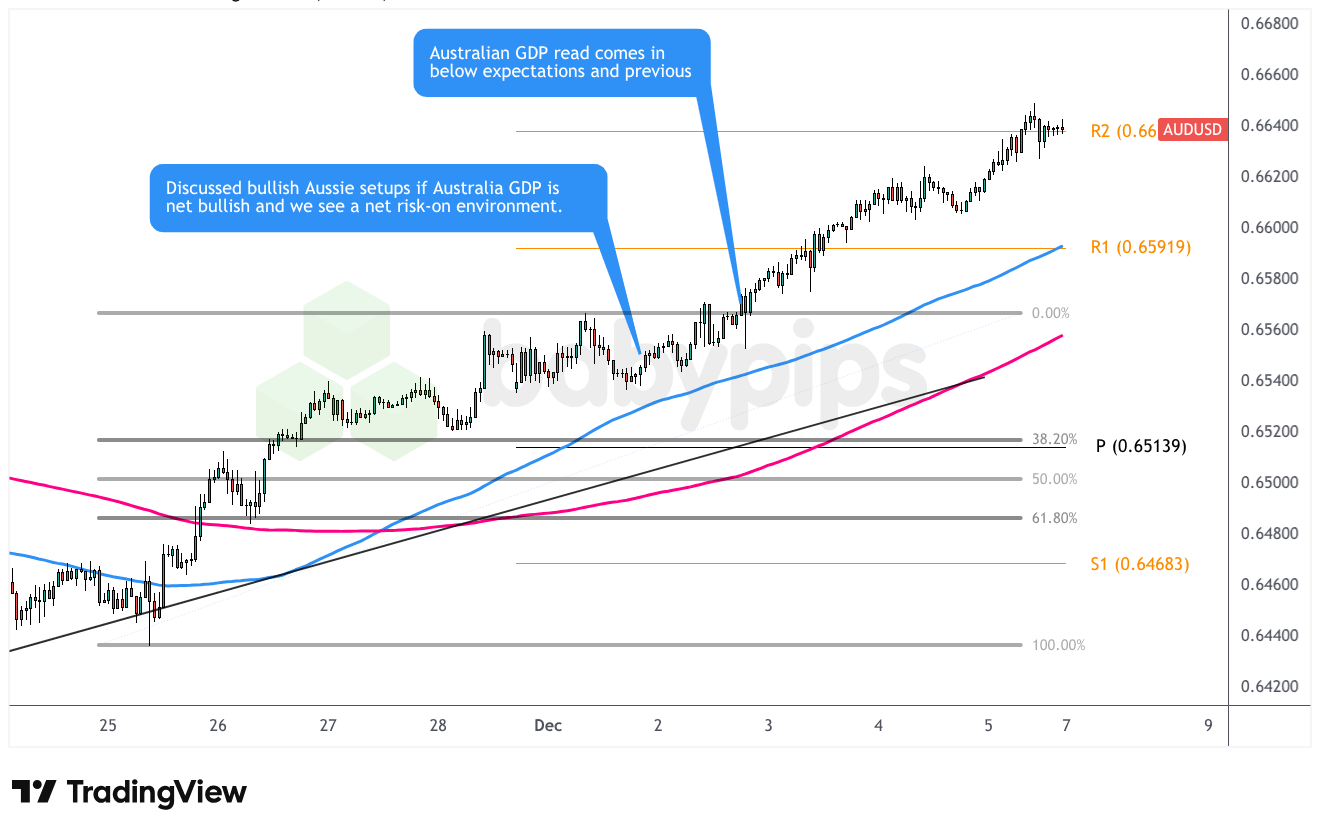

AUD/USD: Bullish Event Outcome + Risk-On Scenario

AUD/USD 1-hour Forex Chart by TradingView

Our analysts had sights set on the newly-forming ascending trend line on the short-term chart of AUD/USD, keeping watch for a possible correction bounce in case the Australian GDP beats expectations in a risk-on setting. Of course, the GDP miss invalidated this discussion from moving beyond the watchlist stage right away.

While our directional bias was technically invalidated by the GDP miss, the pair’s ultimate trajectory actually aligned with our bullish scenario—just driven by different catalysts (hawkish RBA repricing and dovish Fed expectations) rather than a GDP beat.

Given that AUD/USD spent virtually no time in sustained bearish territory post-GDP and instead rallied strongly throughout the week, and traders who recognized the rapid narrative shift toward RBA hawkishness could have still captured substantial gains by abandoning the original setup thesis and following the dominant price momentum driven by policy divergence.

GBP/AUD: Bullish Event Outcome + Risk-Off Scenario

GBP/AUD 1-hour Forex Chart by TradingView

This Aussie pair had already fallen through an ascending trend line, setting up an opportunity for a break-and-retest play that could sustain the reversal in case the Australian GDP beats estimates in a risk-off environment. Unfortunately, the GDP miss invalidated this discussion from moving beyond the watchlist stage right away.

The weaker than expected headline GDP figure triggered a brief bounce for the pair, but this was more likely on the heels of an upgraded U.K. services PMI update, taking the pair above our discussion price area and nearly testing the 200 SMA.

But with hawkish RBA commentary, upbeat Australian household spending data, and risk-taking from Fed rate cut positioning in the mixed, those combined forces took GBP/AUD back into bear mode, moving it below intraweek lows and S1 (2.0087) by Friday’s close.

The Verdict

Australia’s Q3 GDP disappointment initially supported bearish AUD opportunities, with the 0.4% q/q print (versus 0.8% expected) triggering immediate selling pressure across Aussie pairs. However, the currency’s weakness proved remarkably short-lived—lasting less than 48 hours in most cases—as traders quickly pivoted to focus on the underlying resilience in the report’s composition and what it meant for RBA policy trajectory.

The critical factor driving the Aussie’s recovery wasn’t the headline GDP figure, but rather the dramatic shift in RBA policy expectations that had been building throughout the week. Markets had entered December pricing in multiple rate cuts through 2026, but a confluence of factors—including the GDP report’s robust 2.9% surge in business investment, persistent household spending growth, and RBA Governor Bullock’s midweek emphasis that inflation had “surprised to the upside”—forced a complete reassessment.

By Friday’s close, Reuters polling captured the magnitude of this shift: expectations had moved from anticipated 2026 cuts to an extended pause, with some analysts even flagging hike risks given inflation’s acceleration above the target band. This hawkish repricing overwhelmed any near-term growth concerns from the GDP miss, leaving the Australian dollar as the week’s best-performing major currency despite the disappointing data that was supposed to weigh it down.

AUD/NZD was our primary candidate to move beyond the watchlist stage given the bearish GDP outcome and the arguably neutral-to-positive risk environment heading into the release. However, the reversal came swiftly, as discussed above. By Friday, AUD/NZD had not only recovered all GDP-related losses but broken above the triangle resistance to test R1 (1.1502)—essentially invalidating the entire bearish premise as traders positioned for the December 9 RBA meeting with rate cut expectations off the table.

Overall, we rate our watchlist discussions as “not-likely” supportive of a potential positive outcome. The bearish AUD setup was fundamentally sound based on the GDP miss, and the initial market reaction validated our directional bias. However, the rapid pivot to focus on RBA policy implications—driven by resilient underlying data and Bullock’s hawkish messaging—created an environment where only the most aggressive profit-taking strategies during Wednesday’s initial reaction would have captured gains.

The week ultimately demonstrated how quickly markets can look through disappointing data when the underlying composition supports a hawkish central bank narrative—particularly during periods when policy trajectory shifts are in play. What began as a GDP miss that should have pressured the Aussie ended with the currency rallying on expectations that the RBA would maintain restrictive policy far longer than previously anticipated, with December 2026 rate cuts being priced out entirely.

Key Takeaways:

Underlying Policy Narratives Can Also Shape Direction

Just because the headline figure fell short of estimates doesn’t always translate to a bearish currency reaction. It always helps to look at the bigger picture and whether or not a data point can be enough to completely shift the narrative. Also don’t forget that monetary policy commentary (in this case from RBA Governor Bullock) can reinforce prevailing biases and put reports in better context.

Consider Booking Profits Early in Busy Weeks

Sentiment and currency direction can shift on a dime during particularly busy weeks, which means initial reactions to top-tier events can quickly reverse. In the case of AUD/NZD, the pair dipped in reaction to Australia’s GDP miss but was unable to sustain its selloff as Aussie strength ultimately prevailed in response to hawkish RBA commentary and resurfacing dovish Fed expectations.

Adapt to Evolving Narratives Rather Than Anchoring to Original Thesis

The week’s most profitable opportunity wasn’t the bearish AUD setup we identified based on GDP disappointment expectations, but rather recognizing within 24-48 hours that markets had pivoted to an entirely different narrative—RBA hawkishness driven by underlying data strength and persistent inflation. Traders who remained anchored to “GDP missed, therefore AUD should be weak” likely missed the sustained rally, while those who adapted to the emerging policy repricing narrative could have captured significant gains despite their original thesis being invalidated. Always stay frosty!

Disclaimer: The forex analysis content provided in Babypips.com is intended solely for informational purposes only. The technical and fundamental scenarios discussed are presented to highlight and educate on how to spot potential market opportunities that may warrant further independent research and due diligence. This content shows how we cover a portion of the full trading process, and does not constitute that we ever give specific investment or trading advice. The setups and analyses presented on Babypips.com are very likely not suitable for all portfolios or trading styles.

Trade and risk management are the sole responsibility of each individual trader. All trading decisions and their subsequent outcomes are the exclusive responsibility of the individual making them. Please trade responsibly.

Trading responsibly means knowing as much as you can about a market before you think about taking on risk, and if you think this kind of content can help you with that, check out our BabyPips Premium subscribe page to learn more!