Crypto Prediction Markets Lure Traders With AI And Arbitrage

Blockchain-based prediction markets are drawing in more speculators as traders hunt for returns that can beat simply holding spot cryptocurrencies, according to a new report.

Prediction markets are emerging as a new speculative arena for traders, pitting casual retail participants against data-driven, professional traders, creating “extreme information asymmetry and meaningful arbitrage windows,” according to a Monday report from crypto research company 10X Research.

While sports bets account for the lion’s share of activity on these platforms, Bitcoin (BTC) and crypto-outcome related events are presenting more niche opportunities that digital asset traders can’t ignore, according to 10X.

“It is a valuable reminder that nearly every major crypto trading venue operated its own market-making or ‘treasury’ desk, not just to provide liquidity, but to stand on the other side of retail flow, and rarely at a loss,” the company wrote.

Related: BTC poised for December recovery on ‘macro tailwinds,’ Fed rate cut: Coinbase

For quantitative traders, prediction markets can offer asymmetric payoffs that compare favorably with the upside on underlying spot tokens, the report suggested.

For instance, traders on decentralized prediction market Polymarket are betting on whether the BNB (BNB) token will hit $1,500 by Dec. 31, 2025. “Yes” shares on that market recently traded around $0.01, implying a potential 100x payout if the event happens. By comparison, a spot BNB holder would see roughly a 1.65x gain if the token climbed to the same level from current prices.

Related: BitMine buys $199M in Ether as smart money traders bet on ETH decline

High win-rate accounts, AI bots raise Insider trading concerns

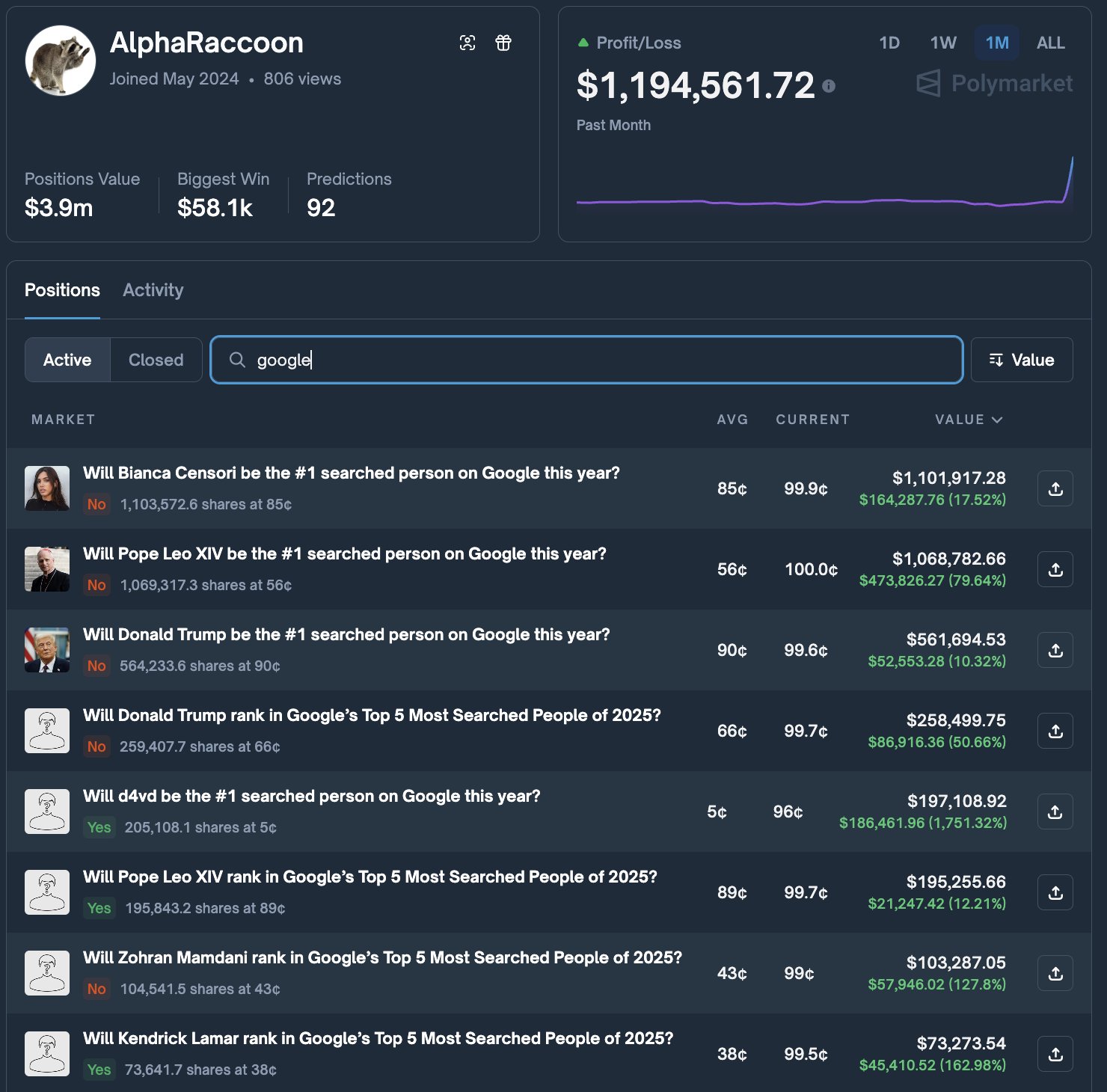

However, some prediction market accounts are showing concerning signs of insider trading, particularly a newly emerged account that made over $1 million in a single day by betting on Google search trends.

Polymarket user ‘AlphaRaccoon’ generated $1 million by successfully winning 22 out of 23 placed bets, according to crypto investors Haeju.

“This isn’t a lucky streak. He previously made $150K+ predicting the early release of Gemini 3.0 before results were out,” he wrote in a Thursday X post.

Others are employing artificial intelligence bots to increase their chances of winning.

Polymarkt user “ilovecircle” earned over $2.2 million during the past two months, boasting a 74% win rate through bets encompassing politics, sports and cryptocurrency.

The user’s volume and winning consistency “almost guarantees” that it is employing a machine learning (ML) model for “cross-niche arbitrage and auto trading,” wrote prediction market trader Archive, in a Sunday X post.

Magazine: Train AI agents to make better predictions… for token rewards