Bitcoin Coinbase Premium Hits 7-month Low: Is $95K Next?

Key takeaways:

Bitcoin dropped below $100,000 and could retest its yearly open at $93,500 as its momentum weakens.

The Coinbase Premium hit a seven-month low, reflecting strong US spot Bitcoin selling pressure.

Short-term holders are accumulating BTC, while long-term holders continue taking profits.

Bitcoin’s (BTC) recent weakness extended into Friday’s trading session, with BTC once again slipping below the $100,000 mark. The cryptocurrency could potentially retest its previous low of $98,200, a level formed on June 23.

On Nov. 6, the Bitcoin Coinbase Premium Index, a metric that tracks the difference between Bitcoin’s price on Coinbase and other global exchanges like Binance, dropped to its lowest level since April 11.

The premium turning negative implied that Bitcoin is trading at a discount on Coinbase, often reflecting stronger selling pressure from US-based investors and ETF-related outflows. Historically, extended periods of negative premiums have coincided with short-term price weakness.

However, Crypto trader Daan Trades noted that such phases are not unusual during broader downtrends. The analyst explained that the discount tends to emerge when the market faces concentrated spot selling from Coinbase-linked flows. While not a bullish sign in itself, Daan added,

“The market rarely bottoms locally without first seeing such a discount.”

In other words, a sustained price recovery following this discount could signal that the market is absorbing sell pressure, potentially marking the early stages of accumulation.

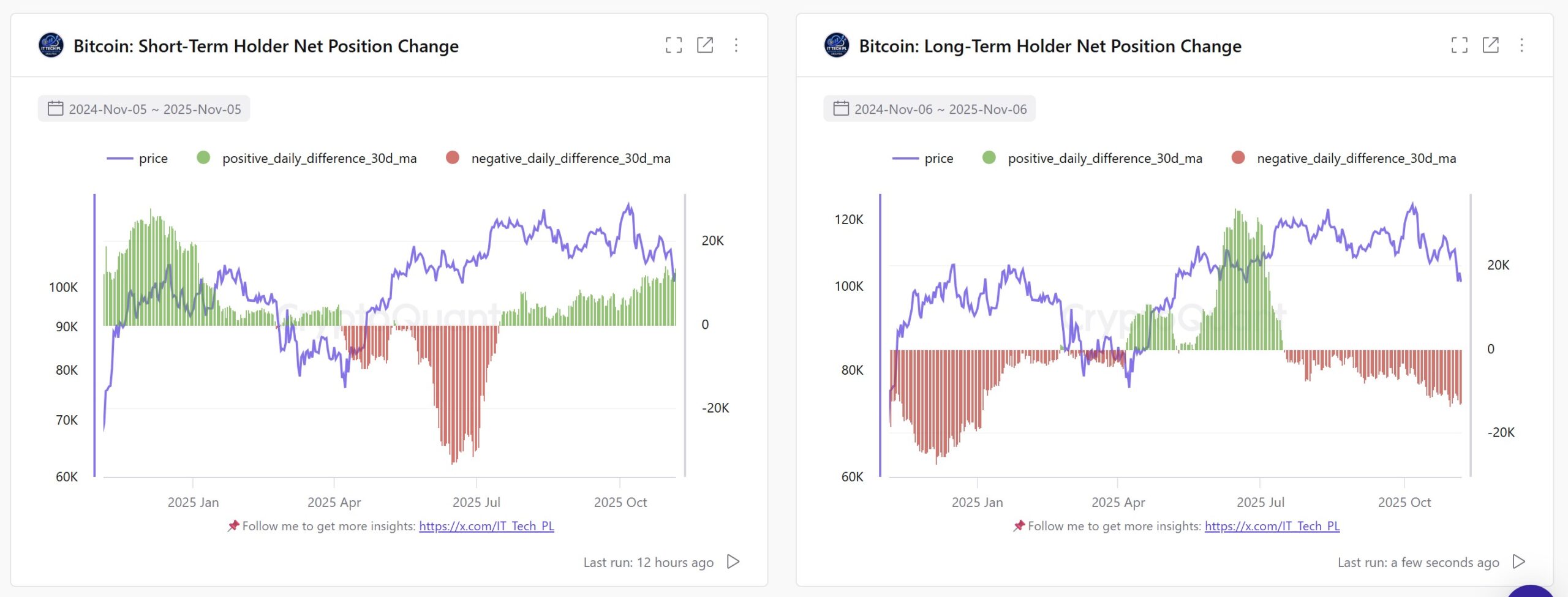

Onchain data further supported this mixed setup. The short-term holder (STH) net position change recently surged to a yearly high, suggesting that traders who typically hold coins for less than 155 days are adding to their positions despite the pullback.

Conversely, the long-term holder (LTH) net position change approaches yearly lows, indicating ongoing profit-taking from seasoned investors. This divergence indicates that while new buyers are stepping in, the absorption isn’t yet strong enough to establish a definitive bottom range.

Related: Why this key Bitcoin price trendline at $100K is back in focus

Bitcoin may test the yearly open before recovery

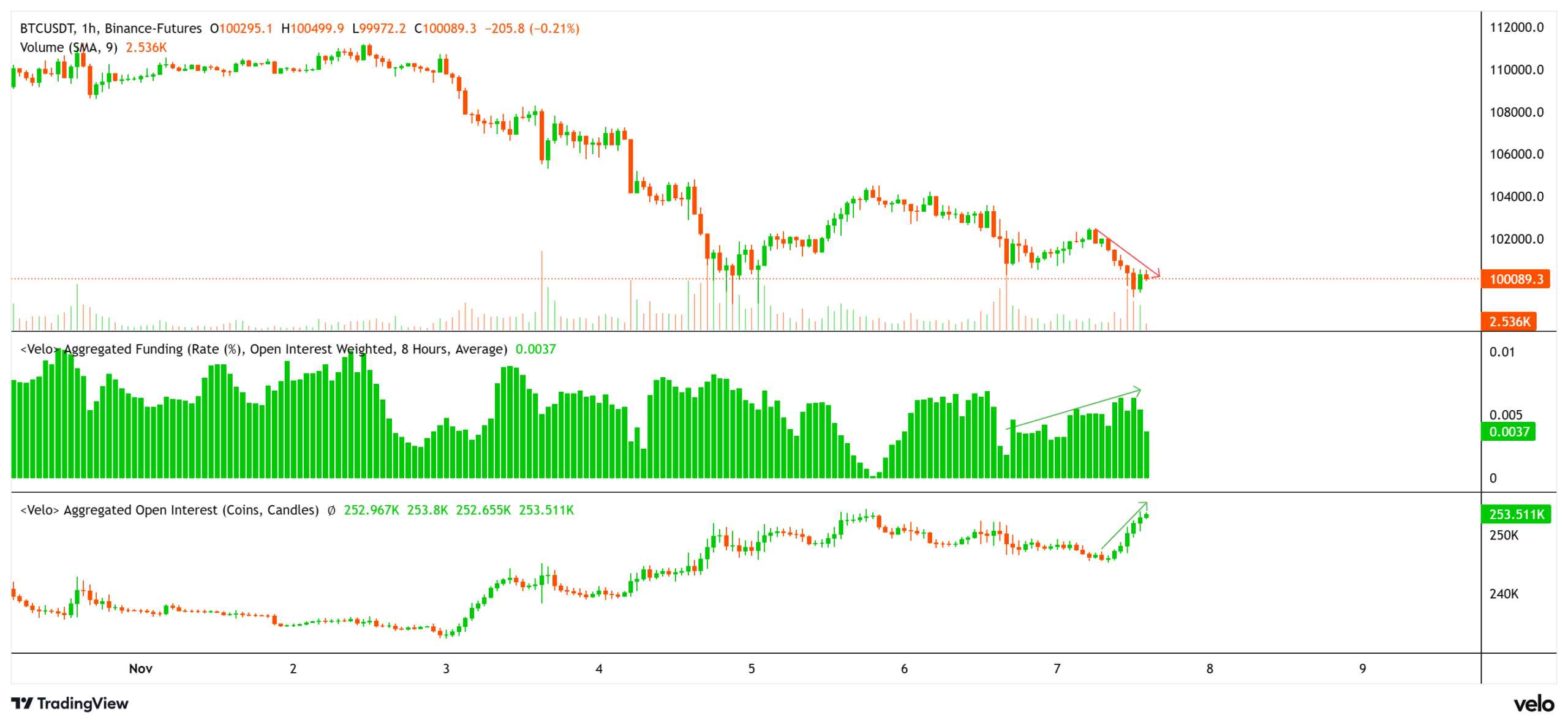

From a technical standpoint, Bitcoin’s short-term charts, both the one-hour and four-hour timeframes, show no signs of a bullish reversal setup. The recent uptick in price was primarily driven by shorts covering, not genuine buying pressure. However, over the past few hours, BTC open interest has steadily risen while funding rates remained elevated, signaling that traders could be opening new long positions.

Yet, unless BTC reclaims the $104,000 level as firm support, a deeper pullback toward $95,000 might take place, and potentially the yearly open near $93,500, in the coming week. Such a move could flush out remaining longs before setting the stage for a possible rebound led by short liquidations.

Related: $100B in old Bitcoin moved, raising ‘OG’ versus ‘trader’ debate

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.