Polymarket Trades Inflated by Wash Trading

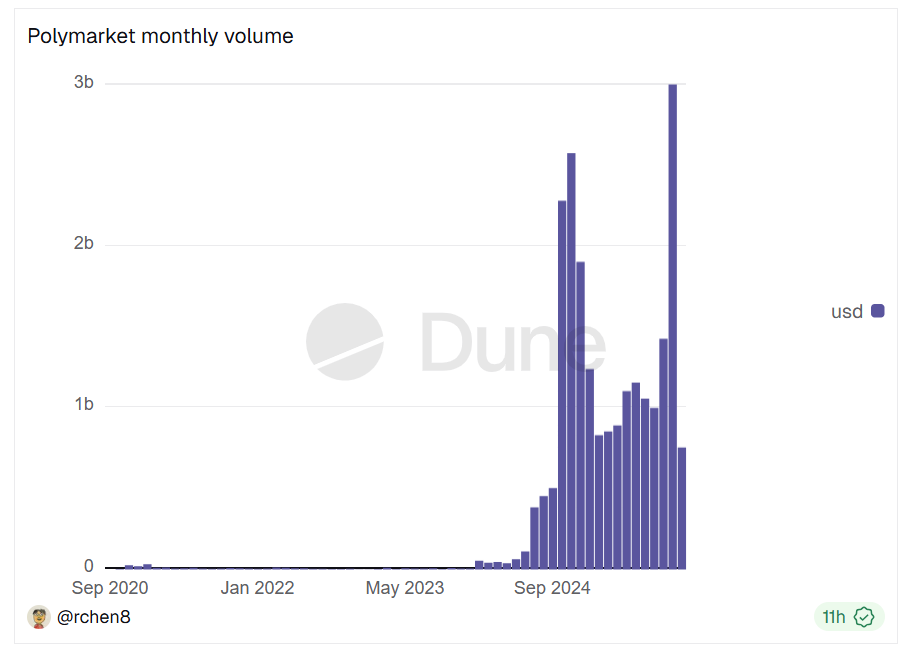

The rapid growth of the prediction market Polymarket may not be entirely organic but instead inflated by artificial trading activity, according to research published by Columbia University.

In an 80-page paper titled “Network-Based Detection of Wash-Trading,” which has not yet undergone peer review, Columbia researchers identified extensive wash-trading activity on Polymarket beginning in July 2024. That month, they found that wash trades accounted for nearly 60% of the platform’s total trading volume.

“This activity persisted through late April 2025 before subsiding substantially, and once again increased to about 20 percent of volume in early October 2025,” they wrote.

The researchers determined that 25% of Polymarket’s total trading volume over the past three years was attributable to artificial trading.

One of the paper’s co-authors, Columbia University professor Yash Kanoria, told Bloomberg, “I’m hopeful that Polymarket will welcome the analysis in our paper.” The authors allege that Polymarket was largely responsible for the wash trading, citing the structure of its operations as a contributing factor.

Cointelegraph reached out to Polymarket for comment but had not received a response at time of publication.

Wash trading — a practice in which the same trader buys and sells the same asset to create a false impression of market activity — is illegal in the United States because it manipulates prices and misleads investors about a market’s real demand and liquidity.

Wash trading allegations are not a new phenomenon in the cryptocurrency industry. In 2023, a report by Solidus Labs claimed that decentralized exchanges were particularly rife with wash trading. The report found that, based on an analysis of 30,000 Ethereum-based decentralized exchange liquidity pools, nearly 70% had engaged in wash trading over a three-year period.

Related: Crypto firm pleads guilty to wash trading FBI-made token

Wash-trading allegations cast a shadow on the rise of prediction markets

The latest wash trading allegations cast a shadow over the rapid ascent of Polymarket and the broader blockchain-based prediction market sector.

These markets gained prominence during the 2024 US presidential election cycle for accurately forecasting the outcome. Polymarket’s surge in popularity positioned it to pursue a reported $10 billion valuation amid rumors of a major funding round.

Polymarket has emerged as one of the leading decentralized prediction platforms, allowing users to bet on real-world events without relying on a central bookmaker.

As Cointelegraph recently reported, Polymarket has been preparing to re-enter the US market in November, just months after the Commodity Futures Trading Commission (CFTC) issued a no-action letter to a clearinghouse the company acquired.

Related: Kalshi, Polymarket traders bet Supreme Court will curb Trump’s tariff powers