Daily Broad Market Recap – November 6, 2025

Markets turned decisively risk-off on Thursday as U.S. labor market concerns overwhelmed policy optimism, with equities and risk assets suffering sharp losses while bonds rallied on renewed Federal Reserve easing expectations amid an ongoing government shutdown that continues to starve traders of official economic data.

The session’s dominant narrative centered on Challenger, Gray & Christmas data showing 153,074 job cuts in October—the highest for that month since 2003—which amplified concerns about labor market deterioration at the same time as a record U.S. government shutdown.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Japan Average Cash Earnings for September 2025: 1.9% y/y (1.6% y/y forecast; 1.5% y/y previous)

- Australia Balance of Trade for September 2025: 3.94B (4.0B forecast; 1.83B previous)

- Germany Industrial Production for September 2025: 1.3% m/m (2.5% m/m forecast; -4.3% m/m previous)

- Swiss Unemployment Rate for October 2025: 2.9% (2.8% forecast; 2.8% previous)

- ECB Executive Board member Isabel Schnabel said on Thursday that there is still “a way to go” in balance sheet normalization, far from restarting new bond purchases.

-

Global PMI updates:

- Japan S&P Global Services PMI Final for October 2025: 53.1 (52.4 forecast; 53.3 previous)

- Germany HCOB Construction PMI for October 2025: 42.8 (46.7 forecast; 46.2 previous)

- Euro area HCOB Construction PMI for October 2025: 44.0 (46.5 forecast; 46.0 previous)

- U.K. S&P Global Construction PMI for October 2025: 44.1 (46.0 forecast; 46.2 previous)

- Euro area Retail Sales for September 2025: -0.1% m/m (0.2% m/m forecast; 0.1% m/m previous); 1.0% y/y (1.5% y/y forecast; 1.0% y/y previous)

-

U.K. Official Bank Rate was held at 4.0% (4.0% forecast; 4.0% previous)

- Vote to cut: 4.0 (2.0 previous); Vote Hike: 0.0 (0.0 previous); Vote to hold: 5.0 (7.0 previous)

- U.K. BoE Monetary Policy Report: emphasized that consumer price inflation is judged to have peaked, and progress on underlying disinflation continues, supported by easing pay growth and services inflation. The restrictiveness of monetary policy has fallen, and the risk of inflation persistence has become less pronounced; however, the risk of weaker demand is now more apparent, so overall risks are viewed as more balanced.

- U.S. Challenger Job Cuts for October 2025: 153.07k (73.0k forecast; 54.06k previous)

- Canada Ivey PMI s.a for October 2025: 52.4 (55.0 forecast; 59.8 previous)

- Cleveland Fed’s Beth Hammack expressed Thursday skepticism on further rate cuts, citing persistent inflation and prior easing from completed reductions.

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Thursday’s trading session saw a sharp reversal in risk sentiment as U.S. labor market concerns dominated across all asset classes, triggering significant losses in equities and cryptocurrencies during the U.S. session, while driving a flight to safety in bonds.

The S&P 500 fell over 1.0%, with technology megacaps including Nvidia and Tesla leading losses. The Nasdaq 100 slumped notably as concerns over lofty valuations surfaced amid the labor market weakness. The selloff accelerated following the release of the Challenger job cuts data, which revealed the highest October layoff announcements in over two decades.

Gold saw early session gains then retreated from recent highs with the broad market sell-off, trading around $3,979 at the Thursday close. Despite the pullback, gold maintained some support, signaling demand may still be there due to the government shutdown and rise in Fed rate cut odds.

WTI crude oil continued its rebound in Asia before facing selling pressure from London through the end of the session. The energy complex struggled in the back half of the session, likely on worries about economic weakness and potential demand destruction took center stage after weak U.S. employment data.

Bitcoin suffered notable losses once again, sinking 3% to trade around $100,600 as the cryptocurrency market participated in the broader risk-off move. The digital asset retreated from levels above $103,000, highlighting its continued sensitivity to shifts in risk appetite.

The 10-year Treasury yield tumbled Thursday highs around 4.16% to 4.09%, marking the largest single-day decline in a month. The bond market rally reflected growing conviction that labor market weakness will compel the Federal Reserve to resume rate cuts, with the CME Fed Watch Tool now pricing in better than 69% odds of a December reduction.

FX Market Behavior: U.S. Dollar vs. Majors:

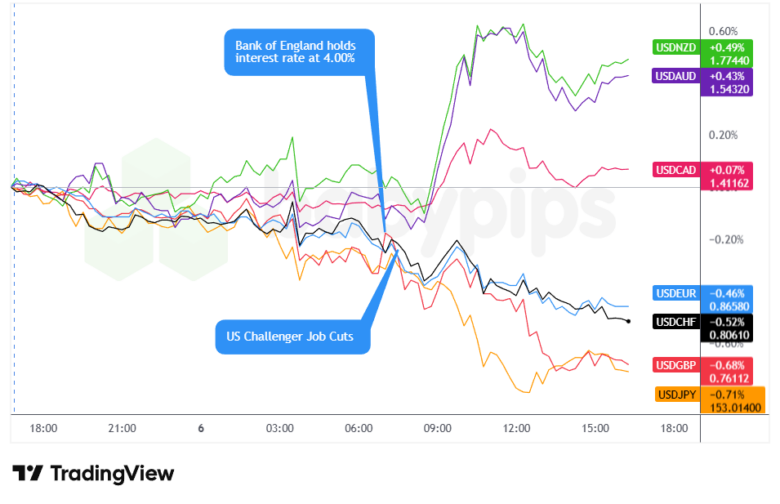

The U.S. dollar experienced notable intraday volatility on Thursday, ultimately closing mixed against major currencies with a net bearish bias. Losses against European currencies and the yen seem to outweigh the Greenback’s gains versus commodity-linked currencies.

During the Asian and early London sessions, the greenback traded with a softer tone across the board. With no major catalysts to point to, this grind lower likely reflected ongoing uncertainty about the U.S. economic outlook amid the U.S. government shutdown, and likely Asia session traders pricing in some of Wednesday’s positive vibes.

The dollar’s trajectory became more erratic during the U.S. morning session following the release of the Challenger job cuts data. The report triggered a spike in volatility as traders reassessed the labor market outlook in the absence of official government employment statistics. The greenback initially weakened sharply on the disappointing jobs data before staging a partial recovery, arguably on the idea on whether the private-sector report alone warranted aggressive repositioning.

By the session close, the dollar settled mixed across the major currency pairs. The greenback posted gains against the Australian dollar, New Zealand dollar, and Canadian dollar as commodity-linked currencies underperformed amid falling oil prices and broader risk aversion. However, these gains were offset by notable losses against the euro, British pound, Swiss franc, and Japanese yen.

The dollar’s mixed performance possibly reflected competing narratives: U.S. labor market concerns supporting the case for Fed easing versus ongoing uncertainty about the global economic outlook and the implications of the prolonged U.S. government shutdown.

Upcoming Potential Catalysts on the Economic Calendar

- Japan Household Spending for September 2025 at 11:30 pm GMT

- Japan Reuters Tankan Index for November 2025 at 12:00 am GMT

- China Balance of Trade for October 2025 at 3:00 am GMT

- Germany Balance of Trade for September 2025 at 7:00 am GMT

- U.K. Halifax House Price Index for October 2025 at 7:00 am GMT

- Swiss Foreign Exchange Reserves for October 2025 at 8:00 am GMT

- Swiss Consumer Confidence for October 2025 at 8:00 am GMT

- China Foreign Exchange Reserves for October 2025

- U.S. Fed Williams Speech at 8:00 am GMT

- China Current Account Prel for September 30, 2025 at 9:00 am GMT

- U.K. BBA Mortgage Rate for October 2025 at 10:00 am GMT

- U.S. Fed Jefferson Speech at 12:00 pm GMT

- Canada Employment Situation update for October 2025 at 1:30 pm GMT

- Euro area ECB Elderson Speech at 1:30 pm GMT

- U.S. Government Employment update for October 2025 (tentative)

Friday’s calendar features low to mid-tier economic catalysts, so attention will center primarily on three key areas.

Any fresh developments regarding the U.S. government shutdown could trigger significant volatility across markets, particularly if there are signs of progress toward resolution or, conversely, indications that the impasse may extend further. The shutdown continues to complicate the economic outlook by preventing the release of official data and creating stress on millions of Americans without their usual pay and/or government benefits.

Traders will also monitor for any updates on the U.S.-China trade front, as ongoing tensions and tariff uncertainties remain a persistent source of market concern. Any rhetoric or policy signals from either side could influence risk sentiment and currency markets.

The Canadian employment report for October will provide insight into labor market conditions north of the border at a time when employment trends are under intense scrutiny across North America. Given Thursday’s weak Challenger data and the absence of official U.S. employment statistics due to the shutdown, the Canadian figures may receive outsized attention as a proxy for broader North American labor market health.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!