Daily Broad Market Recap – November 5, 2025

Markets rebounded on Wednesday as easing U.S.-China trade tensions provided fresh momentum, with China’s confirmation of tariff suspensions on U.S. goods helping to lift risk appetite following Tuesday’s tech-driven selloff. Equities staged a recovery rally while traders also assessed mixed economic signals and awaited the Supreme Court’s hearing on tariff legality.

The session featured stronger-than-expected U.S. services sector data that temporarily lifted Treasury yields and the dollar, though both pared gains later in the day. Bitcoin bounced back above $100,000 after dipping below that psychological level overnight.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- China confirms suspension of 24% tariff on US goods, retains 10% levy

-

New Zealand Employment Change for quarter ending September 2025: 0.0% q/q (0.1% q/q forecast; -0.1% q/q previous)

- New Zealand Unemployment Rate: 5.3% (5.3% forecast; 5.2% previous)

- Australia Business sentiment arguably showed net improvement:

- S&P Global Services PMI Final for October 2025: 52.5 (53.1 forecast; 52.4 previous)

- Australia Ai Group Industry Index for October 2025: -11.2 (-18.0 forecast; -16.0 previous)

- Australia AIG Manufacturing Index for October 2025: -22.0 (-15.0 forecast; -13.2 previous)

- Australia Ai Group Construction Index for October 2025: -7.1 (-10.0 forecast; -12.3 previous)

- The Bank of Japan’s released minutes highlighted a moderate economic recovery with 2.5-3.0% CPI inflation, resilient wages, and accommodative financial conditions, but amid risks from U.S. tariffs and global slowdowns; the board voted 7-2 to maintain the short-term policy rate at around 0.5%, emphasizing patience in monitoring impacts before any hikes.

- China RatingDog Services PMI for October 2025: 52.6 (52.3 forecast; 52.9 previous)

- Euro area HCOB Services PMI Final for October 2025: 53.0 (52.6 forecast; 51.3 previous)

- Germany Factory Orders for September 2025: 1.1% m/m (1.5% m/m forecast; -0.8% m/m previous)

- Euro area PPI for September 2025: -0.1% m/m (-0.3% m/m forecast; -0.3% m/m previous); -0.2% y/y (-0.3% y/y forecast; -0.6% y/y previous)

- U.K. S&P Global Services PMI Final for October 2025: 52.3 (51.1 forecast; 50.8 previous)

- U.S. MBA Mortgage Applications for October 31, 2025: -1.9% (7.1% previous)

- U.S. MBA 30-Year Mortgage Rate for October 31, 2025: 6.31% (6.3% previous)

- U.S. ADP National Employment Report for October 2025: 42.0k (20.0k forecast; -32.0k previous)

- Canada S&P Global Services PMI for October 2025: 50.5 (47.0 forecast; 46.3 previous)

- U.S. S&P Global Services PMI Final for October 2025: 54.8 (55.2 forecast; 54.2 previous)

-

U.S. ISM Services PMI for October 2025: 52.4 (50.8 forecast; 50.0 previous)

- U.S. ISM Services Prices for October 2025: 70.0 (69.0 forecast; 69.4 previous)

- U.S. ISM Services Employment for October 2025: 48.2 (47.5 forecast; 47.2 previous)

- U.S. EIA Crude Oil Stocks Change for October 31, 2025: 5.2M (-6.86M previous)

- Supreme Court heard arguments on the legality of President Trump’s use of emergency powers to impose tariffs, with key conservative justices expressing skepticism

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Wednesday’s session delivered a textbook example of dip-buying behavior as investors shrugged off the previous day’s tech-driven selloff and returned to risk assets following a brief consolidation period.

Equities staged a robust recovery, with the S&P 500 climbing nearly 1% from Asia session lows as chipmakers led the rebound with a 4% surge. The index had opened cautiously during Asian hours following overnight weakness but found support, correlating with overnight news of China’s suspension of 24% tariff on US goods.

Gold advanced on the session, rising 1.30% from the Tuesday close to trade around $3,989 per troy ounce. This may have been due to gold attracting safe-haven flows amid ongoing government shutdown concerns and Tuesday’s tech selloff on concerns of AI valuation. The metal maintained steady gains throughout all three trading sessions.

WTI crude oil declined 0.97% to close near $59.50. After trading green in Asia and London, the downturn during the U.S. session was likely a reaction to a larger-than-expected build in U.S. crude inventories (5.2 million barrels versus forecasts for a drawdown).

Bitcoin rebounded 3.3% to trade above $103,500 after briefly falling below the psychologically important $100,000 level overnight for the first time since June. The cryptocurrency tracked the recovery in risk assets, particularly technology stocks.

Treasury yields rose steadily after the initial Asia session dip, following the positive trade news from China, and likely in reaction to stronger-than-expected ADP employment & ISM U.S. services data. The 10-year yield climbing to 4.16% as bond markets digested signs of economic resilience. The 2-year yield increased by a similar magnitude to 3.58%. The yield curve steepened slightly as traders adjusted expectations for the pace of Fed rate cuts, with December cut probabilities declining to roughly 62.5% from 68.6% on Tuesday.

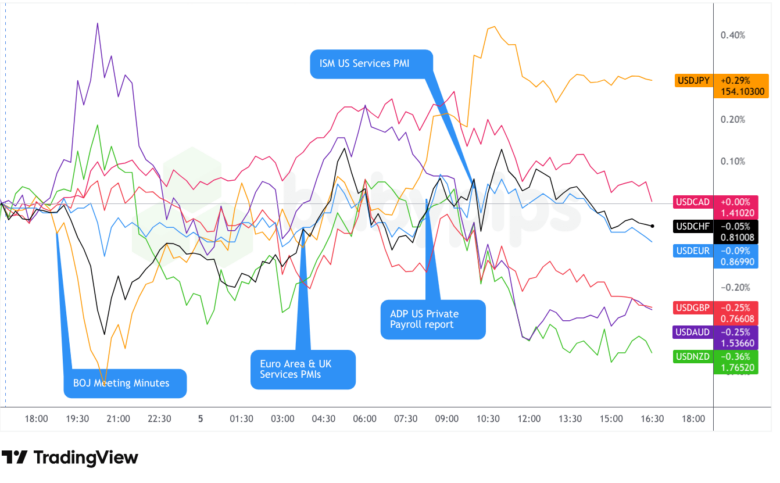

FX Market Behavior: U.S. Dollar vs. Majors:

The U.S. dollar exhibited choppy, range-bound trading on Wednesday, ultimately closing mixed to slightly weaker against major currencies despite periodic strength following economic data releases.

During the Asian session, the greenback traded mixed and choppy with a slight bearish lean as markets digested overnight developments, including the Bank of Japan meeting minutes and growing risk-off sentiment stemming from continued equity market weakness. Safe-haven currencies like the yen and Swiss franc showed relative strength during these hours.

The London session brought a shift in dollar dynamics, with the greenback turning net positive against most major currencies as European markets absorbed the upwardly revised U.K. and eurozone services PMI data. The dollar index climbed modestly as traders positioned ahead of key U.S. data releases scheduled for the New York session.

The U.S. session delivered the most volatility, with the dollar initially strengthening following the better-than-expected ADP employment report (42,000 versus 20,000 expected) and the robust ISM services PMI (52.4 versus 50.8 expected). The data suggested the government shutdown was placing only limited drag on the economy and prompted a brief uptick in Treasury yields.

However, the dollar’s gains proved short-lived as the greenback reversed lower through the U.S. afternoon session, ultimately closing as a net loser against most major currencies. The reversal appeared driven by a positive broad market shift, most notably in risk assets as “buy-the-dip” behavior and possibly reduced China-U.S. trade tensions potentially overshadowed continued concerns about the government shutdown’s impact and skeptical reactions from Supreme Court justices during the tariff legality hearing.

Upcoming Potential Catalysts on the Economic Calendar

Thursday’s calendar is busy once again, and it centers on the Bank of England’s monetary policy decision, where markets are pricing a 65% probability that rates will remain unchanged at 4.0%. Recent upward revisions to U.K. services PMI data and concerns about persistent inflation have reduced expectations for an imminent cut, though the decision could be close given recent weak labor market data and the fiscal tightening implied by Treasury Chief Rachel Reeves’ pre-budget statements.

Several Federal Reserve speakers will take the stage throughout the day, potentially offering guidance on the December rate decision following Wednesday’s mixed economic signals. The Fed faces a delicate balance between cooling labor markets (as evidenced by recent ADP data) and sticky inflation (reflected in the ISM services prices index hitting 70%).

Any developments regarding the U.S. government shutdown will highly likely move markets, particularly if there are signs of imminent resolution that would allow the release of official labor market statistics before the Fed’s December 10 meeting.

On the U.S.-China trade front, markets will watch for any additional details or implementation updates following China’s confirmation of tariff suspensions on U.S. agricultural products and the removal of U.S. firms from export control lists. The one-year framework for the trade agreement provides near-term stability, though analysts note that follow-through on pledges will be critical for sustained improvement in bilateral relations.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!