Chart Art: Is AUD/CAD Heading Back to Its Long-Term Range Support?

2025-11-05 01:59:00

Now that the long-term range resistance on AUD/CAD appears to be holding as a ceiling, can the pair gain enough bearish traction to make it down to the bottom?

Or can it make another attempt at an upside breakout?

Here are the inflection points I’m watching on the 4-hour time frame.

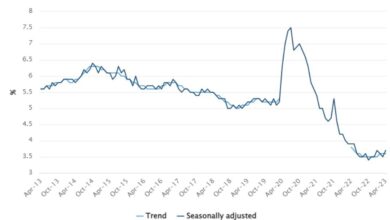

The Reserve Bank of Australia (RBA) gave a less dovish monetary policy announcement earlier this week, but that didn’t seem enough to carry this Aussie pair past the key resistance near the .9200 major psychological handle.

After all, the Bank of Canada (BOC) sounded a tad more optimistic in last week’s interest rate statement as well, suggesting that the central bank could also be approaching the end of their rate cut era.

Is AUD/CAD about to go further south from here?

Remember that directional biases and volatility conditions in market price are typically driven by fundamentals. If you haven’t yet done your homework on the Australian dollar and the euro, then it’s time to check out the economic calendar and stay updated on daily fundamental news!

The pair is currently hovering around the area of interest near S1 (.9130) and another bounce could be enough to spur a test of near-term resistance zones at the pivot point (.9170) then the range resistance near R1 (.9210).

On the other hand, long red candlesticks piercing below S1 could confirm enough bearish pressure for a potential test of support near S2 (.9090). Look out for stronger downside momentum that could even trigger a break lower and a move towards the next bearish target at S3 (.9040).

Just be sure to keep your eyes and ears peeled for BOC Governor Macklem’s testimony, as his rhetoric could continue to shape monetary policy expectations.

Whichever bias you end up trading, don’t forget to practice proper risk management and stay aware of top-tier catalysts that could influence overall market sentiment.

Disclaimer:

Please be aware that the technical analysis content provided herein is for informational and educational purposes only. It should not be construed as trading advice or a suggestion of any specific directional bias. Technical analysis is just one aspect of a comprehensive trading strategy. The technical setups discussed are intended to highlight potential areas of interest that other traders may be observing. Ultimately, all trading decisions, risk management strategies, and their resulting outcomes are the sole responsibility of each individual trader. Please trade responsibly.