Death Cross Risk Builds as Ripple Token Plunges 6%

تكنلوجيا اليوم

2025-11-04 17:47:00

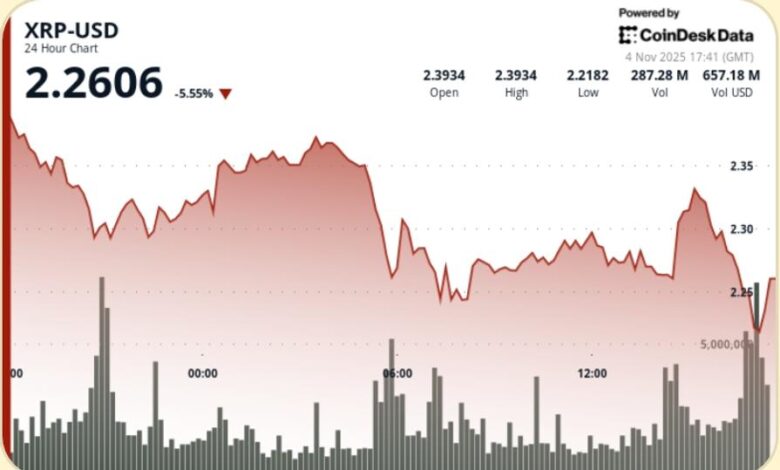

XRP extended its decline Tuesday, dropping 6% to $2.25 as whale selling and a clean trendline break accelerated downside momentum. The move—paired with a 15% open-interest drop—keeps pressure on bulls ahead of a looming death-cross setup and a key $2.20 support retest.

What to Know

• XRP fell from $2.39 to $2.25 (-6%), confirming a break below the multi-month ascending trendline

• Whale wallets offloaded ~900,000 XRP over five days

• Open interest dropped ~15% as leveraged longs unwound

• Volume spiked to ~193.7M during breakdown period

• Lower-high structure now established at $2.39 → $2.37 → $2.33

News Background

The selloff tracks persistent whale distribution since late October, with large holders shedding positions following repeated failures above the 200-day moving average. Macro risk also resurfaced across risk assets as open interest compressed across majors, suggesting deleveraging—not panic retail flow—drove Tuesday’s move. Analysts point to a looming death-cross setup as momentum indicators shift decisively lower, while some positioning desks flagged bids near $2.20 as the next liquidity pocket for potential stabilization.

Price Action Summary

• Inability to reclaim $2.37–$2.39 supply zone

• Progressive lower highs signaling distribution

• Trendline breach triggered accelerated algo selling

• Volume surged ~87% vs 24-hr average during breakdown

• Session low printed at $2.24 before modest bid recovery to $2.25

Technical Analysis

• Trend: Breakdown from rising structure, momentum bearish

• MAs: 50-day MA curling down toward 200-day → death-cross risk

• Support: $2.25 short-term base; $2.20–$2.00 psychological layer; deeper pocket toward $1.85

• Resistance: $2.37–$2.39 zone remains dominant supply wall

• Volume: Expansion confirms distribution; late-session exhaustion hints near-term pause

What Traders Are Watching

• Whether $2.20 absorbs sell pressure or cracks to $2.00

• Confirmation (or fade) of death-cross setup

• Open-interest stabilization after 15% flush

• Whale wallet behavior after ~900K tokens dumped

• Reclaim of $2.37–$2.39 range as bull invalidation threshold