Capital Group, a 94-year-old mutual fund powerhouse recognized for its conservative funding strategy, has grown a $1 billion place in Bitcoin-related shares into greater than $6 billion.

Mark Casey, a portfolio supervisor with 25 years at Capital Group, led the agency’s transfer into Bitcoin. Casey, who describes his funding fashion as formed by Benjamin Graham and Warren Buffett, has turn out to be an advocate for Bitcoin (BTC), in keeping with a Sunday report by The Wall Avenue Journal.

“I simply love Bitcoin, I simply assume it’s so fascinating,” Casey mentioned throughout a podcast interview with enterprise agency Andreessen Horowitz. He referred to as Bitcoin “one of many coolest issues that has ever been created by folks,” per the WSJ report.

Over the previous 4 years, Capital Group has constructed its publicity primarily by means of investments in so-called Bitcoin treasury corporations, public corporations that accumulate and maintain Bitcoin on their stability sheets.

Associated: Ether vs. Bitcoin treasuries: Which technique is successful

Capital Group’s greatest Bitcoin guess is on Technique

Capital Group’s most notable holding is in Technique (previously MicroStrategy), the software program agency remodeled right into a Bitcoin automobile by founder Michael Saylor.

In 2021, Capital Group acquired a 12.3% stake in Technique for over $500 million. That stake, now diluted to 7.89% resulting from share issuance and a few trimming, is price about $6.2 billion following a greater than 2,200% surge in Technique’s inventory over 5 years.

Casey mentioned he and his colleagues analyze these corporations the identical method they assess corporations concerned in commodities like gold or oil. “We view Bitcoin as a commodity,” he instructed the WSJ.

Capital Group’s Bitcoin publicity additionally features a 5% stake in Japan-based Metaplanet, a lodge operator-turned-Bitcoin holder, and shares of mining firm Mara Holdings.

Associated: Bitcoin in consolidation as treasuries eye altcoins: Novogratz

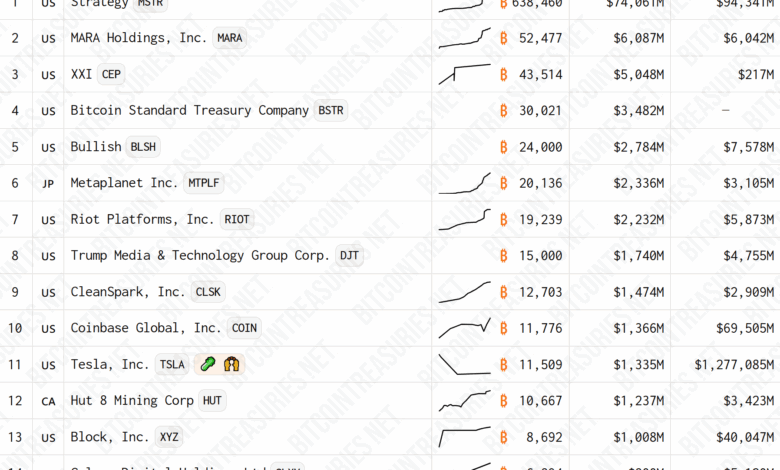

Company Bitcoin treasuries high 1 million BTC

As Cointelegraph reported, company Bitcoin treasuries now maintain over 1 million BTC price greater than $117 billion, in keeping with BitcoinTreasuries.NET.

Michael Saylor’s Technique stays the highest holder with 636,505 BTC, adopted by MARA Holdings with over 52,000 BTC. Newcomers like XXI and Bitcoin Commonplace Treasury are shortly gaining floor, whereas corporations like Metaplanet, Bullish and Coinbase spherical out the highest 10.

Wanting forward, corporations like Metaplanet and Semler Scientific have revealed aggressive accumulation targets, aiming to amass 210,000 BTC and 105,000 BTC by 2027, respectively.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder