Firms including underperforming altcoins to their stability sheets are muddying the broader treasury narrative, says Bitcoin treasury firm Nakamoto CEO, David Bailey.

“The treasury firm moniker itself is complicated,” Bailey mentioned in an X publish on Sunday.

“Poisonous financing, failed altcoins rebranded as DATs, too many failed firms with no plan or imaginative and prescient. It’s completely muddled the narrative,” Bailey mentioned.

David Bailey says the sector is “being examined”

Bailey emphasised that “the core technique is to construct and monetize your stability sheet.”

“If you are able to do it effectively, you’ll develop your belongings over time; in case you do it poorly, you’ll commerce at a reduction and be consumed by somebody who can do it higher,” he mentioned.

“The bitcoin treasury firm of the fiat system is a financial institution. At present we’re constructing Bitcoin Banks. If you happen to’re afraid of that time period, name them Bitcoin monetary establishments.”

Bailey mentioned that the complete treasury sector is “being examined.” His feedback come as publicly-listed firms are beginning to look past Bitcoin (BTC) and down the chance curve for different crypto belongings so as to add to their treasuries. On Aug. 2, it was reported that Nasdaq-listed Mill Metropolis Ventures III could increase one other $500 million below an fairness settlement to fund its just lately introduced Sui treasury technique.

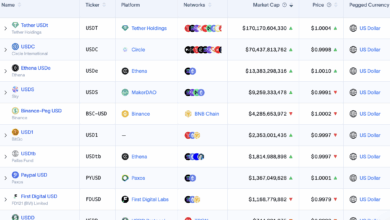

Narrative-driven theses are driving companies to broaden their treasuries past Bitcoin, Galaxy Digital mentioned in a July 31 report. Ether (ETH), Solana (SOL), XRP (XRP), BNB (BNB), and HyperLiquid (HYPE) are among the many cryptocurrencies gaining traction exterior of Bitcoin.

Bitcoin held in publicly-traded firms is roughly $117.91 billion on the time of publication, in line with BitcoinTreasuries.NET.

Ether is gaining traction in its place as a result of it can be staked for annual returns, making it a retailer of worth and a supply of revenue. Roughly 3.14% of Ether’s whole provide is held in publicly-listed treasury firms, in line with StrategicETHReserve.

Increasing curiosity could be the purpose for Bitcoin’s sideways value

Galaxy Digital CEO Mike Novogratz mentioned treasury firms displaying curiosity within the broader crypto market could be the purpose for Bitcoin’s sideways value motion in current instances.

“Bitcoin’s at a consolidation proper now. Partly since you’re seeing a variety of these treasury firms in different cash take their shot,” Novogratz mentioned.

Associated: Altseason index hits highest degree this 12 months: Right here’s what merchants assume

Whereas altcoins in treasuries have confronted some scrutiny, questions have additionally been raised about Bitcoin treasuries.

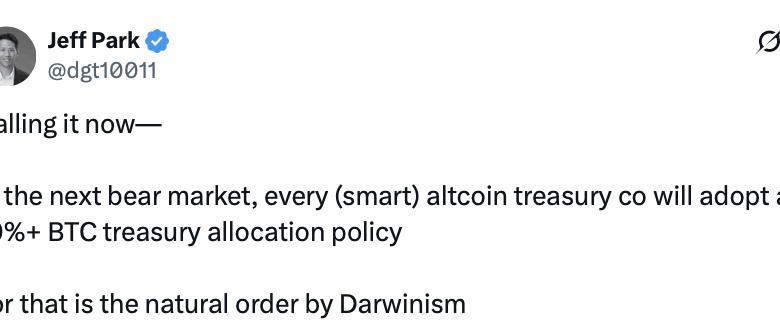

Enterprise capital agency Breed mentioned just a few Bitcoin treasury firms will stand the take a look at of time and keep away from the vicious “loss of life spiral” that may influence BTC holding firms that commerce near internet asset worth (NAV).

Journal: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Journal