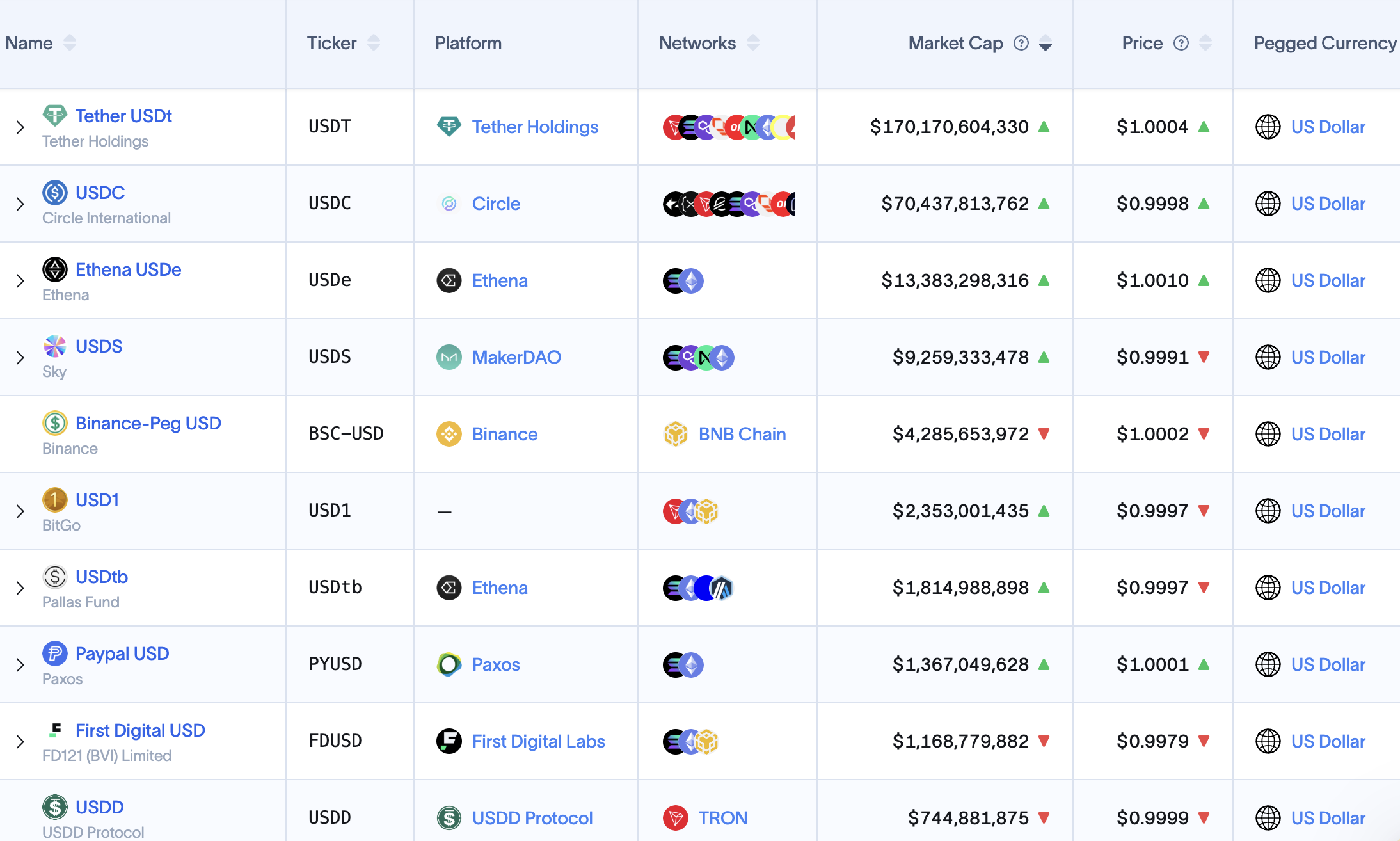

Greenback-pegged stablecoins will ultimately lose their value tickers, as exchanges summary away the in a different way denominated steady tokens on the backend, presenting solely a “USD” choice to the person, in keeping with Mert Mumtaz, CEO of distant process name (RPC) node supplier Helius.

The bidding conflict for the Hyperliquid USD stablecoin (USDH), and proposals from a number of corporations promising to provide 100% of the yield again to Hyperliquid, revealed that the stablecoin sector has develop into “commoditized,” Mumtaz mentioned.

Mumtaz added that he expects many corporations to situation their very own stablecoins and lots of current stablecoin issuers to begin their very own fee chains sooner or later, which can create liquidity fragmentation, holding capital trapped inside these ecosystems.

He mentioned that probably the most optimum answer to get forward of this liquidity downside is for exchanges to easily settle for all stablecoins and convert them to the specified denomination on the backend with out the person seeing what’s going on. Mumtaz wrote:

“The eventual endgame is that you do not see the ticker in any respect. The apps will simply show ‘USD’ as a substitute of USDC, USDT, or USDX, and they’ll swap all the things within the backend through a standardized interface.”

Stablecoins are more likely to emerge because the de facto commonplace for fiat currencies within the digital age as the worldwide monetary system strikes onchain and adopts internet-native methods, additional eroding the necessity to denominate stablecoins from completely different issuers for finish customers.

Associated: Contained in the Hyperliquid stablecoin race: The businesses vying for USDH

Synthetic intelligence to extend stablecoin abstraction

Reeve Collins, co-founder of stablecoin agency Tether and blockchain neo-bank WeFi, additionally instructed Cointelegraph that he expects the variety of stablecoins to proliferate within the coming years, which will likely be abstracted by AI brokers managing portfolios on behalf of customers.

Collins mentioned the subsequent era of stablecoin merchandise, which incorporates yield-bearing tokens, will likely be robotically managed by agentic AI, eradicating “all the complexity” of coping with a mess of various tokens, decreasing technical hurdles for the top person.

“The one factor that can drive which token to make use of is which one makes you probably the most cash, which one is the best to make use of,” Collins added.

Journal: Crypto wished to overthrow banks, now it’s changing into them in stablecoin struggle