Fabian Dori, the chief funding officer at digital asset financial institution Sygnum, says that banks providing crypto-backed loans favor crypto collateral within the type of onchain belongings reasonably than exchange-traded funds (ETFs), and utilizing onchain collateral can profit debtors.

Dori mentioned that onchain belongings are extra liquid, permitting lenders to execute margin requires crypto-backed loans on demand and supply increased loan-to-value (LTV) ratios to debtors as a result of the lender can liquidate the collateral in real-time. Dori advised Cointelegraph:

“It is really preferable to have the direct tokens as collateral, as a result of then you are able to do it 24/7. If you must execute a margin name on an ETF on Friday at midnight, when the market is closed, then it is harder. So, direct token holding is definitely preferable from that standpoint.”

Mortgage-to-value ratios in crypto consult with the entire quantity of a mortgage versus the collateral backing the mortgage, like Bitcoin (BTC), Ethereum (ETH), or another tokens accepted by the lender.

The next LTV ratio means the borrower is ready to entry extra credit score in relation to their posted crypto collateral, whereas a decrease LTV means they are going to get a smaller mortgage for a similar quantity of collateral.

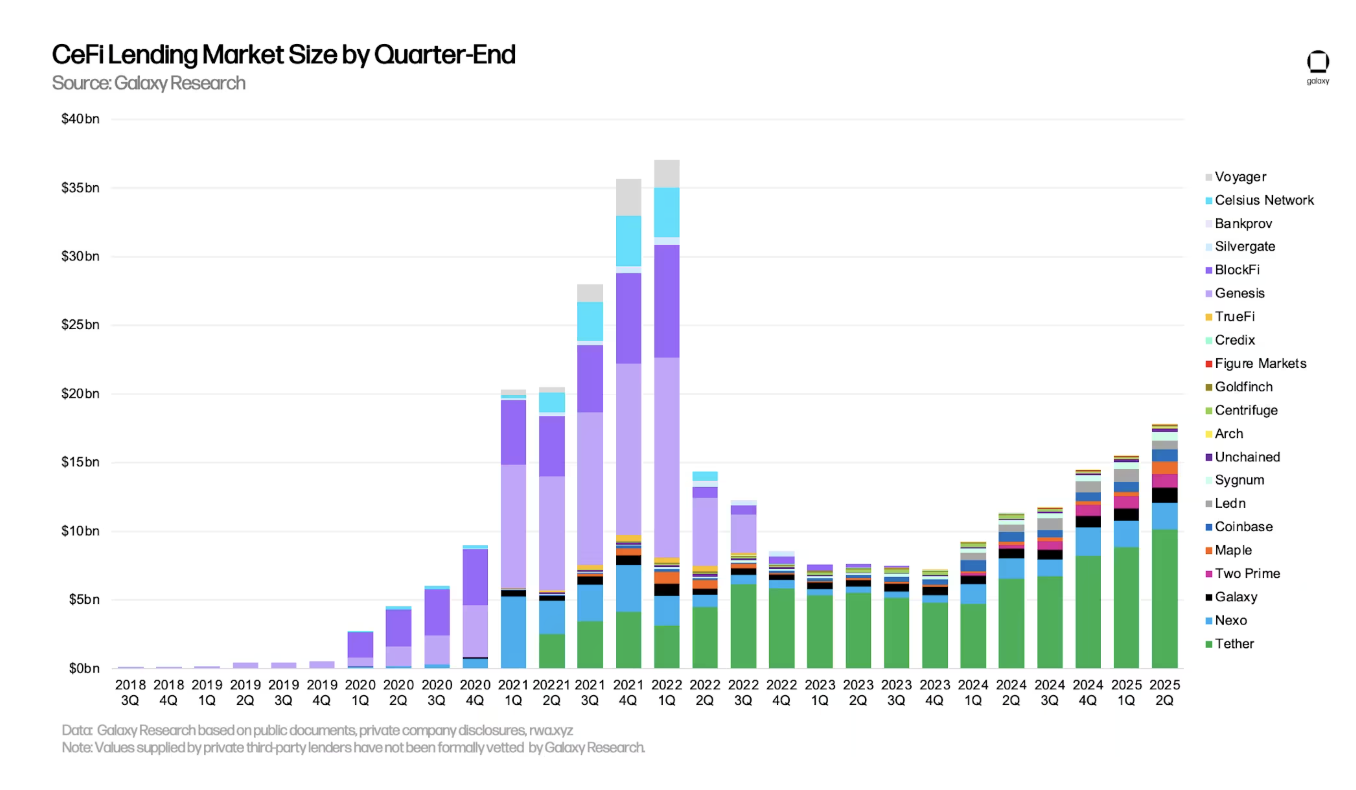

Crypto-backed loans are nonetheless of their infancy, Dori mentioned, however he was assured that the sector would proceed to develop as crypto good points widespread adoption.

Monetary establishments are steadily embracing loans secured by crypto as crypto lenders go public on US inventory exchanges, and conventional monetary (TradFi) corporations heat as much as the concept of accepting crypto as mortgage collateral.

Associated: South Korea caps crypto lending charges at 20%, bans leveraged loans

Crypto lending debuts on Wall Road as TradFi warms as much as crypto-backed lending

Determine Know-how, a crypto-backed lending firm, made its debut on the Nasdaq trade, a tech-focused US inventory trade, on Thursday.

Shares of the corporate surged by over 24% throughout intraday buying and selling on the primary day, and the corporate at the moment has a market capitalization of over $6.8 billion, in line with Yahoo Finance.

Monetary companies firm JP Morgan can also be contemplating providing crypto-backed loans to purchasers, a growth that might happen someday in 2026 if the legacy monetary large strikes ahead with the concept.

Journal: Residence loans utilizing crypto as collateral: Do the dangers outweigh the reward?