Stablecoin issuer Circle seems set to deepen its position in decentralized finance by making ready a local launch of USD Coin (USDC) on Hyperliquid’s Layer 1 chain, HyperEVM.

On Sept. 12, blockchain researcher MLM Blockchain flagged take a look at transactions involving USDC on HyperEVM’s mainnet, suggesting {that a} native deployment might roll out within the coming weeks.

Including to hypothesis, the identical pockets related to Circle lately acquired about $5 million price of Hyperliquid’s HYPE token.

The acquisition bolstered the view that Circle is positioning itself extra deeply within the Hyperliquid ecosystem. If the launch goes reside, HyperEVM would be a part of 24 different networks that already assist USDC, together with Ethereum, Solana, and the XRP Ledger.

Circle’s USDC is the second-largest stablecoin within the trade, with a market capitalization of greater than $72 billion. Hyperliquid, however, is the dominant decentralized perpetual trade, controlling greater than 60% of the market.

USDC scenario on Hyperliquid

The potential launch follows a public assertion from Circle CEO Jeremy Allaire, who wrote that the corporate intends to be “a serious participant and contributor” inside the Hyperliquid ecosystem.

Enrollment Closing Quickly…

Safe your spot within the 5-day Crypto Investor Blueprint earlier than it disappears. Study the methods that separate winners from bagholders.

Delivered to you by CryptoSlate

In line with him:

“We’re coming to the HYPE ecosystem in an enormous method. We intend to be a serious participant and contributor to the ecosystem. Joyful to see others buy new USD tickers and compete Hyper quick native USDC with deep and almost immediate cross chain interoperability can be effectively acquired.”

But Circle’s push comes as Hyperliquid prepares to introduce its native stablecoin, USDH. That undertaking has drawn consideration from main gamers similar to Native Market, Paxos, OpenEden, and Agora, signaling an actual problem to Circle’s place.

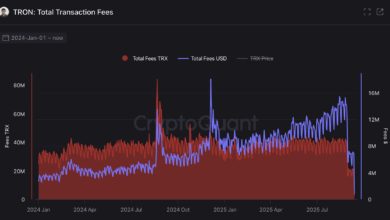

Over the previous 12 months, Hyperliquid has relied closely on Circle’s stablecoin to energy its markets, with round $5.773 billion in USDC provide on the platform. That focus means Hyperliquid accounts for roughly 8% of all USDC in circulation, making it considered one of Circle’s most dominant chains, in accordance with DeFiLlama knowledge.

So, ought to liquidity migrate to USDH, Circle might lose as a lot as $200 million in annual income, which could influence its enterprise.