Main monetary establishments are reshaping crypto’s narrative in 2025, marking a departure from earlier cycles outlined by retail hypothesis, memecoins and digital artwork alongside Bitcoin’s rise.

Two of the world’s largest banks — HSBC and BNP Paribas — have joined the tokenization-focused Canton Basis, following the likes of Goldman Sachs and different main backers as establishments push to convey blockchain-based utility to purchasers.

On the identical time, crypto markets are seeing a wave of billion-dollar shelf registrations and expanded preliminary public providing (IPO) plans, underscoring the race to build up digital belongings and faucet public markets.

This week’s Crypto Biz e-newsletter covers HSBC and BNP Paribas becoming a member of the Canton Basis, Mega Matrix’s $2 billion shelf registration to accumulate Ethena’s governance token, Gemini’s IPO focusing on a $3 billion valuation and the arrival of tokenized gold in US particular person retirement accounts (IRAs).

HSBC, BNP Paribas be a part of Canton Basis

HSBC and BNP Paribas — two of the world’s largest monetary establishments — have joined the Canton Basis, the physique driving adoption of the tokenization-focused Canton blockchain.

The banks be a part of current backers, together with Goldman Sachs, Hong Kong FMI Providers and Moody’s Rankings, in supporting the event of Canton, which is designed for institutional finance and real-world-asset administration.

A BNP Paribas government mentioned the transfer displays the financial institution’s continued efforts to leverage blockchain expertise “to serve our evolving shopper wants.”

HSBC, in the meantime, has been lively throughout a number of blockchain initiatives, together with plans to use for a stablecoin license in Hong Kong. HSBC can be concerned in blockchain functions throughout custody, bond issuance and tokenization.

Mega Matrix eyes $2 billion Ethena stablecoin treasury

Crypto-focused holding firm Mega Matrix has filed to lift $2 billion for a treasury technique centered on the Ethena stablecoin ecosystem — a transfer it says will present publicity to protocol income whereas amplifying its position in community governance.

Regulatory filings present the corporate plans to focus “solely on ENA, concentrating affect and yield in a single digital asset.” Fairly than holding Ethena’s USDe artificial stablecoin, Mega Matrix will construct its place across the ENA governance token.

The announcement comes amid surging curiosity in Ethena’s mannequin. Not like collateralized stablecoins similar to USDC (USDC) and USDt (USDT), USDe maintains its greenback peg by means of a hedging mechanism. Ethena’s USDe has grown quickly, with a market capitalization of roughly $13 billion, making it one of many largest stablecoins in circulation.

Gemini targets $3 billion valuation in IPO

Gemini, the cryptocurrency alternate based by Cameron and Tyler Winklevoss, is aiming for a $3 billion valuation in its deliberate preliminary public providing — an indication of rising institutional demand for crypto-focused listings.

Up to date filings with the US Securities and Trade Fee present the alternate now expects to cost shares between $24 and $26, up from the preliminary $17 to $19 vary. At roughly 16.7 million shares, the IPO may elevate about $433 million — larger than the $317 million projected in earlier filings.

The providing is backed by Nasdaq, which is able to purchase 2.1 million shares of Gemini inventory.

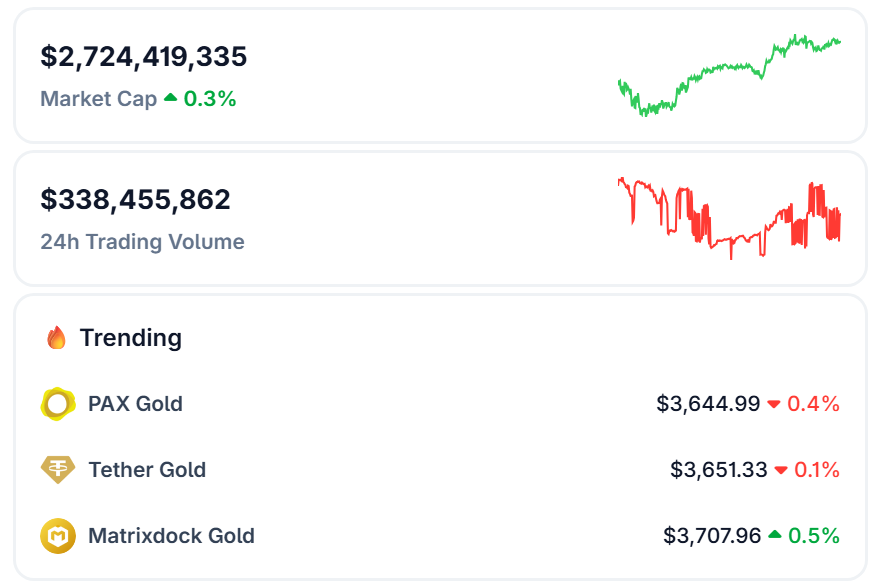

Buying and selling exercise on the Gemini alternate has picked up forward of the itemizing, with 24-hour volumes reaching round $200 million, in keeping with CoinMarketCap.

Tokenized gold enters US IRAs

The tokenization of real-world belongings is shifting into retirement accounts, with gold-backed IRA supplier SmartGold set to supply its vaulted belongings in tokenized kind. The transfer would give US retirement savers the flexibility to realize tax-advantaged publicity to gold onchain.

By means of a partnership with Chintai Nexus, SmartGold plans to tokenize as much as $1.6 billion value of vaulted gold, topic to investor demand.

Beneath the mannequin, buyers buy and retailer gold by means of SmartGold, with Chintai issuing digital tokens that signify the holdings. As soon as onchain, the tokens will be deployed into yield-generating methods, whereas the underlying gold stays securely vaulted.

Crypto Biz is your weekly pulse on the enterprise behind blockchain and crypto, delivered on to your inbox each Thursday.