Asset supervisor WisdomTree launched its Personal Credit score and Various Earnings Digital Fund (CRDT), a tokenized personal credit score car, amid an uptick in companies increasing into the tokenized personal credit score area of interest and different tokenized real-world property (RWAs).

The fund will embrace credit score prolonged to personal companies, loans made to actual property funding trusts (REITs), that are funds that monitor baskets of business properties, and debt from enterprise improvement companies, that are funding firms that provide financing to different companies, in response to Friday’s announcement.

CRDT is accessible to retail and institutional buyers, increasing entry to an asset class usually reserved for institutional and complicated buyers.

Tokenization is the method of changing possession or rights to an asset, bodily or digital, right into a digital token on a blockchain.

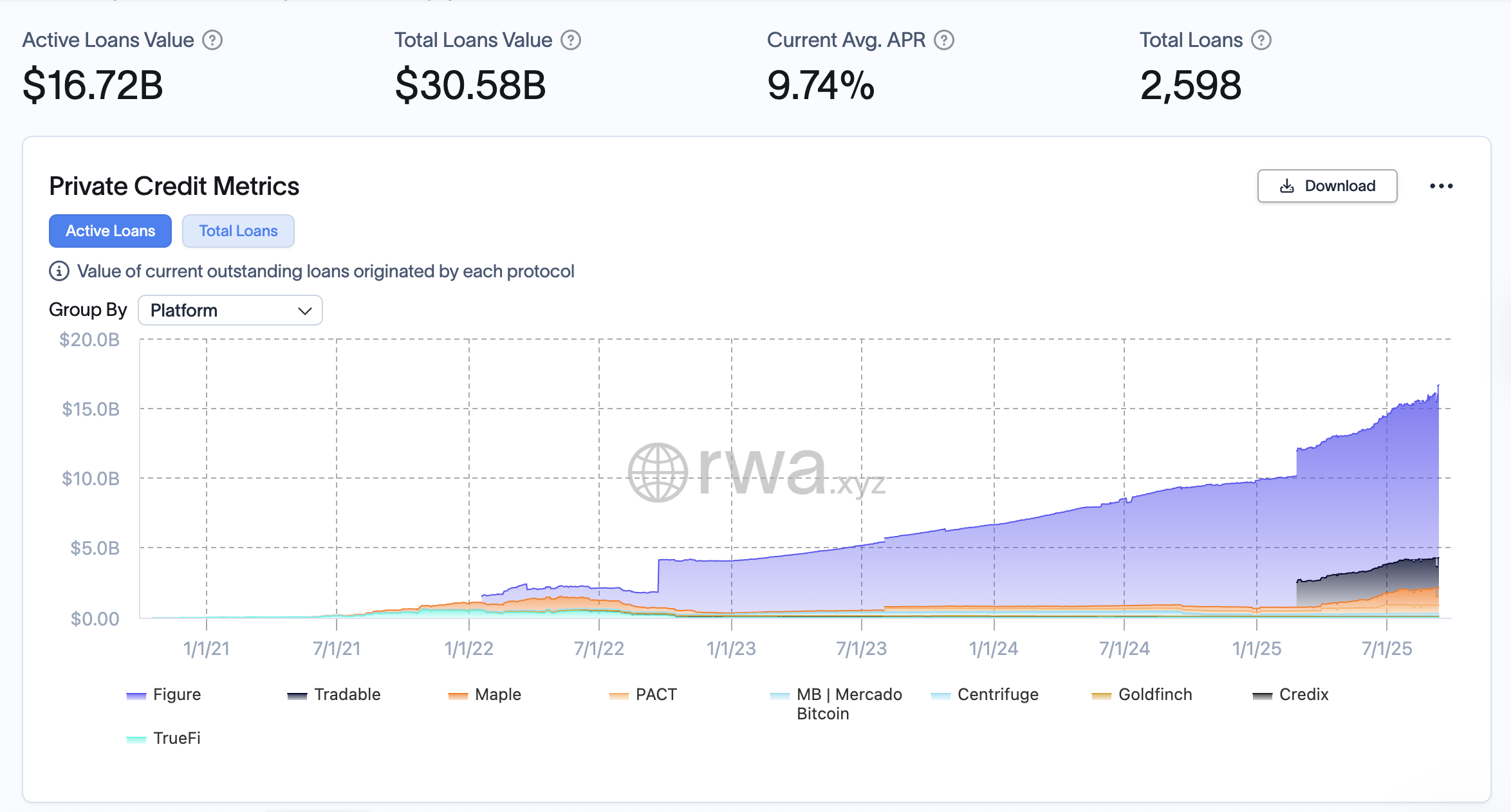

Tokenized personal credit score devices now account for over $16.7 billion in worth, and the market has steadily grown since 2021, in response to RWA.xyz.

Tokenized funds of all kinds, together with US Treasury funds, cash market funds, which spend money on yield-bearing debt, personal fairness funds and different different funding automobiles proceed to develop in market cap and recognition because the legacy monetary system strikes onchain.

Associated: Tokenized different funds leap 47% to $1.7B in 30 days

Tokenized funds grow to be all the trend as a number of companies announce choices

Funding financial institution Goldman Sachs and banking establishment Financial institution of New York (BNY) Mellon provided entry to tokenized cash market funds for institutional buyers in July.

State Avenue, one of many “huge three” asset managers, which incorporates BlackRock and Vanguard, signed on as the primary custodian for monetary providers firm JPMorgan’s tokenized debt platform in August.

State Avenue accomplished the platform’s first transaction by buying $100 million in tokenized business debt from the Oversea-Chinese language Banking Company (OCBC), one among Southeast Asia’s oldest banking establishments.

Oracle supplier Chainlink, UBS, an asset supervisor with $5.9 trillion in property beneath administration, and RWA change DigiFT, launched a pilot program to check tokenized fund settlement in Hong Kong in September.

BlackRock, the world’s largest asset supervisor with over $12.5 trillion in property beneath administration, is reportedly exploring tokenizing exchange-traded automobiles (ETFs), funds, or baskets of equities which are listed on inventory exchanges.

Tokenizing ETFs may enhance capital velocity and permit the tokenized funding automobiles for use as collateral in DeFi functions.

Journal: Can Robinhood or Kraken’s tokenized shares ever be really decentralized?