Key factors:

-

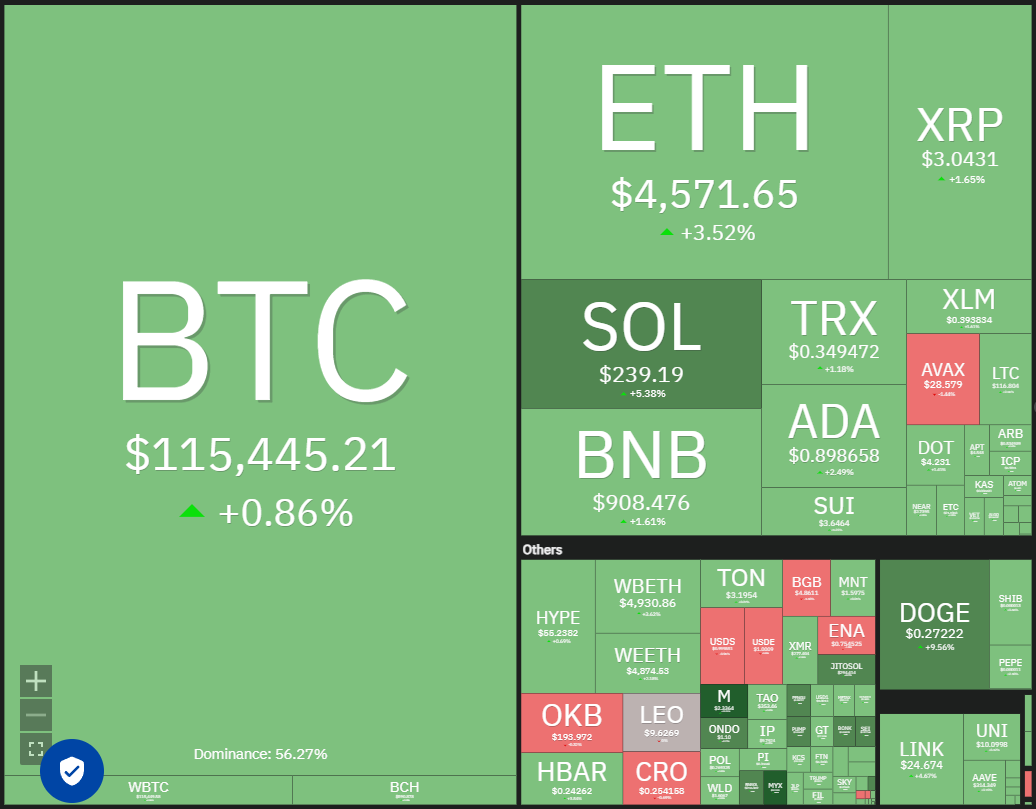

Bitcoin’s restoration stays on monitor, backed by stable demand from the spot Bitcoin ETF consumers.

-

BNB, HYPE, and SOL are main the altcoin cost increased, signaling stable shopping for by the bulls.

Bitcoin (BTC) rose to $116,495 on Friday, and the reduction rally is backed by stable shopping for within the spot BTC exchange-traded funds (ETFs), which witnessed $1.7 billion in web inflows this week, in response to information from SoSoValue.

Crypto dealer and analyst Matthew Hyland noticed essentially the most excessive degree of tightness on the Bollinger Bands on the month-to-month timeframe. Individually, fashionable analyst Crypto Ceasar mentioned in a put up on X that comparable tightness beforehand led to heavy upside volatility and “BTC may very well be in for a spicy This fall.”

Nevertheless, not everyone seems to be bullish on BTC within the close to time period. CryptoQuant analyst JA Maartun mentioned in a put up on X that BTC’s momentum was cooling as “8 out of 10 alerts within the CryptoQuant Bull Rating Index” had been flashing bearish for BTC.

What are the essential help and resistance ranges to be careful for in BTC and the key altcoins? Let’s analyze the charts of the highest 10 cryptocurrencies to seek out out.

Bitcoin value prediction

BTC broke above the $113,500 resistance on Wednesday and prolonged the restoration above the 50-day easy shifting common ($114,544) on Thursday.

There’s resistance at $117,500, but when the consumers overcome it, the BTC/USDT pair may soar to $120,000 and ultimately to $124,474. Sellers will attempt to halt the up transfer at $124,474 as a result of a break above it may begin the following leg of the uptrend to $141,948.

The bears must pull the Bitcoin value again under the 20-day exponential shifting common ($112,622) to weaken the bullish momentum. The pair might then collapse to $107,000, the place the consumers are anticipated to step in.

Ether value prediction

Ether (ETH) slender vary buying and selling resolved to the upside on Friday, indicating that the bulls have overpowered the bears.

The bulls will attempt to problem the $4,957 degree, the place they’re anticipated to face important promoting from the bears. If the worth turns down from $4,957 however rebounds off $4,500, it improves the prospects of an upside breakout. The ETH/USDT pair may then surge towards $5,500.

Conversely, if the pair turns down and breaks under $4,250, it means that the bears are promoting on each minor rally. The Ether value may then drop to $4,060 and subsequently to $3,500.

XRP value prediction

The bulls pushed XRP (XRP) above the downtrend line on Thursday however are struggling to construct on the breakout.

If the worth turns down and breaks under the 20-day EMA ($2.93), it suggests the breakout might have been a bull lure. The bears will then attempt to pull the XRP/USDT pair to the stable help at $2.73.

As a substitute, if the worth turns up from the 20-day EMA and breaks above $3.15, it alerts a change in sentiment from promoting on rallies to purchasing on dips. The XRP value may then rally to $3.40.

BNB value prediction

BNB (BNB) hit a brand new all-time excessive on Friday, indicating that the bulls are attempting to construct upon their benefit.

If consumers preserve the worth above $900, the BNB/USDT pair may rally to the psychological degree of $1,000. Sellers are anticipated to vigorously defend the $1,000 degree, but when consumers defend the 20-day EMA ($868) on the way in which down, it alerts a optimistic sentiment. The BNB value might then resume the uptrend to $1,090.

This optimistic view might be negated within the close to time period if the pair turns down and plummets under the 20-day EMA. The worth might then tumble to the 50-day SMA ($834).

Solana value prediction

Solana (SOL) picked up momentum after breaking above the $218 resistance and is marching towards the $260 degree.

Sellers are prone to pose a powerful problem within the $240 to $260 overhead resistance zone. If the worth turns down from the overhead zone, the bulls will attempt to arrest the pullback on the 20-day EMA ($209). In the event that they handle to try this, the chance of a break above $260 will increase. The SOL/USDT pair may then surge to $295.

The primary signal of weak point might be an in depth under the 20-day EMA. That means revenue reserving by short-term merchants. The Solana value might then stoop to the uptrend line.

Dogecoin value prediction

Patrons try to maintain Dogecoin (DOGE) above the $0.26 resistance, indicating energy.

The DOGE/USDT pair might climb to the $0.29 overhead resistance, which is a important degree for the bears to defend. If consumers drive the worth above $0.29, the pair may begin a brand new up transfer towards $0.44.

Opposite to this assumption, if the Dogecoin value turns down sharply from the overhead resistance, it means that the pair may stay range-bound between $0.29 and $0.14 for just a few extra days.

Cardano value prediction

Cardano (ADA) closed above the downtrend line of the descending channel sample on Wednesday, however the bears are unlikely to surrender simply.

Sellers will attempt to pull the worth again under the shifting averages. In the event that they handle to try this, a number of aggressive bulls might get trapped, pulling the ADA/USDT pair to the help line.

Then again, if the Cardano value rebounds off the 20-day EMA ($0.85), it means that the bulls are in management. Patrons will attempt to push the pair to $0.96 after which to $1.02, the place the bears are anticipated to step in.

Associated: Right here’s what occurred in crypto as we speak

Chainlink value prediction

Chainlink (LINK) broke above the $24 resistance on Thursday, indicating that the bulls are attempting to make a comeback.

The 20-day EMA ($23.36) is the essential help to be careful for on the draw back. If consumers preserve the worth above the 20-day EMA, the LINK/USDT pair may rally to the $26 to $28 overhead resistance zone.

Contrarily, a break and shut under the 20-day EMA suggests a scarcity of demand at increased ranges. The Chainlink value may stoop to the 50-day SMA ($21.84) and later to the uptrend line.

Hyperliquid value prediction

Hyperliquid (HYPE) continued its march increased after breaking above the $49.88 resistance, indicating sustained demand from the bulls.

The rally had pushed the RSI into the overbought territory, growing the danger of a pullback towards the breakout degree of $49.88. If the worth rebounds off the $49.88 degree with power, it means that the bulls stay in cost. The HYPE/USDT pair may then try a rally to the sample goal of $64.25.

Sellers are prone to produce other plans. They may try to tug the worth under the 50-day SMA ($44.68), signaling a short-term prime.

Sui value prediction

Sui (SUI) is nearing the downtrend line, the place the sellers are prone to mount a powerful protection.

If the worth turns down from the downtrend line however bounces off the 20-day EMA ($3.48), it alerts a optimistic sentiment. That will increase the chance of a break above the downtrend line. If that occurs, the bearish setup might be invalidated, and the SUI/USDT pair may rally to $4.18.

Sellers must pull the Sui value under the 20-day EMA to retain the pair contained in the triangle. The bears will acquire the higher hand in the event that they sink the worth under $3.11.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.