Blockchain-powered prediction market Polymarket is reportedly getting ready a US launch that would worth the corporate as excessive as $10 billion, highlighting the surge of investor curiosity in prediction markets and crypto ventures.

Citing sources acquainted with the dialog, Enterprise Insider reported Friday that Polymarket is exploring re-entering the US whereas looking for new funding that would greater than triple its June valuation of $1 billion. One investor valued the corporate at as much as $10 billion, the report stated.

As Cointelegraph reported, Polymarket was elevating a $200 million spherical in June led by Peter Thiel’s Founders Fund, an early backer of corporations together with OpenAI, Paxos and Palantir.

Polymarket, a decentralized platform that enables customers to commerce occasion outcomes with out a centralized bookmaker, gained prominence through the 2024 US presidential election, the place its markets accurately anticipated Donald Trump’s victory.

The corporate was barred from serving US customers in 2022 following a settlement with the Commodity Futures Buying and selling Fee (CFTC). In July, nevertheless, it acquired Florida-based derivatives alternate QCX, which might pave the way in which for a regulated return to the US market.

In September, the CFTC issued a no-action letter to QCX, granting reduction from sure federal reporting and recordkeeping necessities for occasion contracts. Polymarket CEO Shayne Coplan stated the choice successfully offers the platform “the inexperienced gentle to go stay within the USA.”

Associated: Trump Jr. joins Polymarket board as prediction market eyes US comeback

Blockchain prediction markets achieve steam

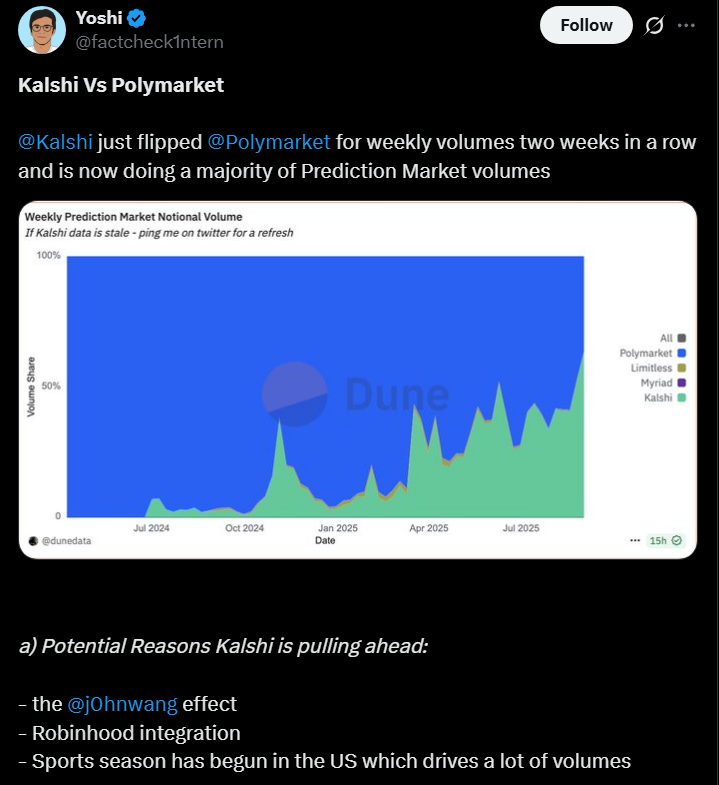

The transfer comes as rival platform Kalshi is reportedly nearing a $5 billion funding spherical, in keeping with The Data. That follows a Paradigm-led elevate in June, when the corporate secured $185 million at a $2 billion valuation.

Kalshi’s latest momentum stems partly from a 2024 court docket ruling that allowed it to supply political-event contracts — a ruling the CFTC appealed however voluntarily dropped in Could of this yr. The favorable rulings left intact Kalshi’s proper to record political-event contracts beneath present regulation.

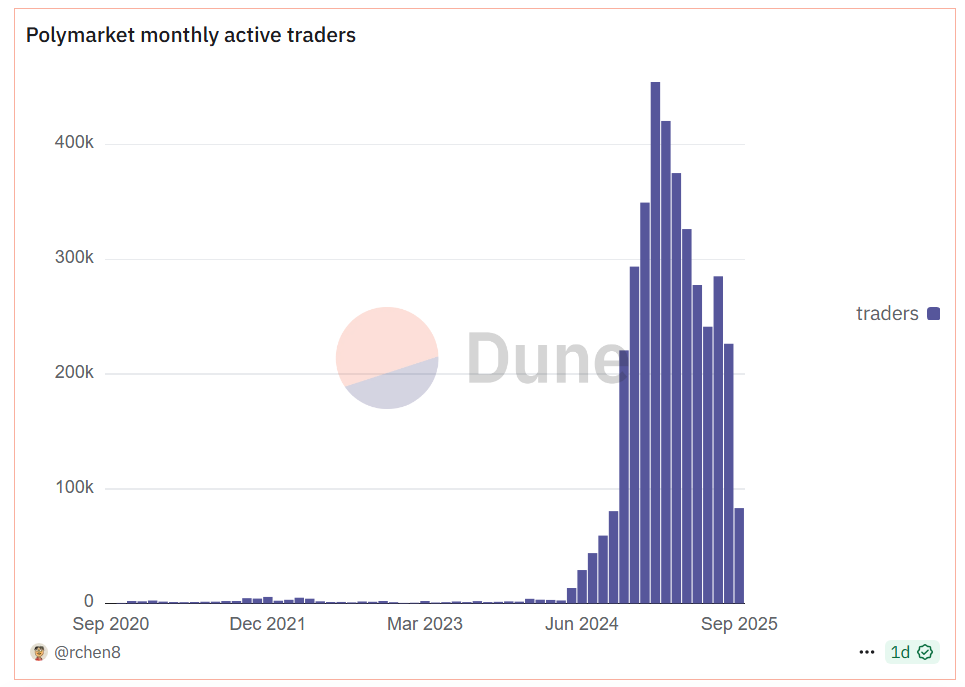

Kalshi ranks among the many most energetic prediction markets alongside Polymarket, measured by buying and selling volumes and month-to-month energetic customers. Nonetheless, like Polymarket, its person base has declined because the election.

Market watchers say momentum is shifting, fueled by the beginning of the Nationwide Soccer League season. Market analyst Tarek Mansour famous this week that Kalshi processed $441 million in quantity since kickoff, writing: “NFL Week 1 is the same as a US election.”

Associated: Kalshi hires crypto influencer John Wang to guide digital belongings arm