Shares of Gemini House Station (GEMI), the digital asset change based by Cameron and Tyler Winklevoss, surged of their market debut on Friday, signaling sturdy institutional urge for food for crypto-related equities.

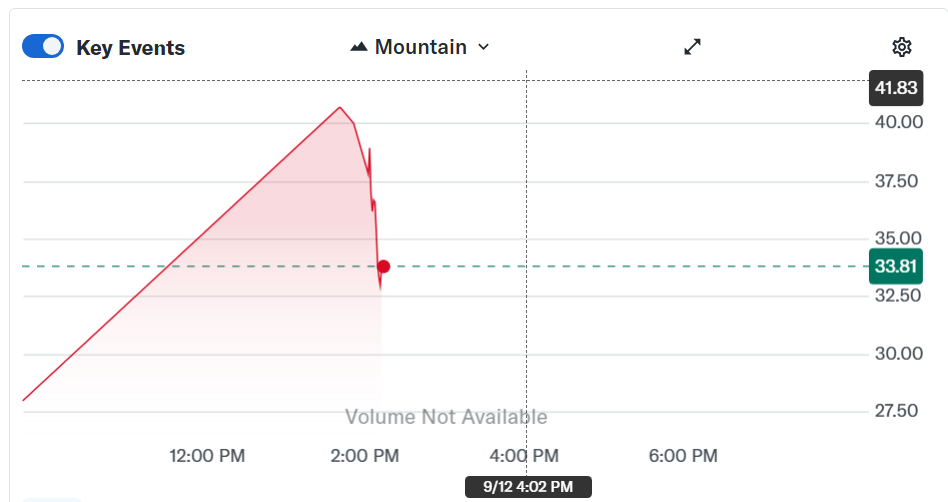

Gemini shares briefly topped $40 on Friday, in accordance with Yahoo Finance knowledge, earlier than retreating later within the session. By the afternoon, Gemini was buying and selling close to $35 a share, up 24% on the day, for a market cap of round $1.3 billion.

The corporate priced its preliminary public providing at $28 per share late Thursday — effectively above its preliminary goal vary of $17 to $19, and even larger than the upwardly revised $24 to $26 vary.

In response to CNBC, Gemini capped its providing at 15.2 million shares, elevating $425 million and signaling heightened investor demand.

The change moved swiftly from submitting its Kind S-1 with the US Securities and Alternate Fee to debuting on the Nasdaq. As Cointelegraph reported, Gemini submitted its IPO registration on Sept. 2 and commenced buying and selling 10 days later.

Though not among the many world’s largest cryptocurrency exchanges by buying and selling quantity, Gemini is thought to be a serious US platform with a repute for safety and regulatory compliance. In response to CoinMarketCap, the change noticed buying and selling exercise rise within the days main as much as its public itemizing.

Associated: Web3 IPOs stay scorching with Gemini’s ’20X oversubscribed,’ Determine debut leaping 24%

Crypto IPOs see sturdy investor urge for food

Gemini is certainly one of a number of cryptocurrency corporations to stage high-profile public choices in 2025, amid a surge of investor curiosity within the sector.

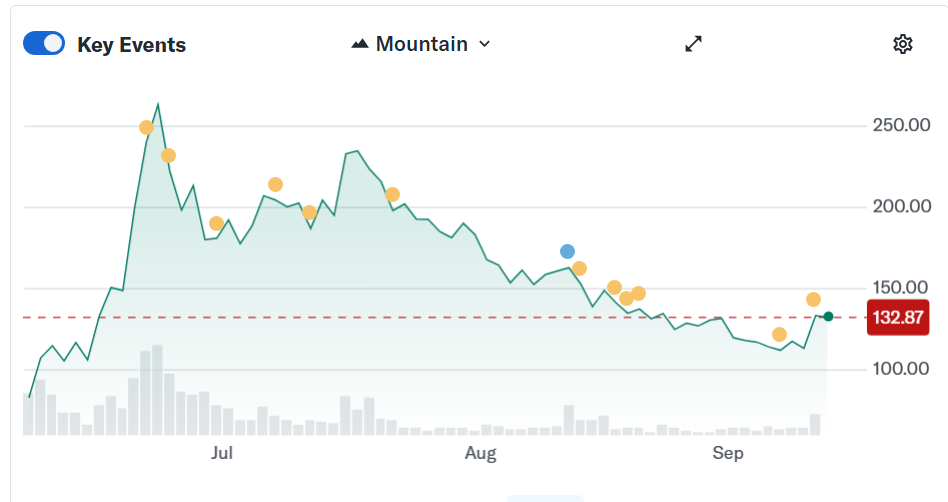

Stablecoin issuer Circle (CRCL) has been among the many standout performers, with its shares hovering greater than 160% on their first day of buying and selling on the New York Inventory Alternate. Since debuting at $31, the inventory has climbed to over $60, giving the corporate a market capitalization above $33 billion, in accordance with Yahoo Finance.

Shortly after boosting its IPO value, blockchain-focused monetary providers firm Determine Know-how Options (FIGR) delivered a robust debut, rising greater than 24% on its first day of buying and selling on Thursday. The inventory prolonged features in Friday’s session, up greater than 12% at noon.

Whereas not an IPO, recreation writer–turned–digital asset treasury firm Mega Matrix (MPU) has additionally seen its inventory surge after saying plans to pivot into the stablecoin sector. Its stablecoin push culminated in early September, when the corporate unveiled a $2 billion shelf registration to assist investments within the Ethena ecosystem.

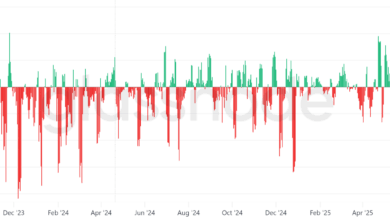

MPU inventory has skilled heavy volatility, however stays up over 150% over the previous six months.

Journal: Can Robinhood or Kraken’s tokenized shares ever be really decentralized?