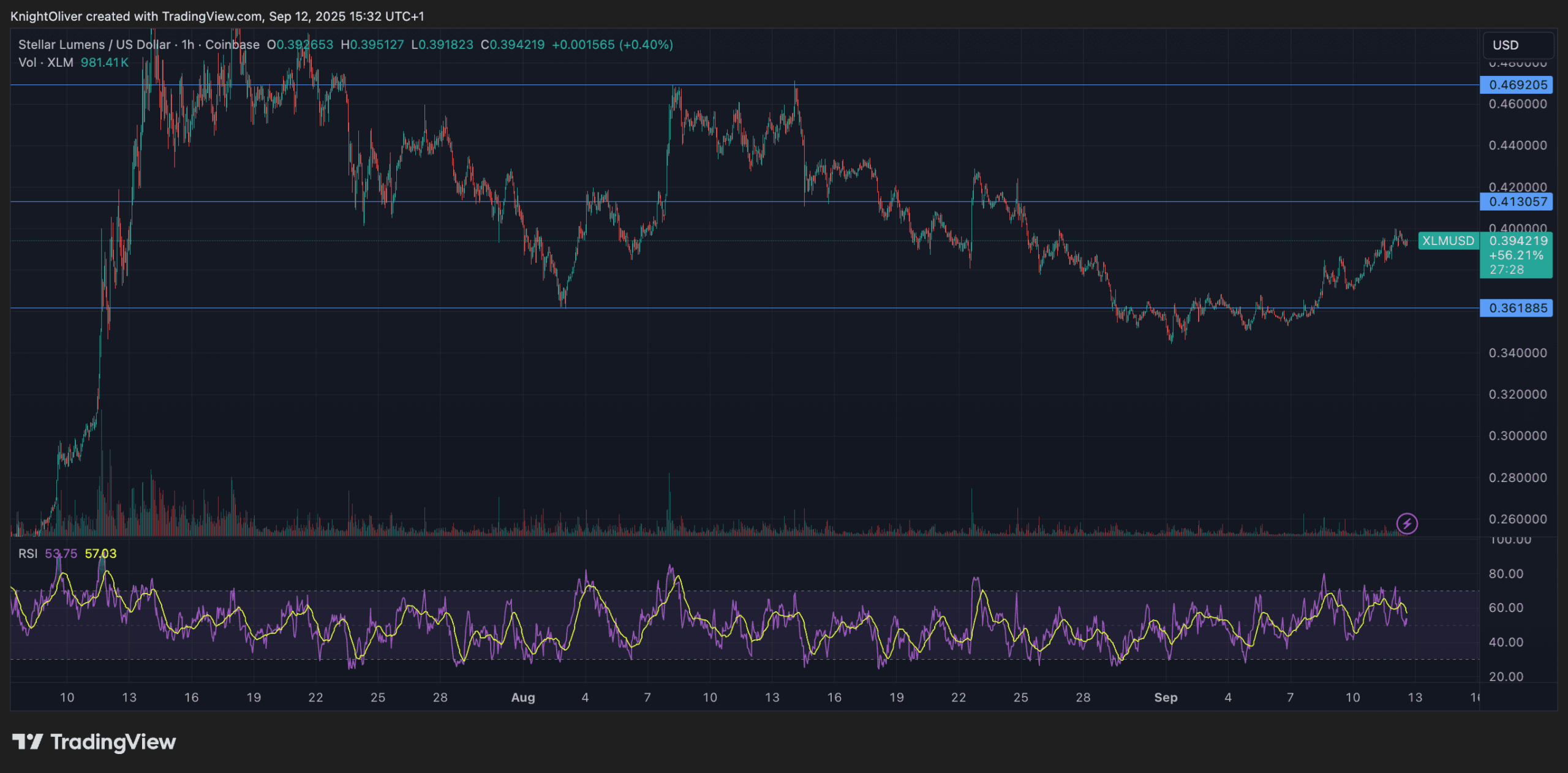

Stellar’s XLM navigated a risky 24-hour buying and selling session from Sept. 11 to Sept. 12, oscillating between $0.384 and $0.400 earlier than closing close to $0.393. The token noticed early power, advancing to session highs round $0.400, however promoting stress within the ultimate hours pushed costs again towards help ranges at $0.392. Market analysts notice this late-session distribution exercise underscores the corrective motion that has weighed on XLM regardless of its in any other case resilient efficiency.

The pullback coincided with rising competitors within the funds sector. New entrant Remittix has launched with a 15% USDT referral incentive and secured $25.2 million in funding, sharpening challenges to incumbents like Ripple’s XRP and Stellar’s XLM. The aggressive go-to-market technique highlights intensifying rivalry within the cross-border funds enviornment, a sector lengthy dominated by these two tokens.

On the similar time, some technical strategists see long-term upside for XLM. Elliott Wave projections recommend the token may stage a 400% rally towards $1.96, a transfer that may place Stellar’s market capitalization within the $60–$71 billion vary. That outlook hinges on broader adoption tendencies and the resilience of Stellar’s ecosystem as competitors ramps up.

Including to market intrigue, a digital asset researcher has steered Ripple and Stellar could also be collaborating on a unified world monetary infrastructure that leverages Zero-Information cryptographic protocols. Whereas unconfirmed, such a transfer would symbolize a big step in aligning blockchain networks to reinforce safety, privateness and interoperability throughout world finance.

Technical Metrics Evaluation

- XLM established a complete buying and selling vary of $0.02 representing 4% volatility spanning $0.38 to $0.40.

- Sustained bullish momentum maintained all through opening 17 hours with 3% development supported by elevated quantity participation.

- Session peak of $0.40 achieved at midnight on 12 September earlier than encountering technical resistance.

- Assist basis established round $0.39 threshold containing the pullback throughout closing seven hours.

- Closing 60 minutes demonstrated bearish stress with decline from $0.39 to $0.39 confirming broader corrective development.

- Intraday summit of $0.39 at 11:24 earlier than sharp reversal at $0.39 resistance threshold.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.