- The Euro trims earlier features because the US Greenback bounces up on a uneven buying and selling session.

- ECB’s Rehn has warned in regards to the draw back threat for inflation stemming from low power costs and a robust EUR.

- Preliminary claims for unemployment advantages within the US elevated at their quickest tempo in 4 years.

The EUR/USD pair offers away features on the early European session and retreats to ranges close to 1.1700, amid uneven and risky buying and selling on Friday. Feedback from ECB official Olly Rehn, warning in regards to the draw back dangers to inflation, have did not assist the Euro (EUR), which stays weighed down underneath a firmer US Greenback.

On Thursday, the ECB left its Deposit Facility fee unchanged at 2% and President Christine Lagarde mentioned that “threat to financial progress has turn into extra balanced”. These feedback curbed market expectations of additional rate of interest cuts within the close to time period and offered a major increase to the Euro.

Within the US, knowledge from the US Division of Labour revealed that Preliminary Jobless Claims elevated at their quickest tempo within the final 4 years final week, whereas August’s Client Costs Index (CPI) superior broadly according to the market expectations, clearing the best way for a quarter-point Fed fee reduce subsequent week and at the least one other one earlier than the top of the yr.

In Friday’s calendar, the main target is on the College of Michigan’s US Client Sentiment Survey, which is predicted to indicate an additional deterioration, including strain to the US central financial institution to ease its financial coverage. The danger for the US Greenback is skewed to the draw back.

Euro Value In the present day

The desk under reveals the proportion change of Euro (EUR) towards listed main currencies at the moment. Euro was the strongest towards the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.18% | 0.35% | 0.07% | 0.24% | 0.43% | 0.14% | |

| EUR | -0.09% | 0.08% | 0.28% | -0.01% | 0.16% | 0.35% | 0.06% | |

| GBP | -0.18% | -0.08% | 0.18% | -0.10% | 0.04% | 0.27% | -0.02% | |

| JPY | -0.35% | -0.28% | -0.18% | -0.30% | -0.14% | 0.01% | -0.27% | |

| CAD | -0.07% | 0.00% | 0.10% | 0.30% | 0.21% | 0.38% | 0.08% | |

| AUD | -0.24% | -0.16% | -0.04% | 0.14% | -0.21% | 0.23% | -0.10% | |

| NZD | -0.43% | -0.35% | -0.27% | -0.01% | -0.38% | -0.23% | -0.29% | |

| CHF | -0.14% | -0.06% | 0.02% | 0.27% | -0.08% | 0.10% | 0.29% |

The warmth map reveals proportion adjustments of main currencies towards one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, for those who choose the Euro from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will characterize EUR (base)/USD (quote).

Each day digest market movers: The Greenback loses footing following weak employment knowledge

- US Preliminary Jobless Claims elevated to 263K within the first week of September, from 236K within the earlier week, towards expectations of a slight decline to 235K. Though the state of Texas accounted for many of this enhance – suggesting that there have been some momentary distortions within the knowledge – these figures present additional proof of the deterioration of the US labour market and set the situations for the Fed to chop charges by at the least 25 foundation factors subsequent week.

- On the similar time, US Client Value Index figures confirmed the average uptick in inflation forecasted by market analysts. Yearly inflation picked as much as 2.9% from the two.7% stage seen in July, whereas the core CPI elevated at a gentle 3.1%, additionally according to expectations. The month-to-month CPI accelerated 0.4% from July’s 0.2% tempo, beating market expectations of a 0.3% enhance. These numbers didn’t alter Fed easing bets, however trimmed expectations of a larger-than-usual 50 bps reduce subsequent week.

- In Europe, the European Central Financial institution left the Fee on the Deposit Facility regular for the second consecutive assembly, and President Lagarde’s feedback on the ensuing press convention revealed that the financial institution is just not planning to ease its financial coverage additional within the close to time period. Lagarde sounded assured in regards to the financial system and warned in regards to the unsure inflation outlook. All in all, a balanced stance that poses a Euro-supportive financial coverage divergence with the Fed.

- German knowledge launched on Friday confirmed that client inflation stood at 0.1% in August with July and at 2.2% in contrast with August final yr. The affect on the Euro has been minimal.

- At 14:00 GMT, the preliminary US College of Michigan Client Sentiment Index for September is predicted to additional decline to 58.0 from August’s 58.2 studying. These figures are about 15% under the common ranges of the second half of 2024, revealing a major deterioration in customers’ confidence and including bearish strain on the US Greenback.

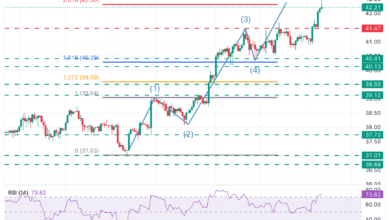

Technical Evaluation: EUR/USD maintains its bullish bias intact

EUR/USD bounced up from the underside of the final three weeks’ ascending channel on Thursday, protecting the broader bullish bias intact. Technical indicators present a light upside momentum on Friday, regardless of the current reversal. The RSI has bounced again past the 50 stage, and the MACD has crossed above the sign line, suggesting that additional appreciation appears to be like possible.

Speedy resistance is on the intra-day excessive of 1.1750. Additional up, the 1.1780-1.1790 (September 8, July 24 highs) is prone to maintain bulls forward of the channel high, now at 1.1810.

To the draw back, the intra-day low is now within the space of 1.1715. Under right here, the channel backside is at 1.1670, proper above Thursday’s low at 1.1660. A breach of that stage would cancel the bullish view and enhance strain in direction of the September 2 and three lows within the space of 1.1610.

ECB FAQs

The European Central Financial institution (ECB) in Frankfurt, Germany, is the reserve financial institution for the Eurozone. The ECB units rates of interest and manages financial coverage for the area.

The ECB major mandate is to take care of worth stability, which suggests protecting inflation at round 2%. Its major software for reaching that is by elevating or decreasing rates of interest. Comparatively excessive rates of interest will often lead to a stronger Euro and vice versa.

The ECB Governing Council makes financial coverage selections at conferences held eight occasions a yr. Selections are made by heads of the Eurozone nationwide banks and 6 everlasting members, together with the President of the ECB, Christine Lagarde.

In excessive conditions, the European Central Financial institution can enact a coverage software known as Quantitative Easing. QE is the method by which the ECB prints Euros and makes use of them to purchase belongings – often authorities or company bonds – from banks and different monetary establishments. QE often leads to a weaker Euro.

QE is a final resort when merely decreasing rates of interest is unlikely to realize the target of worth stability. The ECB used it throughout the Nice Monetary Disaster in 2009-11, in 2015 when inflation remained stubbornly low, in addition to throughout the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It’s undertaken after QE when an financial restoration is underway and inflation begins rising. While in QE the European Central Financial institution (ECB) purchases authorities and company bonds from monetary establishments to supply them with liquidity, in QT the ECB stops shopping for extra bonds, and stops reinvesting the principal maturing on the bonds it already holds. It’s often constructive (or bullish) for the Euro.