- Gold consolidates beneath $3,650, holding in a slender vary after this week’s report excessive close to $3,675.

- Protected-haven demand stays robust, pushed by international commerce rigidity and geopolitical danger.

- Markets have absolutely priced in a 25 bps lower on the Fed’s September 17 assembly, a +90% likelihood says CME Fedwatch Software.

Gold (XAU/USD) is buying and selling with a light optimistic tone on Friday, consolidating close to $3,650 mark after rebounding from Thursday’s pullback. The dear metallic stays caught in a slender vary after notching an all-time excessive close to $3,675 earlier this week.

Regardless of the sideways worth motion, Gold is on target for a fourth straight weekly achieve, supported by a broadly weaker US Greenback (USD) and the rising conviction that the Federal Reserve (Fed) will lower charges at subsequent week’s assembly.

The newest batch of US knowledge has given the Fed loads of causes to ease financial coverage. August Shopper Worth Index (CPI) confirmed that headline inflation stays barely sizzling, however the broader narrative is considered one of a cooling financial system. Nonfarm Payrolls (NFP) almost stalled in August, earlier job progress has been revised sharply decrease, and Preliminary Jobless Claims have climbed to multi-year highs. On the identical time, producer worth strain has softened.

Collectively, these indicators have overshadowed lingering inflation considerations and underscored that draw back dangers to employment are rising, making a Fed fee lower subsequent week all however sure.

Past the US outlook, broader market elements additionally proceed to favor the metallic. Persistent geopolitical rigidity and commerce friction tied to US tariffs are retaining safe-haven demand alive, reinforcing a broadly bullish outlook for Gold.

Market movers: Gold steadies amid sticky inflation, comfortable labor knowledge

- US inflation picked up in August, with headline CPI rising 0.4% on the month after a 0.2% improve in July, coming in barely above the 0.3% forecast. On an annual foundation, headline inflation rose by 2.9%, matching expectations and up from 2.7% beforehand. Core CPI, which excludes meals and vitality, held regular at 0.3% MoM and three.1% YoY, the identical as July and absolutely in-line with forecasts.

- US weekly Preliminary Jobless Claims surged to 263,000 within the week ending September 6, marking the very best degree in nearly 4 years. The four-week transferring common additionally climbed to round 240,500, pointing to a transparent upward pattern in layoffs. Whereas Persevering with Jobless Claims held close to 1.94 million, the regular rise in new functions highlights mounting strain within the labor market and provides to the case for a Fed fee lower at subsequent week’s assembly.

- The US Greenback Index (DXY), which tracks the Buck’s worth in opposition to a basket of six main currencies, is stabilizing after Thursday’s pullback. The index is buying and selling round 97.66, up roughly 0.12% on the day. The modest rebound within the Buck is appearing as a headwind for Gold, limiting the metallic’s upside potential.

- US tariff revenues jumped to an all-time excessive of about $30 billion in August, marking the primary full month underneath US President Donald Trump’s reciprocal tariff regime.

- The Monetary Instances reported on Thursday that the US is pushing G7 allies to impose steep tariffs on China and India over their continued purchases of Russian oil, aiming to use financial strain on Moscow and drive it into peace talks.

- Afterward Friday, the preliminary College of Michigan survey will supply a recent learn on family confidence and inflation expectations. The headline Shopper Sentiment Index is forecast at 58.0, down barely from 58.2 in August, whereas the Shopper Expectations Index is projected at 54.9 in contrast with 55.9 beforehand.

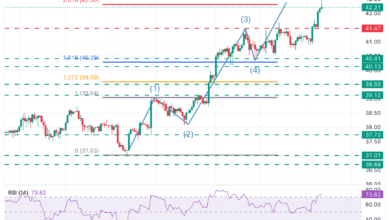

Technical evaluation: XAU/USD consolidates beneath report highs

XAU/USD is consolidating on the 4-hour chart slightly below its all-time excessive close to $3,675. Worth motion has been confined to a slender band between $3,620 and $3,650 in current classes, reflecting a pause in momentum after the robust rally earlier this week.

The 21-period Easy Transferring Common (SMA), presently close to $3,640, is appearing as speedy help, whereas the 50-period SMA round $3,596 offers a stronger cushion, which carefully aligns with the $3,600 psychological degree. On the upside, speedy resistance is positioned on the higher finish of the present vary close to $3,650, adopted by the report excessive at $3,675. A transparent break above this zone may open the trail to the psychological $3,700 degree.

Momentum indicators are per consolidation inside an ongoing bullish pattern. The RSI is holding round 61 after slipping again towards impartial ranges on Thursday, indicating that momentum has stabilized in optimistic territory and that consumers haven’t given up management. The ADX stays elevated round 42, signaling that the underlying pattern continues to be robust even when directional power has moderated barely.

Gold FAQs

Gold has performed a key function in human’s historical past because it has been extensively used as a retailer of worth and medium of change. Presently, aside from its shine and utilization for jewellery, the dear metallic is extensively seen as a safe-haven asset, which means that it’s thought of a great funding throughout turbulent instances. Gold can be extensively seen as a hedge in opposition to inflation and in opposition to depreciating currencies because it doesn’t depend on any particular issuer or authorities.

Central banks are the largest Gold holders. Of their goal to help their currencies in turbulent instances, central banks are inclined to diversify their reserves and purchase Gold to enhance the perceived power of the financial system and the forex. Excessive Gold reserves could be a supply of belief for a rustic’s solvency. Central banks added 1,136 tonnes of Gold price round $70 billion to their reserves in 2022, in accordance with knowledge from the World Gold Council. That is the very best yearly buy since information started. Central banks from rising economies similar to China, India and Turkey are rapidly rising their Gold reserves.

Gold has an inverse correlation with the US Greenback and US Treasuries, that are each main reserve and safe-haven belongings. When the Greenback depreciates, Gold tends to rise, enabling traders and central banks to diversify their belongings in turbulent instances. Gold can be inversely correlated with danger belongings. A rally within the inventory market tends to weaken Gold worth, whereas sell-offs in riskier markets are inclined to favor the dear metallic.

The value can transfer on account of a variety of things. Geopolitical instability or fears of a deep recession can rapidly make Gold worth escalate on account of its safe-haven standing. As a yield-less asset, Gold tends to rise with decrease rates of interest, whereas greater value of cash often weighs down on the yellow metallic. Nonetheless, most strikes depend upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAU/USD). A robust Greenback tends to maintain the value of Gold managed, whereas a weaker Greenback is prone to push Gold costs up.