The Australian Greenback (AUD) traded barely decrease on Friday, beneath 0.6650 in opposition to the US Greenback (USD), shedding 0.15% over the session. Warning dominates buying and selling forward of the weekend as merchants await Monday’s launch of key Industrial Manufacturing and Retail Gross sales knowledge from China, Australia’s foremost buying and selling associate.

This Foreign exchange session is thus marked by contained volatility on the AUD/USD, in distinction to Thursday’s session, which was shaken by US inflation knowledge.

If the Chinese language knowledge disappoint on Monday, they may rekindle considerations about Chinese language demand for uncooked supplies, a historic driver of the Australian Greenback, and immediate buyers to scale back their publicity to the AUD.

The Chinese language financial system: Driving drive or brake for the Aussie?

Australia’s financial system is structurally linked to that of China, the nation’s largest buyer for iron ore, coal and pure gasoline exports. Because of this, Chinese language macroeconomic knowledge, notably industrial manufacturing, are carefully adopted by Foreign exchange buyers.

For August, the consensus is for annual Industrial Manufacturing progress of 5.8%, up barely on July’s 5.7%.

On the patron entrance, Retail Gross sales are anticipated to rise by 3.8% YoY after 3.7% the earlier month.

Whereas these figures seem right on the floor, they masks a weakened momentum. As Christine Peltier of BNP Paribas notes, “the battle in opposition to deflation is much from gained” in China.

Weaker industrial indicators might intensify doubts in regards to the robustness of Chinese language home demand. This may have a direct influence on Australia’s progress prospects by lowering export volumes, commodity costs and, consequently, mining revenues. There may be then an in depth hyperlink between Chinese language statistics and the trajectory of the Australian Greenback.

The lingering shadow of Chinese language deflation

Regardless of Chinese language GDP progress of 5.3% within the first half of the yr, current indicators level to a lack of momentum. In July, Industrial Manufacturing progress fell to five.7%, its lowest degree in eight months, whereas Retail Gross sales stalled at 3.7%, nicely beneath analysts’ expectations.

Reuters journalists Kevin Yao and Joe Money notice that “retail gross sales and industrial manufacturing missed forecasts, rising stress on authorities to spice up home demand.”

On the identical time, the Shopper Value Index (CPI) fell again into detrimental territory, down 0.4% in August, heightening fears of extended deflation.

This deflationary dynamic isn’t impartial for the AUD. It might immediate Chinese language financial gamers to delay or restrict their purchases of uncooked supplies and curb industrial funding, all elements prone to weaken the Aussie, notably in opposition to the US Greenback.

China on pause, Australia on standby

The Chinese language authorities have stepped up focused measures in an try to spice up consumption, with out saying a large stimulus plan. As Michelle Lam, Higher China economist at Societe Generale, factors out, “the stress to stimulate the financial system could turn into extra seen as winter approaches”, studies The Enterprise Instances.

In opposition to this backdrop, the Reserve Financial institution of Australia (RBA) can be on the defensive. Confronted with slowing Chinese language progress and falling commodity costs, it lately hinted {that a} extended pause on charges was doubtless, particularly as Australian inflation has begun to ease.

For Foreign exchange merchants, which means the Australian Greenback’s capacity to get well will rely much less on the RBA’s selections than on the evolution of Chinese language demand and its implications for overseas commerce.

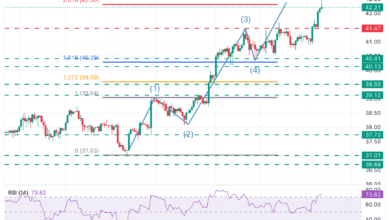

Technical evaluation of AUD/USD: The uptrend could lose steam

AUD/USD day by day chart. Supply: FXStreet.

AUD/USD corrects barely downward on Friday however at this stage stays entrenched in an uptrend that has lasted since Could.

The uptrend is following a channel whose higher restrict is round 0.6700, a threshold which might block any short-term bullish try. Past this threshold, the Aussie might then hunt down the 0.6800 degree, which corresponds specifically to the peaks of July and August 2024.

However after the just about steady rise since 0.6400, the dangers of a bearish correction are rising, and if Chinese language knowledge disappoints on Monday, this might encourage a drop towards the short-term trendline resulting in 0.6570. That response might result in a bearish acceleration beneath with the 100-day Easy Shifting Common (SMA) and the decrease boundary of the channel with 0.6430 in sight.

Australian Greenback Value Right now

The desk beneath exhibits the share change of Australian Greenback (AUD) in opposition to listed main currencies at this time. Australian Greenback was the strongest in opposition to the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.17% | 0.23% | 0.38% | 0.11% | 0.31% | 0.49% | 0.23% | |

| EUR | -0.17% | 0.05% | 0.21% | -0.04% | 0.15% | 0.33% | 0.06% | |

| GBP | -0.23% | -0.05% | 0.16% | -0.10% | 0.07% | 0.28% | 0.02% | |

| JPY | -0.38% | -0.21% | -0.16% | -0.26% | -0.08% | 0.06% | -0.20% | |

| CAD | -0.11% | 0.04% | 0.10% | 0.26% | 0.24% | 0.39% | 0.12% | |

| AUD | -0.31% | -0.15% | -0.07% | 0.08% | -0.24% | 0.21% | -0.09% | |

| NZD | -0.49% | -0.33% | -0.28% | -0.06% | -0.39% | -0.21% | -0.27% | |

| CHF | -0.23% | -0.06% | -0.02% | 0.20% | -0.12% | 0.09% | 0.27% |

The warmth map exhibits proportion modifications of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, if you happen to decide the Australian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will symbolize AUD (base)/USD (quote).