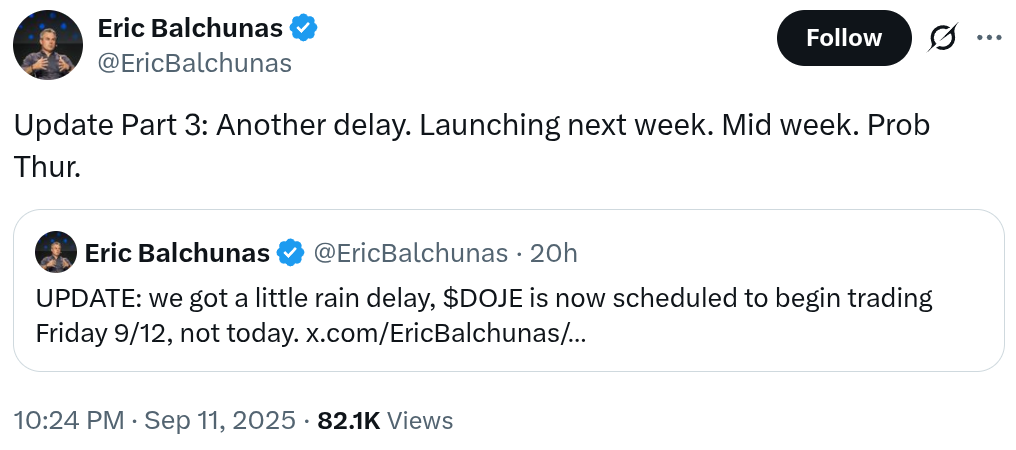

Dogecoin’s value rose Friday even because the launch of a US exchange-traded fund (ETF) tied to the memecoin was delayed once more, in response to a Bloomberg analyst.

Based on CoinMarketCap information, Dogecoin (DOGE) elevated by practically 4% during the last 24 hours — reaching $0.2603 on the time of writing. The rise comes regardless of Bloomberg’s senior ETF analyst Eric Balchunas saying Thursday that the launch of a US DOGE ETF is delayed once more.

Based on a Sept. 8 US Securities and Change Fee (SEC) submitting, the Rex-Osprey DOGE ETF (DOJE) was anticipated to record alongside Bonk (BONK), XRP (XRP), Bitcoin (BTC) and Trump Official (TRUMP) ETFs on Friday, Sept. 12. Nonetheless, Balchunas urged that the itemizing is delayed till the center of subsequent week, possible Thursday.

Earlier this month, the DOJE ETF gained approval beneath the Funding Firm Act of 1940, a framework sometimes used for mutual funds and diversified ETFs. This units it other than Bitcoin ETFs accepted beneath the Securities Act of 1933, which governs commodity- and asset-backed merchandise moderately than fund-style autos.

Balchunas informed Cointelegraph that he realized of the delay immediately from the corporate behind the ETF. He mentioned that the agency has not shared the explanation behind the delay.

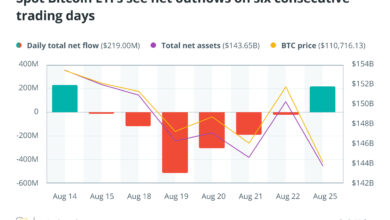

The analyst added that he does anticipate this ETF to have a “minimal“ impression on Dogecoin’s value. He defined that with Bitcoin, there have been buyers who couldn’t work together with crypto immediately. He expects these considering DOGE to have crypto alternate accounts already.

“The additional away you get from BTC, the much less belongings it is going to be.”

Nonetheless, Balchunas mentioned that he expects 4 to 5 Dogecoin ETFs to launch in October or November. He mentioned that “the extra [DOGE ETFs] launch, the extra it should transfer the needle.

Balchunas added that this ETF is totally different from most crypto ETFs which have launched. He defined that it “is just not actually spot” because it doesn’t maintain DOGE immediately, relying as an alternative on a Cayman Islands-based subsidiary and derivatives — that is needed for the reason that 1940 act requires diversification and restricts single-asset focus.

Associated: How excessive can DOGE value go when a Dogecoin ETF is accepted?

Dogecoin ETF triggers hypothesis

This approval seems to be with none precedents. Balchunas mentioned on X on that he’s “fairly positive that is the first-ever US ETF to carry one thing that has no utility or goal.”

Whereas the trade often reacts overwhelmingly positively to the approval of recent crypto ETFs, this case was considerably totally different. Latest reviews highlighted that critics argue {that a} memecoin fund institutionalizes hypothesis, whereas additionally charging charges that buyers might keep away from by shopping for Dogecoin immediately.

Associated: KuCoin targets 10% of Dogecoin mining capability by way of new mining platform

Doge attracts institutional consideration

Dogecoin, the world’s first memecoin, is attracting more and more extra institutional consideration. Friday reviews point out that CleanCore Options, a maker of aqueous ozone cleansing techniques, reached half of its 1 billion Dogecoin treasury goal after shopping for $130 million in DOGE this week.

The announcement follows CleanCore Options’ announcement that it’ll elevate $175 million by way of personal placement, spending the proceeds on buying extra DOGE. This providing was efficiently closed two days after the announcement on Sept. 5.

Additionally this month, Trump family-linked media company Thumzup introduced plans to accumulate 3,500 Dogecoin mining rigs. The announcement described the memecoin as “one of the broadly held cryptocurrencies.”

Journal: Elon Musk Dogecoin pump incoming? SOL tipped to hit $300 in 2025: Commerce Secrets and techniques